Lockheed Martin Corp (LMT) Surpasses Analyst Expectations with Strong Q1 2024 Earnings

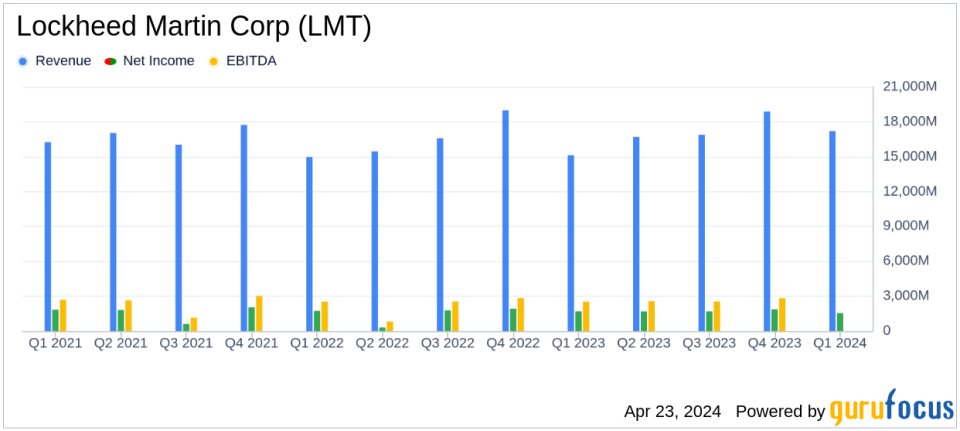

Net Sales: Reported at $17.2 billion, up from $15.1 billion in the previous year's first quarter, surpassing the estimated $15.99 billion.

Net Earnings: Achieved $1.5 billion, compared to $1.7 billion in the same quarter last year, falling short of the estimated $1.387 billion.

Earnings Per Share (EPS): Recorded at $6.39, down from $6.61 year-over-year, exceeding the estimate of $5.81.

Free Cash Flow: Maintained at $1.3 billion, consistent with the previous year's first quarter.

Dividends and Share Repurchases: Returned $1.8 billion to shareholders through dividends and share repurchases.

Research and Development Investment: Invested over $700 million into R&D and capital projects during the quarter.

2024 Financial Outlook: Reaffirmed, expecting net sales between $68.5 billion and $70 billion, and EPS between $25.65 and $26.35.

On April 23, 2024, Lockheed Martin Corp (NYSE:LMT) released its 8-K filing, announcing impressive first-quarter financial results for 2024. The company reported net sales of $17.2 billion, surpassing the estimated $15.99 billion and reflecting a significant increase from $15.1 billion in the same quarter the previous year. Net earnings stood at $1.5 billion, or $6.39 per share, exceeding the analyst's EPS estimate of $5.81.

Lockheed Martin, the world's largest defense contractor, is renowned for its high-end fighter aircraft, particularly the F-35 Joint Strike Fighter program. The company's diverse portfolio spans aeronautics, rotary and mission systems, missiles and fire control, and space systems, contributing to a robust $159 billion backlog that underscores its enduring market leadership and operational excellence.

Financial Performance and Strategic Initiatives

The first quarter of 2024 was marked by a robust performance with net earnings of $1.5 billion, despite a slight decrease from $1.7 billion in the first quarter of 2023. The earnings per share (EPS) also saw a minor reduction from $6.61 to $6.39. The company generated strong cash from operations amounting to $1.6 billion and maintained a healthy free cash flow of $1.3 billion.

Lockheed Martin's strategic capital deployments were highlighted by significant shareholder returns, including $1.8 billion through dividends and share repurchases. Additionally, the company invested over $700 million in research and development (R&D) and capital projects, emphasizing its commitment to innovation and long-term growth.

Segment Performance

The company operates through four primary segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. Each segment demonstrated strong sales performance with notable increases across the board. The Aeronautics segment, in particular, reported a 9% increase in net sales, largely driven by higher volumes on the F-35 and F-16 programs.

The MFC segment saw a 25% increase in sales, attributed to higher volumes on tactical and strike missile programs. However, it experienced a decrease in operating profit due to a $100 million loss recognized on a classified program. RMS and Space segments also reported increases in both sales and operating profits, driven by higher volumes and favorable profit adjustments.

Challenges and Outlook

Despite the strong financial performance, Lockheed Martin faces ongoing challenges such as inflationary pressures and supply chain constraints. The company's leadership remains focused on navigating these challenges while continuing to meet the high demands of its defense contracts.

For the full year 2024, Lockheed Martin reaffirms its financial outlook, projecting net sales between $68.5 billion and $70 billion and diluted earnings per share in the range of $25.65 to $26.35. The company anticipates continued strong cash flow generation, with projected operations cash flows between $7.75 billion and $8.05 billion.

Conclusion

Lockheed Martin's Q1 2024 results not only surpassed analyst expectations but also solidified its position as a leader in the aerospace and defense industry. With a strong financial base, strategic growth initiatives, and a focus on shareholder returns, Lockheed Martin continues to offer promising prospects for investors and stakeholders.

For more detailed information and updates, visit Lockheed Martins investor relations website at www.lockheedmartin.com/investor.

Explore the complete 8-K earnings release (here) from Lockheed Martin Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance