Lockdown lending freeze squeezes Experian

Experian, the world’s largest credit checking company, was hit by a slowdown in lending during the pandemic.

Total revenues at the FTSE 100 data behemoth fell 5pc in the second quarter, stripping out the effect of acquisitions and disposals.

A strong performance in Experian’s key North American market was tempered by a 15pc slump in the UK and a 20pc contraction in Europe, Asia and the Middle East.

Demand for Experian’s services fell as companies adapted to the pandemic - trading was particularly difficult in emerging markets such as India, where ecommerce is less developed and internet access is more limited.

Brian Cassin, chief executive, said the UK’s stringent lockdown hurt his company’s performance and new lending was down sharply in the three months to June.

Explaining the contrast between the company’s 4pc growth in the US and the sharp UK contraction he said: “There's one big difference which is in the US, we're benefiting from what is a mortgage refinancing boom, and in the UK the mortgage market has simply closed up shop.”

The British property market effectively shut for almost two months during lockdown, as social distancing measures made it almost impossible for buyers to view houses and banks focused on processing requests for mortgage holidays and emergency business loans.

Mr Cassin said that increased saving and reduced spending during lockdown helped to improve Britons’ credit scores.

“The credit profile of UK consumers has actually improved for now. A big question is still outstanding as to what happens once the furlough schemes fall away and as we start to see suitable employment kicking up,” he said.

Experian and other credit checking agencies have been co-operating with regulators to ensure the credit scores of customers who avail of temporary mortgage holidays during the crisis are not negatively affected.

The company has also been using its expertise and anonymised data to help the NHS, local councils and food banks to plan and co-ordinate their response to the pandemic.

Experian has used its data to identify areas where there may be a higher concentration of elderly people or people living in food poverty to help authorities project demand for treatment and support.

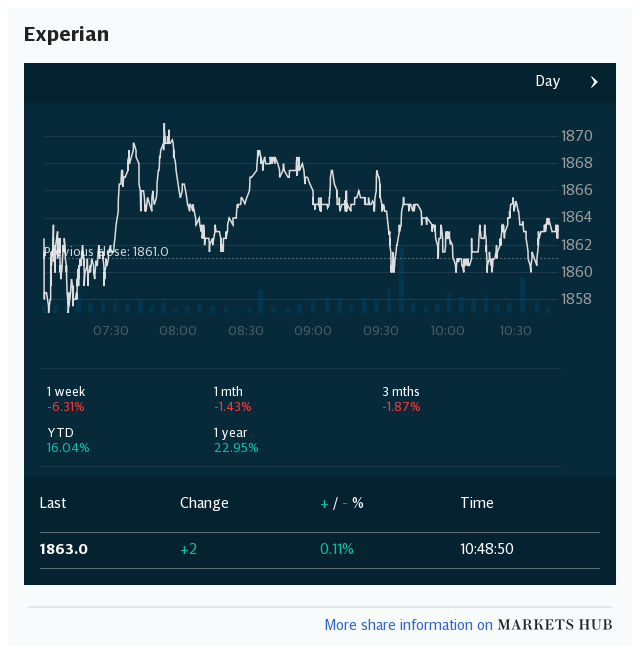

Shares dipped 0.6pc to £28.28, valuing the company at almost £26bn.

Yahoo Finance

Yahoo Finance