Lisata's (LSTA) LSTA1 Gets FDA Orphan Drug Tag for Osteosarcoma

Lisata Therapeutics, Inc. LSTA announced that the FDA has granted an Orphan Drug Designation (“ODD”) to its lead pipeline candidate, LSTA1, for the treatment of osteosarcoma, a rare type of bone cancer that affects children, adolescents and young adults. Shares of the company were up 4.1% on Apr 9, following the announcement of the news.

The FDA grants ODD to support the development of medicines for rare disorders that affect fewer than 200,000 patients in the United States. The ODD will grant Lisata seven-year market exclusivity for LSTA1 for a predefined time period, along with the exemption of FDA application fees and tax credits for qualified clinical studies, all subject to potential approval.

LSTA1 is an investigational drug candidate that allows co-administered or tethered anti-cancer drugs to better penetrate solid tumors by activating a novel uptake pathway. The candidate has exhibited the potential to improve the tumor environment, thereby making tumors more responsive to immunotherapy.

If successfully developed and upon potential approval, LSTA1 can serve an area of high unmet medical need and help patients by providing better treatment for osteosarcoma.

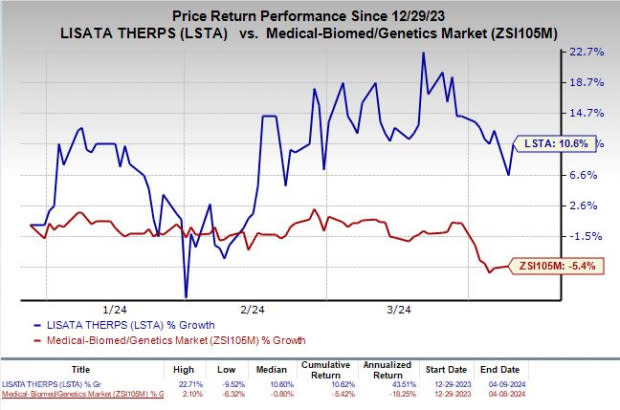

Shares of Lisata have rallied 10.6% so far this year against the industry’s decline of 5.4%.

Image Source: Zacks Investment Research

The FDA granted a Rare Pediatric Disease Designation to LSTA1 for treating osteosarcoma last month.

Previously, the FDA had granted ODD to LSTA1 for the treatment of pancreatic cancer and glioblastoma multiforme (“GBM”). The regulatory body has also granted a Fast Track designation to LSTA1 for pancreatic cancer.

LSTA1 is currently being evaluated as a combination therapy with various anti-cancer regimens in several early-to-mid-stage studies for treating multiple cancer indications, including metastatic pancreatic ductal adenocarcinoma (“mPDAC”).

In December 2023, Lisata completed patient enrollment in the phase IIb ASCEND study, which is evaluating LSTA1 with SoC gemcitabine/nab-paclitaxel for patients with first-line mPDAC.

Top-line data from cohort A (98 patients assigned) of the ASCEND study are expected in the fourth quarter of 2024, while complete data for all 158 patients in the study are anticipated by mid-2025.

LSTA1 is also being studied for other forms of cancers like pancreatic cancer, cholangiocarcinoma, esophageal cancer, head and neck cancer, appendiceal cancer, colon cancer and GBM.

Zacks Rank & Stocks to Consider

Lisata currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are ADMA Biologics, Inc. ADMA, Ligand Pharmaceuticals Incorporated LGND and ANI Pharmaceuticals, Inc. ANIP, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Year to date, shares of ADMA have rallied 35.2%.

ADMA’s earnings beat estimates in three of the trailing four quarters and met the same once, the average surprise being 85.00%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have gained 15%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have improved from $4.06 to $4.43. Year to date, shares of ANIP have jumped 21.6%.

Earnings of ANIP beat estimates in each of the trailing four quarters, the average surprise being 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Lisata Therapeutics, Inc. (LSTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance