Liberty Global (LBTYA) Incurs Loss in Q4, Issues '18 View

Liberty Global LBTYA reported disappointing financial results for the fourth quarter of 2017. The company is a leading cable TV operator in Europe and Latin America.

Liberty Global has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GAAP net loss in the fourth quarter was $0.992 billion against net income of $2.2 billion in the prior-year quarter. Quarterly net loss per share was 68 cents against earnings of $2.45 reported in the year-ago quarter.

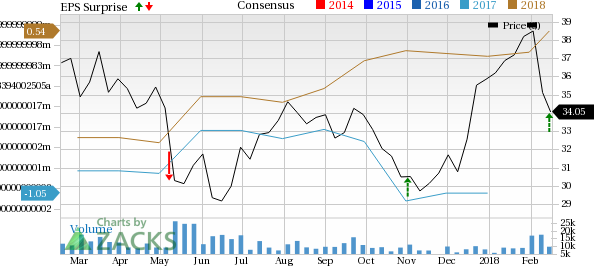

Liberty Global PLC Price, Consensus and EPS Surprise

Liberty Global PLC Price, Consensus and EPS Surprise | Liberty Global PLC Quote

Quarterly total revenues of $3,987.7 million were down 5.4% year over year. Operating income of $495.8 million was down 27.4% on a year-over-year basis.

Operating cash flow in the reported quarter was $1,911.9 million, down 6.1% year over year. Quarterly operating cash flow margin was 47.9% compared with 48.3% in the year-ago quarter.

In the fourth quarter of 2017, Liberty Global generated $1,494.6 million of cash from continuing operating activities, down 9.6%. Adjusted free cash flow in the reported quarter was $844.1 million, reflecting a decline of 16.4% year over year.

At the end of fourth-quarter 2017, Liberty Global had $1,672.4 million of cash and cash equivalents and $41,017.6 million of outstanding debt on its balance sheet compared with $3,400 million and $37,800 million, respectively, at the end of 2016.

Segment-Wise Results

Within the European operations, revenues from Western Europe totaled $3,637.9 million, up 10.9% year over year. Revenues from Central and Eastern Europe came in at $317.1 million, increasing 15.8% year over year. Central and Corporate revenues totaled $38.7 million, up 87% year over year.

Subscriber Statistics

In the reported quarter, this leading European quad-play cable MSO (multi service operator) added a total of 149,200 RGUs (revenue generating units), including net gains of 116,000 and 87,700 subscribers for broadband Internet and telephony services, respectively. However, the company lost 54,500 video customers.

Nonetheless, it added 95,300 mobile customers including a net gain of 118,700 postpaid subscribers and a net loss of 23,400 prepaid subscribers. In the reported quarter, Liberty Global added a net of 210,000 customers for its flagship Horizon TV-platform, Horizon-Lite, Virgin TV V6, Yelo TV platform and TiVo developed TV-platform. The company reached 7.7 million or 43% of its total cable video base (excluding DTH) by the end of 2017.

Deployment of its latest WiFi Connect box increased by more than 1 million in the quarter under review, with an installed base of over 6.4 million or 43% of broadband subscribers across Europe.

2018 Guidance

In 2018, Liberty Global expects to deliver approximately 5% rebased OCF (operating cash flow) growth. Adjusted free cash flow is estimated to be around $1.6 billion. Property and equipment additions are projected to be $5.1 billion for the full year, which includes $1.2 billion expenses for technological upgrades and new build-outs.

The investments highlight the company's customer-friendly attitude and bode well for its growth prospects.

Upcoming Releases

Investors interested in the Zacks Consumer Discretionary sector are keenly awaiting fourth-quarter 2017 earnings reports from key players like AMC Entertainment AMC, AMC Networks AMCX and Cinemark Holdings CNK. While Cinemark is scheduled to report on Feb 23, AMC Entertainment and AMC Networks are scheduled to release results on Mar 1.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMC Networks Inc. (AMCX) : Free Stock Analysis Report

Liberty Global PLC (LBTYA) : Free Stock Analysis Report

Cinemark Holdings Inc (CNK) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance