Lindsay Australia And 2 Other ASX Dividend Stocks To Watch

Over the past year, the Australian market has shown a steady increase of 7.5%, maintaining a flat trajectory in just the last week, with expectations for earnings to grow by 13% annually. In this environment, dividend stocks like Lindsay Australia can be particularly appealing for their potential to offer both stability and income growth.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.14% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.27% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.11% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 4.05% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.29% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.21% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.10% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.54% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

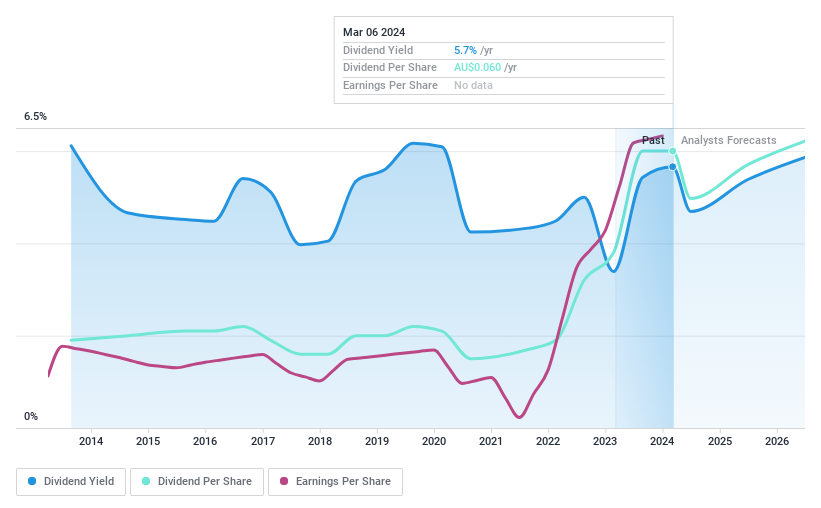

Lindsay Australia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors like food processing and horticulture, with a market capitalization of A$293.68 million.

Operations: Lindsay Australia Limited generates revenue primarily through its transport and rural supply operations, totaling A$571.38 million and A$158.73 million respectively.

Dividend Yield: 6.4%

Lindsay Australia's dividend profile presents a mixed scenario. Despite a 50.3% earnings growth last year, the firm's dividend track record has been unstable with volatile payments over the past decade. Currently, dividends yield at 6.38%, slightly below the top tier in Australia's market. However, both earnings and cash flows substantiate its dividends with payout ratios at 43.7% and 38.9%, respectively, indicating reasonable coverage and sustainability moving forward.

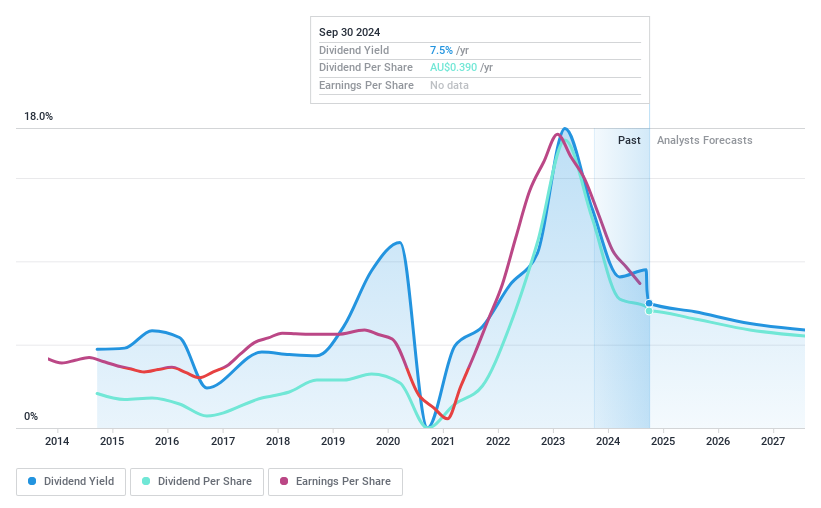

New Hope

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited, with a market cap of A$4.37 billion, is engaged in the exploration, development, production, and processing of coal, as well as oil and gas properties.

Operations: New Hope Corporation Limited generates A$1.88 billion from its Coal Mining NSW operations and A$48.15 million from its Coal Mining QLD, including Treasury and Investments.

Dividend Yield: 8.3%

New Hope's dividend yield stands at a robust 8.32%, ranking in the top quartile of Australian dividend stocks, yet its sustainability is questionable with dividends poorly covered by cash flows (90.2% cash payout ratio). Over the past decade, dividends have shown volatility and unreliability, despite a low earnings payout ratio of 48.4%. The stock trades at a significant discount to estimated fair value (-32.4%), but future earnings are expected to decline annually by 6.4%. Recent board changes include the resignation of Director Todd James Barlow and appointment of Brent Charles Albert Smith, potentially impacting governance and strategic direction.

Take a closer look at New Hope's potential here in our dividend report.

Our valuation report here indicates New Hope may be undervalued.

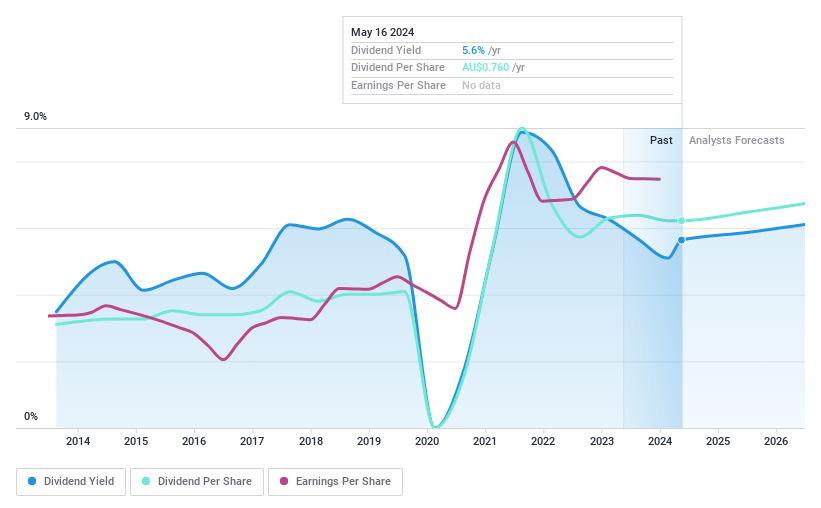

Super Retail Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Super Retail Group Limited operates in Australia and New Zealand, specializing in the retail of auto, sports, and outdoor leisure products with a market capitalization of approximately A$3.06 billion.

Operations: Super Retail Group Limited generates revenue through its segments, with Super Cheap Auto contributing A$1.48 billion, Rebel at A$1.30 billion, and Boating, Camping and Fishing (excluding Macpac) earning A$876 million, alongside Macpac's A$220.60 million.

Dividend Yield: 5.6%

Super Retail Group's dividend history shows variability with significant annual drops, making its reliability questionable for consistent income. Despite this, dividends are adequately covered by earnings and cash flows, with a payout ratio of 65.5% and a cash payout ratio of 28.6%. Trading at 4.9% below estimated fair value suggests attractiveness relative to peers, yet its dividend yield of 5.61% falls short compared to top Australian dividend payers. Forecasted average earnings decline of 0.4% annually over the next three years could pressure future payouts.

Key Takeaways

Delve into our full catalog of 27 Top ASX Dividend Stocks here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:LAU ASX:NHC and ASX:SUL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance