Is Lloyds’ soaring share price still 11% undervalued?

The Lloyds Banking Group (LSE:LLOY) share price has rocketed during the last six weeks. And if the City’s brokers are to be believed, the FTSE 100 bank has scope to keep on rising.

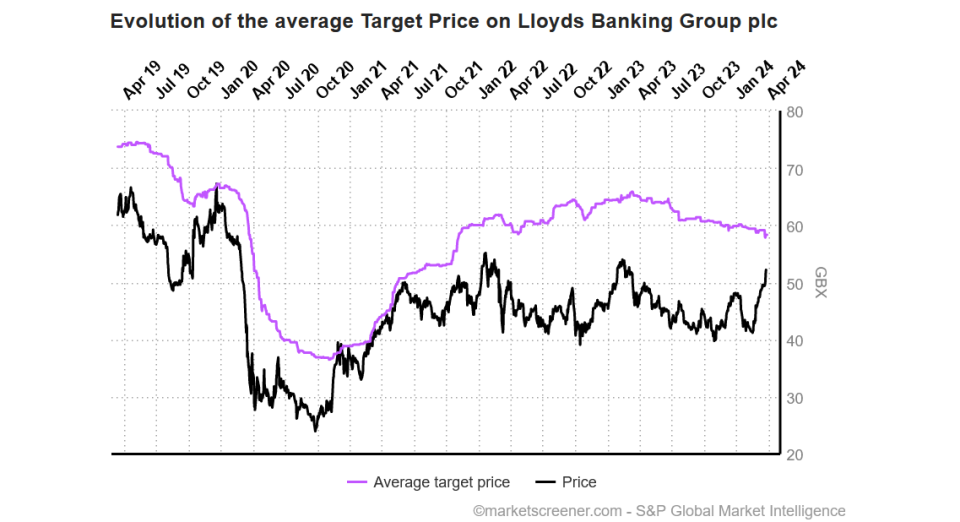

The 17 analysts with ratings on Lloyds have slapped an average 12-month price target of 58.3p per share on the Black Horse Bank. That suggests the bank has a further 11% to run from current levels of 51.9p.

On the up

As the chart shows, the difference between the firm’s actual and target prices have steadily narrowed. But by investing today, I could still enjoy some solid gains if broker forecasts come true.

With Lloyds shares also carrying a 6.1% dividend yield, I could enjoy a brilliant combination of large capital gains and healthy passive income.

But can investors really expect the bank to continue soaring over the next year? And should I buy the FTSE share for my portfolio anyway?

The good

Lloyds’ share price jump reflects, in large part, improving confidence in the UK economy.

Banks are some of the most cyclical businesses out there. During the good times, loan growth tends to strengthen while the level of credit impairments heads the other way.

News that UK GDP increased 0.2% in January has raised hopes of an immediate exit from recession, and by extension an improvement in Lloyds’ fortunes.

A better-than-expected impairment charge of £308m at the bank for 2023 also went some way to improving the mood music. This was down a whopping 80% from the previous year, although the figure was boosted by a single large loan repayment in quarter four that had previously been written down.

The bad

But is there a chance the market has become too giddy around Lloyds and its trading outlook? It’s a thought that has been occupying my mind.

The UK economy is still rumbling along the bottom, despite January’s unexpected uptick. And this is expected to remain the case for some time, stymying profits growth across the banking sector.

Meanwhile, interest rates are expected to recede sharply from the middle of 2024 in response to falling inflation. This in turn will put Lloyds’ net interest margin (NIM) — which fell 10 basis points to 2.98% in the final quarter of last year — under increased pressure.

The even badder

Arguably, however, these are not the biggest threats to Lloyds and its share price. A fresh investigation by the Financial Conduct Authority (FCA) into mis-selling — this time concerning car finance deals — could be a hugely expensive saga.

Lloyds has already set aside £450m to cover any potential penalties.

As analyst Russ Mould of AJ Bell has commented: “anyone with memories of the PPI scandal will have doubts over whether the amount set aside so far will represent the final cost of dealing with this issue. Time will tell if £450m represents the tip of the iceberg or an appropriately conservative assumption.”

Some analysts have tipped a total cost of £1.5bn. It’s a development that would likely wreak havoc on the Lloyds share price.

The verdict

Lloyds is on the up right now. But it still faces considerable risks that could damage its profitability in 2024 and beyond. Right now I’d rather invest in other FTSE 100 momentum stocks.

The post Is Lloyds’ soaring share price still 11% undervalued? appeared first on The Motley Fool UK.

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Aj Bell Plc and Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance