London house prices are falling — but don't get too excited

Discounts on some London houses are reaching their highest levels for years, but that may not make a difference to most Londoners looking to buy in the capital.

New analysis from LonRes has suggested there are significant cuts to house prices in some of the most exclusive areas of London, but they remain well out of reach for the average buyer.

The market for houses in Prime Central London (PCL) has seen an average of 13.6% come off the asking price of a property before a sale was agreed. That discount is up from 10.7% in 2017 and 3.8% five years ago.

However, while PCL might be offering the biggest discounts in years, the average price for houses in the area (excluding new builds) stood at £1,870,774 in October, according to the Residential Index from property investment firm London Central Portfolio. The discounts from the advertised asking price are at new highs, but the average property value still represents an annual increase of 4.2%.

The UK’s Office of National Statistics reported in May 2018 that the average salary in London for 2017 stood at £39,476, meaning a £1.8m house costs more than 40 times the average earnings.

There is more bad news for the average buyer: the market for houses above £2m is seeing a 19% increase in properties receiving offers, suggesting there is more competition for homes that do go on the market.

Meanwhile, the European Union Eurostat office reports that British residents on average spend more than 25% of their income on housing, the highest in the EU after Finland and Denmark.

Over 20% of household expenditure in the EU allocated to housing – highest share recorded in 🇫🇮 Finland (28.8%) and 🇩🇰 Denmark (28.7%), lowest in 🇲🇹 Malta (10.1%). 🏘️🏠🏚️ #Estatspotlight #Eurostat

➡️ https://t.co/IKV2Zqakxf pic.twitter.com/seVK4WKQIO

— EU_Eurostat (@EU_Eurostat) November 30, 2018

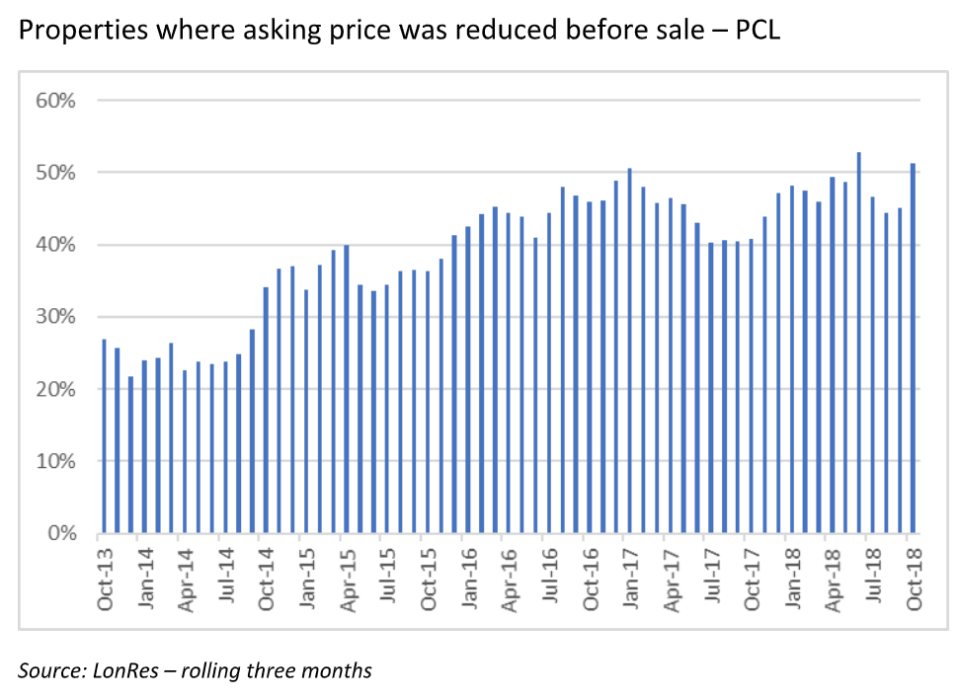

LonRes suggests that while Brexit uncertainty is keeping some buyers away from the market, the discounts now offered by sellers are attracting people back to the market to complete deals. In the three months to October 2018, 51% of sales agreed had reduction in their asking price, compared to 41% in the same period last year.

The average house price across Greater London continues to climb despite Brexit worries. It was estimated to be £631,987, excluding new builds – and £784,351 with new builds, almost three times the cost of the average house price in the rest of the country. That compares to an average price in England and Wales (excluding Greater London), of £264,987.

Yahoo Finance

Yahoo Finance