Lindsay (LNN) Earnings Top Estimates in Q3, Revenues Dip Y/Y

Lindsay Corporation LNN delivered adjusted earnings per share of $1.41 in third-quarter fiscal 2024 (ended on May 31, 2024), beating the Zacks Consensus Estimate of $1.25. The bottom line fell 8% year over year.

Including an income tax credit of 44 cents per share, earnings per share in the quarter were $1.85.

Lindsay generated revenues of $139 million, down 15.4% from the $165 million reported in the year-ago quarter. The top line missed the Zacks Consensus Estimate of $152 million.

The company’s backlog as of May 31, 2024, was $246.9 million compared with $94.5 million as of May 31, 2023.

Lindsay Corporation Price, Consensus and EPS Surprise

Lindsay Corporation price-consensus-eps-surprise-chart | Lindsay Corporation Quote

Operational Update

The cost of operating revenues fell 16.7% year over year to $93 million. Gross profit decreased 12.8% to $46.5 million from the year-earlier quarter. The gross margin was 33.4% compared with the year-ago quarter’s 32.4%.

Operating expenses were $26.6 million in the fiscal third quarter, up 1.1% year over year. Operating income was $20 million, down from the prior-year quarter’s $27 million.

Segmental Results

The Irrigation segment’s revenues fell 19% year over year to around $115 million in the fiscal third quarter. North America irrigation revenues decreased 9% from the year-ago quarter to $68 million due to lower unit sales volumes and reduced sales of replacement parts.

International irrigation revenues dipped 31% year over year to $47 million on lower sales volumes in Brazil and other Latin America markets. The irrigation segment’s operating income fell 36% year over year to $19.5 million.

The Infrastructure segment’s revenues increased 11% year over year to $24 million on higher Road Zipper System sales and increased lease revenues. The segment reported operating income of $6.3 million, up 76% year over year.

Financial Position

Lindsay had cash and cash equivalents of $140 million at the end of the third quarter of fiscal 2023 compared with $161 million at the end of fiscal 2023. The company’s long-term debt stood at around $115 million at the end of the fiscal third quarter, flat with the end of fiscal 2023.

Lindsay issued a quarterly cash dividend of 36 cents per share, a 3% increase compared to the previous quarter's projected rate of 35 cents. This is payable on Aug 30, 2024, to shareholders of record at the close of business on Aug 16, 2024. The current annual indicated rate is $1.44 per share, updated from the previous rate of $1.40.

Outlook

The company anticipates the performance in North America and Brazil to continue being impacted. However, it is confident in the market's long-term growth potential. The company expects continued growth in expanding international markets, driven by the ongoing need to address food security.

LNN's infrastructure business is beginning to benefit from rising infrastructure spending in the United States, particularly in Road Zipper System leasing and sales of road safety equipment. It also continues to actively manage projects through the Road Zipper System project sales funnel. However, project implementation timing is difficult to estimate.

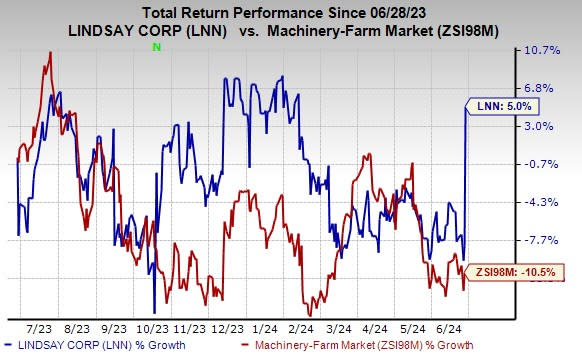

Price Performance

Lindsay’s shares have gained 5% in the past year against the industry’s fall of 10.5%.

Image Source: Zacks Investment Research

Zacks Rank

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Farm Equipment Stocks Awaiting Results

Deere & Company DE is expected to release its third-quarter fiscal 2024 results soon.

The Zacks Consensus Estimate for the company’s earnings per share is pegged at $5.95 for the fiscal third quarter, suggesting a decline of 41.9% from the year-ago reported figure. The Zacks Consensus Estimate for total revenues is pinned at $11.02 billion, indicating a year-over-year decrease of 22.8%

AGCO Corp. AGCO is expected to release its second-quarter 2024 results soon. The Zacks Consensus Estimate for the company’s earnings per share is pegged at $3.09 for the second quarter, suggesting a decline of 27.8% from the year-ago reported figure. The Zacks Consensus Estimate for total revenues is pinned at $3.4 billion, indicating a year-over-year decrease of 5.9%.

CNH Industrial N.V. CNH is expected to release its second-quarter 2024 results soon. The Zacks Consensus Estimate for the company’s earnings per share is pegged at 39 cents for the second quarter, suggesting a decline of 25% from the year-ago reported figure. The Zacks Consensus Estimate for total revenues is pinned at $5.7 billion, indicating a year-over-year decrease of 13.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

CNH Industrial N.V. (CNH): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance