Lincoln Electric (LECO) Aided by Demand, Cost Woes Persist

Lincoln Electric Holdings, Inc. LECO is benefiting from the improving demand in all its end markets, as reflected in solid order levels and solid backlogs for equipment systems and automation solutions. Acquisitions, focus on developing new products and utilization of digital platforms to engage customers will continue driving the company’s top-line performance. LECO’s pricing actions will likely help the company to offset the impact of escalating labor, freight and raw material costs on its margins.

Solid Q4 Results

Lincoln Electric reported fourth-quarter 2022 record adjusted earnings of $1.94 per share, beating the Zacks Consensus Estimate of $1.90. The bottom line increased 21% year over year. Total revenues increased 10.3% year over year to a record $931 million. The improvement in revenues can be attributed to 14.3% growth in organic sales and a 0.7% benefit from acquisitions. The top line surpassed the Zacks Consensus Estimate of $927 million.

Solid Demand, Pricing to Offset Costs in 2023

The company has been witnessing improving order rates across all end-market sectors, regions and products. Robust backlog and acquisitions are expected to benefit the company’s performance throughout this year. While the company will continue to face supply-chain issues and escalating labor, freight and raw material costs, these will likely be countered by its pricing actions and improved productivity.

Lincoln Electric expects organic growth in the mid-single digit percentage for 2023. It anticipates an incremental margin in the mid-to-high-teens range.

The Zacks Consensus Estimate for the company’s earnings for 2023 is currently pegged at $8.66, suggesting year-over-year growth of 4.7%. The consensus mark for 2023 earnings stands at $9.01, indicating a year-over-year improvement of 4%.

Innovation, Acquisitions to Fuel Growth

The company is committed to new product development and utilizing digital platforms to engage customers. Lincoln Electric’s product launches in the automation solutions market are likely to aid growth. Focus on its new additive services business will position the company as a manufacturer of large-scale 3D-printed metal spell parts, prototypes and tooling for industrial customers, which is a major growth prospect.

Meanwhile, the company is continuously evaluating acquisition options focused primarily on tuck-in assets, in sync with its Higher Standard 2025 strategy. In March 2022, the company acquired Sao Paulo-based Kestra, that helped expand Lincoln Electric’s specialty alloy capabilities in South America. LECO also closed the acquisition of Fori Automation in 2022, which is expected to increase its annualized automation portfolio revenues to more than $850 million.

Balanced Capital Allocation Strategy

Lincoln Electric has a balanced capital allocation strategy, prioritizing growth investment while returning cash to shareholders. The company anticipates capital expenditures between $70 million and $80 million for 2022 and plans to repurchase shares opportunistically.

Lincoln Electric ended 2022 with a liquidity of $704 million and cash in hand of around $197 million. Its total debt-to-total capital ratio was 0.52 as of Dec 31, 2022. And the times interest earned ratio was 21.1. Lincoln Electric expects a strong cash flow generation and cash conversion of more than 75% in 2023, compared to 64% in 2022.

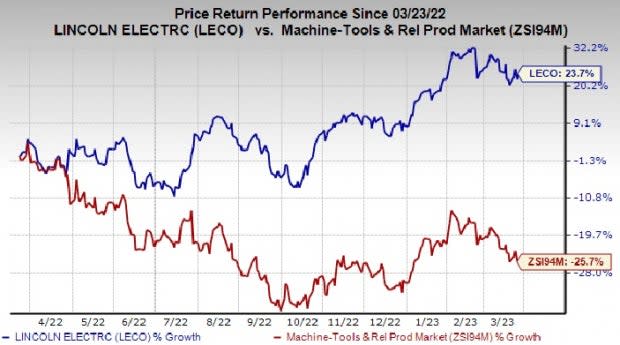

Price Performance

Lincoln Electric’s shares have gained 23.6% over the past year against the industry’s 23.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Lincoln Electric currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are OI Glass OI, Alamo Group ALG and Illinois Tool Works ITW. OI and ALG sport a Zacks Rank #1 (Strong Buy) at present, and ITW has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

OI Glass has an average trailing four-quarter earnings surprise of 16.4%. The Zacks Consensus Estimate for OI’s 2023 earnings is pegged at $2.57 per share. This indicates an 11.7% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved 16% north in the past 60 days. OI’s shares gained 70.2% in the last year.

Alamo has an average trailing four-quarter earnings surprise of 6%. The Zacks Consensus Estimate for ALG’s 2023 earnings is pegged at $9.79 per share. This indicates a 13.6% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved north by 7.5% in the past 60 days. Its shares gained 20.6% in the last year.

The Zacks Consensus Estimate for Illinois Tool Works’ fiscal 2023 earnings per share is pegged at $9.61, suggesting an increase of 4.8% from that reported in the last year. The consensus estimate for fiscal 2023 earnings moved 4% upward in the last 60 days. ITW has a trailing four-quarter average earnings surprise of 0.9%. Its shares gained 9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

O-I Glass, Inc. (OI) : Free Stock Analysis Report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance