Lincoln National (LNC) Q4 Earnings Miss Estimates, Rise Y/Y

Lincoln National Corporation’s LNC fourth-quarter 2019 earnings of $2.41 per share missed the Zacks Consensus Estimate by 1.23%. However, the bottom line improved about 12.1% year over year. Results gained from an increase in fee income and net investment income partly offset by rise in expenses.

Operating revenues of $4.5 billion surpassed the Zacks Consensus Estimate by 0.6%. The top line is aided by strong performance at its segments – Annuities, Retirement Plan Services, Life Insurance and Group Protection. However, revenues declined marginally on a year-over-year basis.

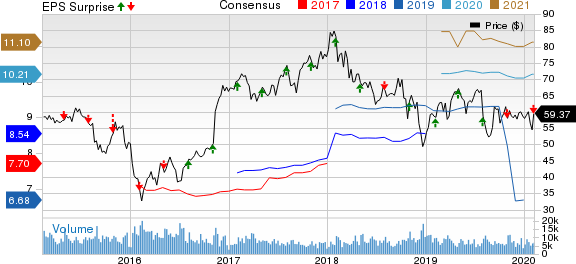

Lincoln National Corporation Price, Consensus and EPS Surprise

Lincoln National Corporation price-consensus-eps-surprise-chart | Lincoln National Corporation Quote

Segmental Performance

Operating income in the Annuities segment rose 4.3% year over year to $269 million. This was mainly driven by strong net flows as well as higher account values from solid equity market performance.

Total annuity deposits improved 3% from the year-ago quarter to $3.9 billion, driven by growth in variable annuity sales.

Operating income in Retirement Plan Services increased 4.4% year over year to $47 million due to higher account values banking on strong equity market performance and net flows. Total deposits improved 23% from the prior-year quarter’s value to $2.7 billion, owing to growth in recurring deposits and strong first-year sales.

Operating income in Life Insurance segment was up 2.3% year over year to $179 million as a result of favorable mortality and consistent business growth. Moreover, operating revenues in this segment surged 70.6% year over year to $447 million.

Operating income in Group Protection improved 8% from the year-ago quarter’s figure to $54 million. This upside was driven by improvement in the overall loss ratio and premium growth. Operating revenues rose 9% year over year to $297 million.

The Other operations segment incurred a loss of $67 million, wider than $53 million suffered in the prior-year quarter.

Financial Update

As of Dec 31, 2019, Lincoln National’s book value per share, excluding accumulated other comprehensive income, improved 5% year over year to $71.27.

Adjusted operating return on equity (ROE), excluding accumulated other comprehensive income and goodwill, improved 50 bps from the year-ago quarter’s number to 15.9%.

The company ended the quarter with long-term debt of $6.1 billion, up 5.2% year over year.

As of Dec 31, 2019, the company had assets worth $334.8 billion, up 12.3% from the year-ago quarter’s number. Shareholders’ equity also improved 37.2% year over year to $19.7 billion.

Zacks Rank and Peer Releases

Lincoln National carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other players from the insurance industry having reported fourth-quarter earnings so far, the bottom-line results of Brown & Brown, Inc. BRO and RLI Corp. RLI beat estimates while that of Principal Financial PFG matched the same.

"Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance