A Look Back at Broadcasting Stocks' Q1 Earnings: TEGNA (NYSE:TGNA) Vs The Rest Of The Pack

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how broadcasting stocks fared in Q1, starting with TEGNA (NYSE:TGNA).

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

The 9 broadcasting stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 0.6%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and broadcasting stocks have had a rough stretch, with share prices down 13.8% on average since the previous earnings results.

TEGNA (NYSE:TGNA)

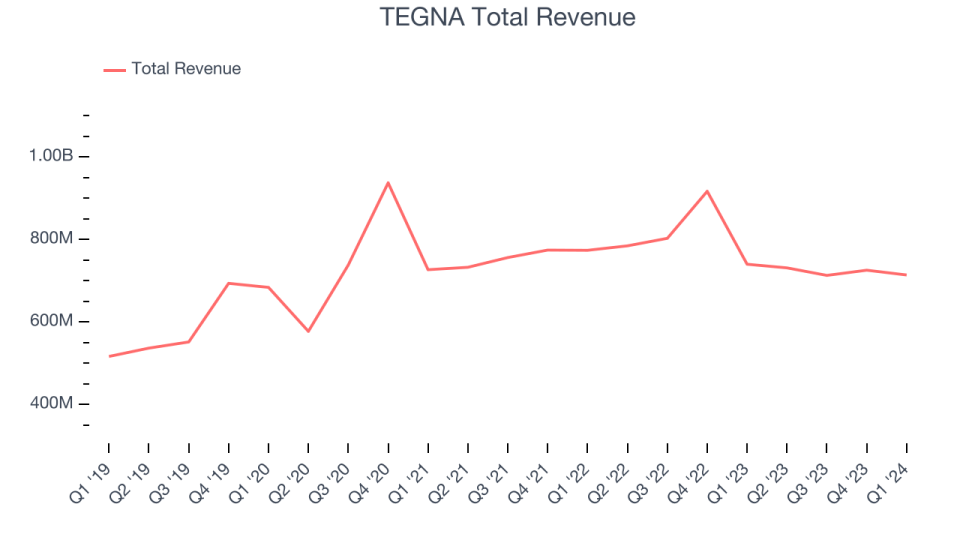

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

TEGNA reported revenues of $714.3 million, down 3.5% year on year, falling short of analysts' expectations by 0.6%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' revenue estimates.

“TEGNA remains focused on maximizing long-term value for our shareholders and delivering on our key priorities. We returned more than $100 million of capital to shareholders during the quarter and announced today that we are increasing our quarterly dividend by 10%,” said Dave Lougee, president and chief executive officer.

The stock is down 2.2% since the results and currently trades at $14.34.

Is now the time to buy TEGNA? Access our full analysis of the earnings results here, it's free.

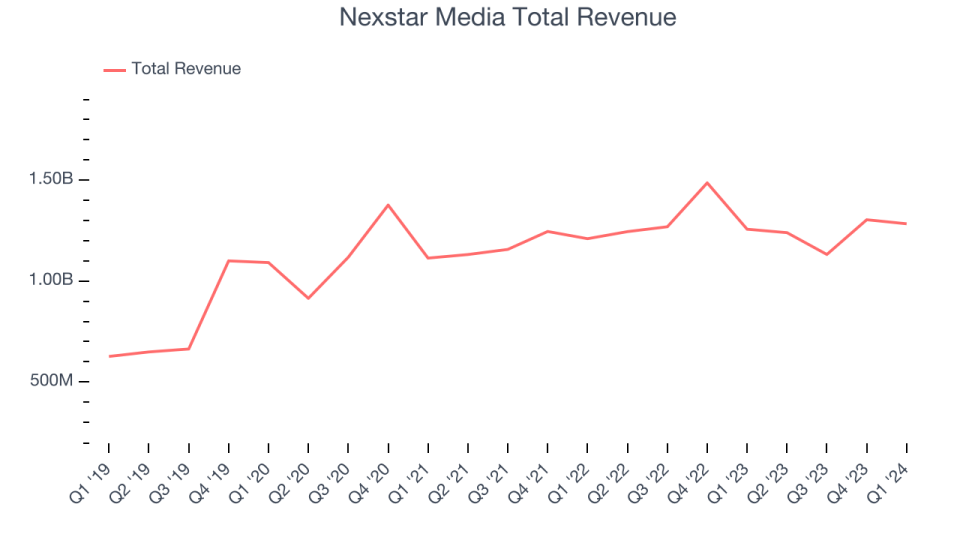

Best Q1: Nexstar Media (NASDAQ:NXST)

Founded in 1996, Nexstar (NASDAQ:NXST) is an American media company operating numerous local television stations and digital media outlets across the country.

Nexstar Media reported revenues of $1.28 billion, up 2.1% year on year, falling short of analysts' expectations by 0.4%. It was a strong quarter for the company, with an impressive beat of analysts' EPS and adjusted EBITDA estimates.

The stock is down 5.2% since the results and currently trades at $159.06.

Is now the time to buy Nexstar Media? Access our full analysis of the earnings results here, it's free.

Slowest Q1: AMC Networks (NASDAQ:AMCX)

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

AMC Networks reported revenues of $596.5 million, down 16.9% year on year, falling short of analysts' expectations by 0.8%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates.

AMC Networks had the slowest revenue growth in the group. The stock is up 10.9% since the results and currently trades at $15.24.

Read our full analysis of AMC Networks's results here.

E.W. Scripps (NASDAQ:SSP)

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ:SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

E.W. Scripps reported revenues of $561.5 million, up 6.4% year on year, falling short of analysts' expectations by 1.3%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates. On the other hand, its revenue fell short of Wall Street's estimates as its Local Media segment underperformed.

E.W. Scripps achieved the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 48.1% since the results and currently trades at $2.4.

Read our full, actionable report on E.W. Scripps here, it's free.

Sinclair (NASDAQ:SBGI)

Founded in 1971, Sinclair (NASDAQ:SBGI) is an American media company operating numerous television stations and providing multi-platform broadcasting services.

Sinclair reported revenues of $798 million, up 3.2% year on year, falling short of analysts' expectations by 0.5%. It was a decent quarter for the company, with EPS exceeding analysts' expectations. Next quarter's revenue and adjusted EBITDA guidance also came in higher than Wall Street's estimates.

The stock is down 5.8% since the results and currently trades at $12.49.

Read our full, actionable report on Sinclair here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance