Should Lifeward (LFWD) be in Your Portfolio Ahead of Q1 Earnings?

ReWalk Robotics Ltd. LFWD, or Lifeward, is expected to release first-quarter 2024 results soon.

The company posted a loss of 35 cents per share in the last reported quarter, much narrower than the Zacks Consensus Estimate of a loss of 91 cents. In each of the trailing four quarters, Lifeward beat earnings estimates, with an average surprise of 32.47%.

Let’s see how things have shaped up prior to this announcement.

Factors to Benefit LFWD in Q1

Lifeward’s transformation from ReWalk Robotics signifies its broader goal of enhancing the standard of care, empowering individuals with physical limitations and disabilities to pursue their passions. After headlining some milestone achievements in 2023, such as gaining Medicare payment for exoskeletons, acquiring commercially successful and highly innovative antigravity products and ongoing technology leadership with new products, the medical device maker has paved the way for exciting growth and expansion this year.

With the addition of AlterG, Lifeward is strategically emerging as the largest U.S. field organization in the exoskeleton industry, possessing both financial size and the infrastructure for the furthest reach and highest quality of support for the industry. Given the integration of the commercial and operational resources of the former ReWalk and AlterG businesses is now successfully complete, we expect this to boost the company’s first-quarter revenues significantly.

Lifeward’s anticipated revenue growth in 2024 incorporates a full year of AlterG business contribution, augmented by the planned mid-year launch of a new entry-level AlterG model. Furthermore, in the Q1 months, the company may have begun to cut its quarterly operating losses through revenue growth, increasing gross margin contributions, more cost-saving initiatives and synergistic expense management with a broader product offering.

Glamorous Bigger Picture

While the above factors should strongly add to the company’s results in the to-be-reported quarter, there are more to consider.

Lifeward is currently poised to benefit from CMS’ (Centers for Medicare & Medicaid Services) recent finalization of the payment rate for the ReWalk Personal Exoskeleton for 2024, effective Apr 1. The decision enables physicians to confidently prescribe the exoskeleton, with the clarity that Medicare patients will have an established reimbursement pathway. It is also worth noting that Lifeward has reported a debt-free balance sheet over the past several quarters, holding sufficient resources to fund multiple years of organic growth while making acquisitions of adjacent product lines.

With a market cap of $40.37 million, Lifeward stands as a top player in the more-than 1-billion worth global medical exoskeleton market. The company boasts a history of innovative firsts — including the first to bring a personal exoskeleton to the market with both FDA and CE approval, the first to commercially apply NASA-derived Differential Air Pressure Technology, and now, the first to achieve Medicare coverage for a personal exoskeleton. Its flagship offering, the ReWalk Personal Exoskeleton technology, received FDA clearance in 2023 for use on stairs and curbs following its designation as a "Breakthrough Device" for helping paralyzed individuals with SCI (spinal cord injury).

The ReBoot soft exo-suit, which received the FDA’s Breakthrough Device designation in November 2021, is currently under evaluation for the reimbursement landscape and its potential clinical impact. The product complements the ReStore Exo-Suit device, which the company began commercializing in June 2019. Since 2020, Lifeward has held an exclusive U.S. Distribution Agreement with MYOLYN, through which it distributes the MyoCycle Functional Electrical Stimulation (“FES”) Pro cycles to U.S. rehabilitation clinics and MyoCycle Home cycles to U.S. veterans through Veterans Health Administration (“VHA”) hospitals. These additional product lines have enhanced Lifeward’s offerings to clinics as well as VHA patients, both having similar clinician and patient profiles.

Figures Show Bullish Trajectory Ahead

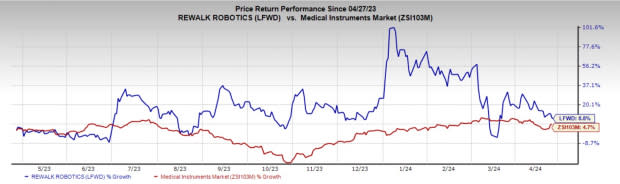

Over the past year, LFWD has mostly outperformed by gaining 8.8% compared with the industry’s 4.7% growth.

Image Source: Zacks Investment Research

Estimates for Lifeward’s 2024 loss have narrowed to $1.75 from $1.82 per share in the past 30 days. The company delivered record annual revenues of $13.9 million in 2023, a stupendous increase of 151% from the 2022 annual figure. On a more optimistic note, the Zacks Consensus Estimate shows a staggering 351.2% rise for the company’s 2024 first-quarter revenues from the 2023 comparable figure.

Our Take

In conclusion, LFWD is a buy ahead of its first-quarter results as earnings estimate revisions continue to rise for both 2024 and 2025.

Lifeward’s ongoing technological advancements and commercial operations have positioned it well to achieve its market goals. Backed by its track record of achieving numerous strategic milestones, we are optimistic about the company’s ability to deliver life-changing technology while simultaneously maintaining financial success. Hence, right now, Lifeward is a good stock for investors to consider.

Zacks Rank and Other Stocks to Consider

Lifeward currently sports a Zacks Rank #1 (Strong Buy).

Here are some other medical stocks worth considering:

TransMedics Group TMDX sports a Zacks Rank #1. The company is set to release first-quarter 2024 results on Apr 30. You can see the complete list of today’s Zacks #1 Rank stocks here.

TransMedics has an expected earnings growth rate of 81.8% for 2024. TMDX surpassed earnings in each of the trailing four quarters, the average being 107.83%.

Inspire Medical Systems INSP sports a Zacks Rank #1 at present. The company is set to release first-quarter 2024 results on May 7.

INSP has an expected earnings growth rate of 51.4% for 2024 compared to the industry’s 20.3%. The company surpassed earnings in each of the trailing four quarters, the average being 353.55%.

High Tide HITI currently sports a Zacks Rank #1. The company is expected to release its first-quarter 2024 results on May 6.

HITI has an expected 2024 earnings growth rate of 100% compared to the industry’s 18.3%. The company surpassed earnings in each of the trailing four quarter, the average being 91.67%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report

TransMedics Group, Inc. (TMDX) : Free Stock Analysis Report

High Tide Inc. (HITI) : Free Stock Analysis Report

ReWalk Robotics Ltd. (LFWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance