Liquidity Services Inc (LQDT) Surpasses Revenue Expectations in Q2 Fiscal Year 2024

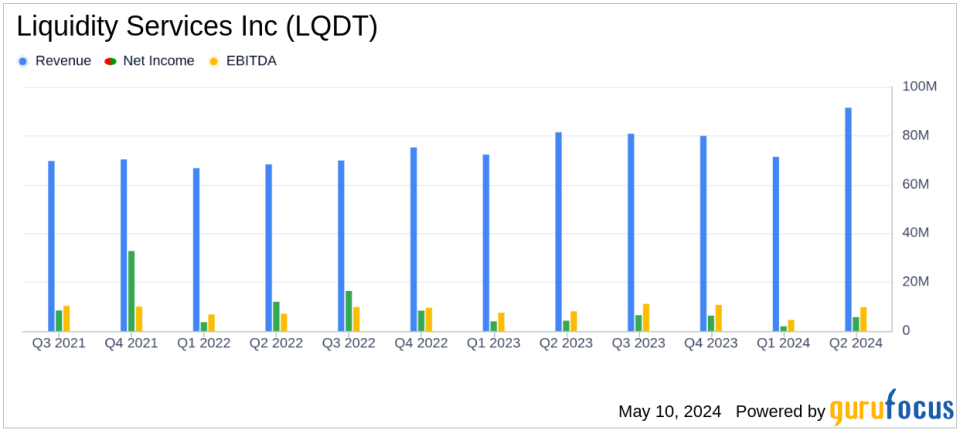

Revenue: Reported at $91.5 million, marking a 12% increase year-over-year, surpassing the estimated $80.80 million.

Net Income: Achieved $5.7 million, up 35% from the previous year, but fell short of the estimated $9.07 million.

Earnings Per Share (EPS): Non-GAAP Adjusted EPS stood at $0.27, up from $0.20 year-over-year, below the estimated $0.32.

Gross Merchandise Volume (GMV): Increased by 13% to $319.4 million, indicating strong market performance and expansion.

Operating Cash Flow: Generated $34.8 million during the quarter, used partly for strategic acquisitions and share repurchases.

Market Expansion: Notable growth in registered buyers by 6% and a 43% increase in auction participants, reflecting enhanced platform engagement.

Future Outlook: Anticipates continued double-digit GMV growth, driven by strategic segment expansions and new service offerings.

Liquidity Services Inc (NASDAQ:LQDT), a leading global commerce company specializing in the circular economy, announced its financial results for the second quarter of fiscal year 2024 on May 9, 2024. The company's performance highlighted significant growth in Gross Merchandise Volume (GMV) and revenue, outpacing analyst expectations. For detailed insights, refer to the company's 8-K filing.

Liquidity Services operates a network of e-commerce marketplaces that facilitate the sale of inventory and equipment for business and government clients. The company's significant segments include GovDeals, Capital Assets Group (CAG), Retail Supply Chain Group (RSCG), and Machinio, with the majority of revenue generated from the RSCG segment in the U.S. and Canada.

Financial Performance Overview

The company reported a GMV of $319.4 million, marking a 13% increase from the previous year, and revenue reached $91.5 million, up 12% year-over-year. This performance resulted in a GAAP Net Income of $5.7 million, a 35% increase, with earnings per share growing by 38% to $0.18. Adjusted EBITDA also saw a rise, up 22% to $12.1 million.

Liquidity Services' strategic acquisitions, including the recent addition of Sierra Auction, have strengthened its market position, particularly in the southwest U.S., enhancing its service offerings to government and commercial clients. The company's focus on automation and operational efficiency continues to pay dividends across its diversified segments.

Segment Performance and Market Developments

The CAG segment reported a 29% increase in GMV, driven by robust sales in industrial and heavy equipment categories. The GovDeals segment saw an 11% rise in GMV, supported by a higher number of active sellers and vehicle availability. The RSCG segment's GMV increased by 9%, influenced by strong performance in sell-in-place consignment solutions, although tempered by a lower value product mix in some programs. Machinio, the classifieds marketplace segment, achieved record revenue and customer counts, benefiting from enhancements to its platform.

Challenges and Strategic Initiatives

Despite the positive trends, the company faces challenges such as variability in inventory product mix and the impact of economic conditions on asset values and sales volume. In response, Liquidity Services is actively pursuing strategic opportunities to enhance its platform and expand its market reach, particularly through the AllSurplus Deals direct-to-consumer sales channel and ongoing investments in technology and operational capabilities.

Outlook and Forward-Looking Statements

For Q3 FY 2024, Liquidity Services anticipates continued growth, with GMV expected to range between $350 million and $385 million. The company projects GAAP Net Income to be between $3.5 million and $6.5 million, and Adjusted EBITDA to range from $10.5 million to $13.5 million. These projections reflect the company's strategic initiatives and market conditions anticipated to influence its performance in the upcoming quarter.

Liquidity Services' robust performance in Q2 FY 2024 underscores its effective strategy and operational efficiency in navigating market dynamics and capitalizing on growth opportunities within the circular economy. The company remains committed to delivering value to shareholders and enhancing its service offerings to meet the evolving needs of its global customer base.

For more detailed financial information and future updates, investors and interested parties are encouraged to refer to the company's filings and announcements, available on the Liquidity Services investor relations website.

Explore the complete 8-K earnings release (here) from Liquidity Services Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance