Lockheed (LMT) Q1 Earnings Beat Estimates, Sales Improve Y/Y

Lockheed Martin Corporation LMT reported first-quarter 2024 adjusted earnings of $6.33 per share, which beat the Zacks Consensus Estimate of $5.80 by 9.1%. The bottom line, however, declined 1.6% from the year-ago quarter's recorded figure of $6.43.

The company reported GAAP earnings of $6.39 per share compared with $6.61 in the prior-year period.

Operational Highlights

Net sales were $17.20 billion, which surpassed the Zacks Consensus Estimate of $16.19 billion by 6.2%. The top line also increased 13.7% from $15.13 billion reported in the year-ago quarter.

The year-over-year top-line improvement can be attributed to sales growth from all of the four segments of Lockheed.

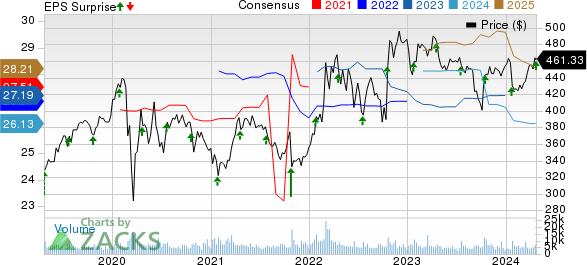

Lockheed Martin Corporation Price, Consensus and EPS Surprise

Lockheed Martin Corporation price-consensus-eps-surprise-chart | Lockheed Martin Corporation Quote

Backlog

LMT’s backlog as of Mar 31, 2024, was $159.37 billion compared with $160.57 billion at the end of fourth-quarter 2023.

Our model projected a backlog worth $161.58 billion for the first quarter of 2024.

The Aeronautics segment accounted for $57.04 billion of this amount, while Rotary and Mission Systems contributed $38.03 billion. The Space, and the Missiles and Fire Control segments contributed $33.01 billion and $31.30 billion, respectively.

Segmental Performance

Aeronautics: Sales improved 9% year over year to $6.85 billion, driven by higher sales from F-35, F-16 and classified programs.

The segment’s operating profit improved 0.5% year over year to $679 million. The operating margin, however, contracted 90 basis points (bps) to 9.9%.

Missiles and Fire Control: Quarterly sales improved a solid 25.3% year over year to $3 billion. This was on account of higher sales from tactical and strike missile programs as well as integrated air and missile defense programs.

The segment’s operating profit decreased 17.5% year over year to $311 million. The operating margin of 10.4% deteriorated 540 bps from the year-ago quarter’s level.

Space: Sales increased 10.5% year over year to $3.27 billion due to higher sales from strategic and missile defense programs, as well as national security space programs.

The segment’s operating profit improved 16.1% to $325 million. The operating margin expanded 40 bps to 9.9% in the quarter under review.

Rotary and Mission Systems: Quarterly revenues improved 16.5% to $4.09 billion on a year-over-year basis. This was primarily driven by higher net sales from integrated warfare systems and sensors (IWSS) programs, along with various C6ISR (command, control, communications, computers, cyber, combat systems, intelligence, surveillance, and reconnaissance) programs. Higher net sales from Sikorsky helicopter programs also aided this segment’s top line.

The segment’s operating profit rose 22.9% to $430 million in the reported quarter. The operating margin expanded 50 bps to 10.5% in the same time frame.

Financial Condition

Lockheed’s cash and cash equivalents totaled $2.79 billion at the end of first-quarter 2024 compared with $1.44 billion at the end of 2023.

Cash from operating activities amounted to $1.64 billion as of Mar 31, 2024, compared with $1,56 billion in the year-ago period.

Long-term debt as of Mar 31, 2024, totaled $19.25 billion, up from $17.29 billion as of Dec 31, 2023.

2024 Guidance

Lockheed has reiterated its financial guidance for 2024. The company still expects revenues in the range of $68.50-$70.00 billion. The Zacks Consensus Estimate for revenues is pegged at $69.43 billion, which lies higher than the mid-point of the company’s guided range.

LMT continues to expect to generate earnings per share (EPS) in the range of $25.65-$26.35. The Zacks Consensus Estimate for the company’s full-year EPS is pinned at $26.13, higher than the mid-point of the company’s guidance.

Lockheed still expects to generate free cash flow in the range of $6.00-$6.30 billion during 2024.

Zacks Rank

LMT currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Q1 Defense Earnings

Textron TXT is scheduled to declare first-quarter 2024 results on Apr 25, before market open. The Zacks Consensus Estimate for first-quarter revenues is pegged at $3.37 billion, indicating a 11.4% increase from the year-ago quarter’s reported figure.

The consensus mark for Textron’s earnings is pinned at $1.28 per share, indicating a 21.9% improvement year over year.

The Boeing Company BA is set to release first-quarter 2024 results on Apr 24, before the opening bell. The Zacks Consensus Estimate for first-quarter revenues is pegged at $17.69 billion, indicating a 1.3% decline from the year-ago quarter’s reported figure.

The bottom-line estimate for BA is pegged at a loss of $1.43 per share, indicating a deterioration from the year-ago quarter’s reported loss of $1.27.

Northrop Grumman NOC is scheduled to report first-quarter 2024 results on Apr 25, before market open. The Zacks Consensus Estimate for first-quarter revenues is pegged at $9.78 billion, indicating a 5.2% increase from the year-ago quarter’s reported figure.

The consensus mark for Northrop’s earnings is pinned at $5.83 per share, indicating a 6% improvement year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance