Liberty (LBRT) Shares Move Up Since Easy Q2 Earnings Beat

The stock of Liberty Energy Inc., LBRT has gained 12.7% since its second-quarter earnings announcement on Jul 25. The company managed to score comfortable top and bottom-line beats.

What Did Liberty Energy’s Earnings Unveil?

Liberty Energy announced second-quarter 2022 earnings per share of 55 cents, which handily beat the Zacks Consensus Estimate of 18 cents and almost doubled from the year-earlier bottom line of 29 cents.

The Denver-CO-based oil and gas equipment company’s outperformance reflects the impact of strong execution, higher activity and increased service pricing, which more than offset rising costs.

Total revenues came in at $942.6 million, ahead of the Zacks Consensus Estimate of $875 million and 62.2% above the year-ago level of $581.3 million.

Meanwhile, second-quarter adjusted EBITDA was $196.1 million against the prior-year quarter figure of $36.6 million.

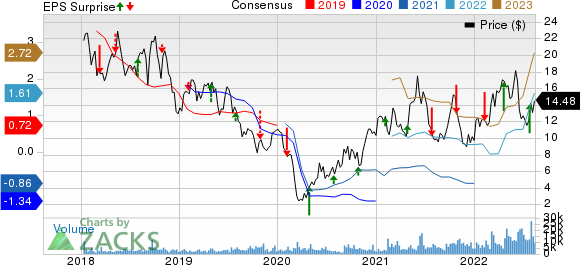

Liberty Energy Inc. Price, Consensus and EPS Surprise

Liberty Energy Inc. price-consensus-eps-surprise-chart | Liberty Energy Inc. Quote

Balance Sheet & Capital Expenditure

As of Jun 30, Liberty had approximately $41.5 million in cash and cash equivalents. The pressure pumper’s long-term debt of $252.9 million represented a debt-to-capitalization of 16%. Further, the company’s liquidity — cash balance, plus revolving credit facility — amounted to $240 million.

In the reported quarter, the company spent $127 million on its capital program.

Guidance

The Ukraine conflict and sweeping international curbs on Moscow have aggravated the oil supply shortage. This means upstream operators are drilling more wells to increase output that has remained depressed over the past two years due to lack of investment, supply chain issues, scarcity of labor and equipment attrition. With crude demand set to remain robust and eventually surpass pre-covid record, most of the domestic fracking capacity is on the verge of being exhausted. In this context, Liberty management sees elevated demand for its reactivated fleet that supports the clients’ long-term development plans. In the third quarter, the Zacks Rank #1 (Strong Buy) company sees some 10% sequential revenue growth, plus higher margins on improved activity and pricing. However, cost inflation might dent some of that.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Snapshot for Oilfield Service Providers

With Liberty belonging to the larger oilfield service industry, let’s see how some of the bigger well-known companies have performed this earnings season.

Schlumberger SLB, the largest oilfield contractor, announced second-quarter earnings of 50 cents per share (excluding charges and credits), which beat the Zacks Consensus Estimate of 40 cents. SLB recorded total revenues of $6.8 billion, outpacing the Zacks Consensus Estimate by 7.8%.

Schlumberger’s strong quarterly earnings resulted from higher sales of exploration data licensing and strong drilling activities in land and offshore resources in North America and the international market. In further good news for investors, SLB revised its 2022 revenue outlook upward to at least $27 billion. This suggests that it expects year-over-year revenue growth in the high-teens compared with the prior projection of mid-teens. Increased participation in growth of drilling and completion activities across the world brightened Schlumberger’s outlook.

Smaller rival Halliburton HAL reported second-quarter adjusted net income per share of 49 cents, surpassing the Zacks Consensus Estimate of 45 cents and well above the year-ago quarter profit of 26 cents. HAL’s outperformance reflects stronger-than-expected profit from both its divisions.

Meanwhile, revenues of $5.1 billion were 36.9% higher than the corresponding period of 2021 and came ahead of the Zacks Consensus Estimate of $4.7 billion. North American revenues rose 54.6% year over year to $2.4 billion, while revenues from Halliburton’s international operations were up 23.9% from the year-ago period to $2.6 billion. Investors should know that HAL has outsized exposure to the North American land drilling market.

On the other hand, Baker Hughes BKR — which along with SLB and HAL makes up the ‘Big Three’ oil services firms — reported second-quarter adjusted earnings of 11 cents per share, missing the Zacks Consensus Estimate of 22 cents. BKR’s revenues for the April-June period totaled $5 billion, also underperforming the Zacks Consensus Estimate by 6.1%.

The lower-than-expected results were primarily caused by a decline in cost productivity and inflation pressures in Digital Solutions. This was partly offset by higher contributions from Baker Hughes’ Oilfield Services business unit.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance