Lindsay Corp (LNN) Earnings: Aligns with EPS Projections Amidst Revenue Decline

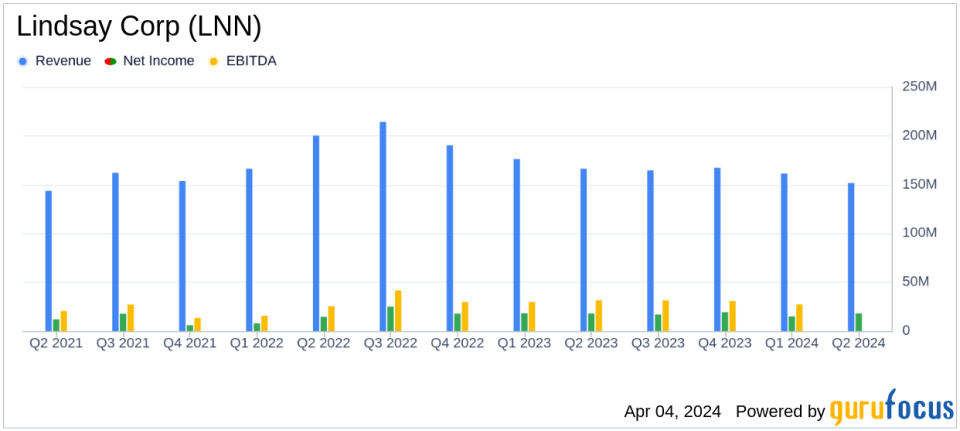

Revenue: Q2 revenue fell by 9% to $151.5 million, missing analyst estimates of $172.2995 million.

Net Income: Net earnings remained flat at $18.1 million, consistent with analyst projections.

Earnings Per Share (EPS): Diluted EPS at $1.64, slightly above the estimated $1.61.

Operating Margin: Decreased to 14.6% from 16.4% year-over-year.

Irrigation Segment: Revenue down 10% to $133.0 million, with North America and International sales declining.

Infrastructure Segment: Revenue stable at $18.5 million, with a significant increase in operating income by 74%.

Backlog: Unfilled orders at $94.2 million, slightly below $95.2 million from the previous year.

Lindsay Corporation (NYSE:LNN) disclosed its second quarter fiscal 2024 results on April 4, 2024, revealing a mixed financial performance. The company, a prominent player in irrigation and infrastructure equipment and technology, reported a slight increase in diluted earnings per share (EPS) to $1.64, up from $1.63 in the prior year quarter, aligning with analyst EPS projections. However, total revenues decreased by 9 percent to $151.5 million, falling short of the estimated $172.2995 million. The complete details of the earnings can be found in their recent 8-K filing.

Company Overview

Lindsay Corp is known for its advanced water management and road infrastructure products and services. The company operates through two main segments: Irrigation and Infrastructure. The Irrigation segment, which is the primary revenue driver, includes the manufacturing and marketing of various irrigation systems and technology solutions. Lindsay Corp is headquartered in the United States, where it generates the majority of its revenue.

Performance and Challenges

The company's performance in the second quarter reflects a stable demand for irrigation equipment in North America, which aligns with expectations due to the carryover impact of solid farm profits from the previous year. However, a significant drop in commodity prices in Brazil, coupled with reduced yields, has led to a decline in grower profitability and capital investment capacity, affecting the company's international sales. Lindsay's infrastructure business, on the other hand, showed resilience with the growth of its Road Zipper System leasing business, contributing to an improved margin profile.

Financial Achievements

Lindsay Corp's financial achievements in the quarter include maintaining net earnings at $18.1 million, despite a decrease in total revenues. The company's ability to keep earnings stable is a testament to its operational efficiency and strategic sales mix, particularly in the infrastructure segment, where operating income surged by 74 percent. These results are significant as they demonstrate Lindsay Corp's capacity to navigate market volatility and maintain profitability.

Segment Results and Outlook

The Irrigation segment saw a 10 percent decrease in revenues, with both North American and international sales experiencing declines. The Infrastructure segment maintained its revenue level, but operating income rose substantially due to a more favorable margin mix. Looking ahead, Lindsay Corp's CEO, Randy Wood, expressed cautious optimism, noting potential challenges in the U.S. farm income outlook that could impact irrigation equipment demand. Nevertheless, the company expects continued growth in infrastructure segment revenues, driven by U.S. infrastructure spending and the Road Zipper System lease revenues.

Overall, Lindsay Corp's fiscal second quarter results showcase a company facing market headwinds but still managing to align with EPS projections, a key indicator of financial stability. The company's strategic investments in innovation and manufacturing modernization, as highlighted by the CEO, position it to capitalize on long-term growth opportunities despite near-term challenges.

For more detailed information and analysis on Lindsay Corp's financial performance and strategic direction, investors and interested parties are encouraged to join the company's investor conference call or access the presentation materials through Lindsay Corporation's website.

Explore the complete 8-K earnings release (here) from Lindsay Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance