Lockheed's (LMT) Arm Wins Deal to Support CH-53K Aircraft

Lockheed Martin Corp.’s LMT business unit, Sikorsky, recently won a contract for procuring long-lead items involving full-rate production of CH-53K aircraft. The Naval Air Systems Command, Patuxent River, MD, offered the contract.

Valued at $35.3 million, the contract is expected to get completed by December 2022. Work related to this deal will be executed in Stratford, CT.

Growing Importance of CH-53K Helicopter

The CH-53K helicopter takes forward Sikorsky’s 50 years of manufacturing and operational success with its CH-53A, CH-53D/G and CH-53E predecessors. The new heavy lifter allows the U.S. Marine Corps and international militaries to move troops and equipment from ship to shore and to higher altitude terrains more quickly and effectively. It is also effective in handling missions like humanitarian aid, troop transport, casualty evacuation, support of special operation forces, and combat search and rescue.

In February 2021, Israel made a decision to purchase Lockheed’s CH-53K helicopter over Boeing's BA CH-47, in an effort to further build on the Israel Defense Force’s capabilities. Such a strategic move by Israel could be pivotal for Lockheed’s growth in the trouble-ridden Middle East area over top competitors.

Growth Prospects

Substantial fleet modernization plans of militaries deploying new and advanced attack helicopters are anticipated to support the combat helicopter market growth. Notably, per a Mordor Intelligence report, the global attack helicopter market is expected to witness a CAGR of more than 4% during the 2020-2025 time period.

Such growth can be attributed to the rise in global threats, geopolitical instabilities and increased spending on defense. These projections are expected to boost the growth of major combat helicopter producers like Lockheed.

Will Other Helicopter Makers Benefit?

No doubt, the aforementioned growth projections for the combat helicopter market also bode well for other helicopter makers such as Airbus SE EADSY, Boeing and Textron TXT.

Boeing’s MH-47G belongs to the family of CH-47 Chinook multi-role heavy-lift helicopters. The helicopter enjoys massive global demand owing to the advanced and combat-proven features that enable it to work in all kinds of combat and tactical missions.

During the third quarter, Boeing delivered four CH-47F Block II Chinook helicopters for the U.S Army. The company boasts a long-term earnings growth rate of 4%.

Airbus is among the world's largest suppliers of advanced military helicopters. Airbus helicopters are in service across more than 150 countries worldwide. Airbus’ product line offers the full spectrum of rotary-wing aircraft solutions for civil, government, military, law enforcement and Para public uses. Some of the significant helicopters manufactured by EADSY are H125M, H135M and H145M.

The Zacks Consensus Estimate for Airbus’ 2021 earnings has increased 8% in the past 60 days. Shares of Airbus have appreciated 3.4% in the past year.

Textron’s Bell unit is a renowned manufacturer of military helicopters like AH-1Z, UH-1Y, V-22 among others. The segment delivered 33 commercial helicopters in the third quarter.

The Zacks Consensus Estimate for Textron’s 2021 earnings has been revised upward by 1.5% to $3.33 in the last 60 days. TXT has gained 56.2% in the past year.

Price Movement and Zacks Rank

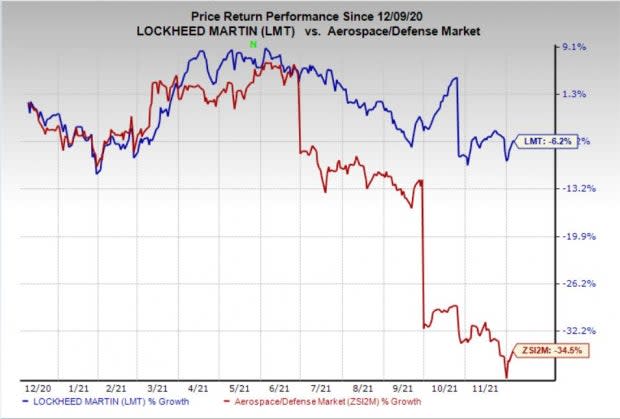

Shares of Lockheed Martin have lost 6.2% in the past year compared with the industry's decline of 34.5%.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance