LKQ Beats Q3 Earnings Estimates, Raises Dividend by 10%

LKQ Corporation LKQ reported adjusted earnings of 97 cents per share in third-quarter 2022, beating the Zacks Consensus Estimate of 95 cents, riding on higher-than-expected revenues from the Wholesale North American segment. The bottom line, however, declined 4.9% year over year. This aftermarket auto parts distributor registered quarterly revenues of $3,104 million, missing the Zacks Consensus Estimate of $3,209 million. The top line fell 5.9% from the year-ago level. The parts and services organic revenues also increased 4.8% year over year.

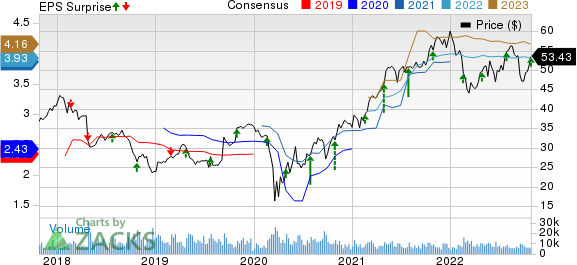

LKQ Corporation Price, Consensus and EPS Surprise

LKQ Corporation price-consensus-eps-surprise-chart | LKQ Corporation Quote

Segment Highlights

In the reported quarter, revenues from the Wholesale North American segment totaled $1,109 million, decreasing 0.3% from $1,112 million reported in the prior-year period but topping the consensus mark of $1,090 million. The segment’s EBITDA came in at $216 million, up from $190 million in the third quarter of 2021.

Revenues from the European segment were $1,380 million, down 9.5% from $1,525 million in the year-earlier quarter and missing the consensus mark of $1,408 million. The segment’s EBITDA came in at $155 million, contracting from $175 million in the year-ago period.

Revenues from the Specialty segment came in at $452 million, down 3% year over year and missing the consensus mark of $493 million. The segment EBITDA was $49 million, declining from the year-ago figure of $52 million.

Revenues from the Self Service segment totaled $164 million, down nearly 16% from the year-earlier quarter’s sales. The segment’s EBITDA was $4 million, massively shrinking from $36 million.

Financial Position & Dividend

LKQ had cash and cash equivalents of $269 million on Sep 30, 2022, down from $274 million recorded as of Dec 31, 2021. The long-term debt (excluding the current portion) amounted to $2,390 million as of Sep 30, 2022, down from $2,777 million recorded on Dec 31, 2021. As of Sep 30, 2022, LKQ’s balance sheet reflected net debt of $2.2 billion.

During the quarter, cash flow provided by operating activities totaled $273 million. Capital expenditure was $49 million, with the company recording a positive free cash flow of $224 million.

During the reported quarter, the company repurchased 6.8 million shares worth $343 million. Between the period of initiating the stock buyback program in late October 2018 and Sep 30, 2022, it repurchased around 52 million shares for a total of $2.2 billion. The buyback program has been boosted by a further $1 billion through October 2025.

On Oct 25, 2022, LKQ declared a quarterly cash dividend of 27.5 cents per share of common stock, an increase of 10% from the prior dividend of 25 cents. The dividend is payable on Dec 1, 2022, to stockholders of record at the close of business on Nov 17, 2022

2022 Guidance

For 2022, the company lowered its projection for adjusted EPS to $3.85-$3.95 from the prior range of $3.85-$4.05 per share. The company’s estimate of free cash flow has been changed to nearly $1 billion from the previous forecast of a minimum of $1 billion. The operating cash flow projection has been brought down to $1.25 billion from the previous level of $1.3 billion. Its forecast of organic revenue growth for parts and services has been modified to the range of 4.75-5.75% from 4.5-6.5%.

Zacks Rank & Key Picks

LKQ currently has a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Cummins Inc. CMI, CarParts.com PRTS and Allison Transmission Holdings ALSN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Cummins has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for CMI’s current-year earnings has been revised 1% upward in the past 30 days.

CarParts has an expected earnings growth rate of 45% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant over the past 30 days.

Allison has an expected earnings growth rate of 21.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 4.34% downward over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

CarParts.com, Inc. (PRTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance