A Look Back at Consumer Internet Stocks' Q1 Earnings: Wayfair (NYSE:W) Vs The Rest Of The Pack

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the consumer internet industry, including Wayfair (NYSE:W) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 43 consumer internet stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 2.6%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the consumer internet stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.6% on average since the previous earnings results.

Wayfair (NYSE:W)

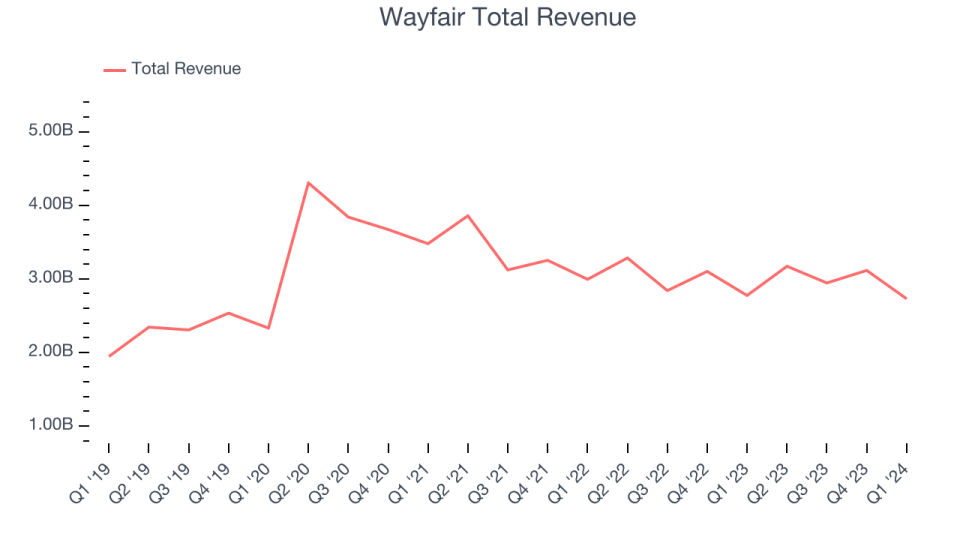

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $2.73 billion, down 1.6% year on year, topping analysts' expectations by 3.5%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but slow revenue growth.

"The first quarter ended on an upswing," said Niraj Shah, CEO, co-founder and co-chairman, Wayfair.

The stock is up 21.7% since the results and currently trades at $61.46.

Read our full report on Wayfair here, it's free.

Best Q1: MercadoLibre (NASDAQ:MELI)

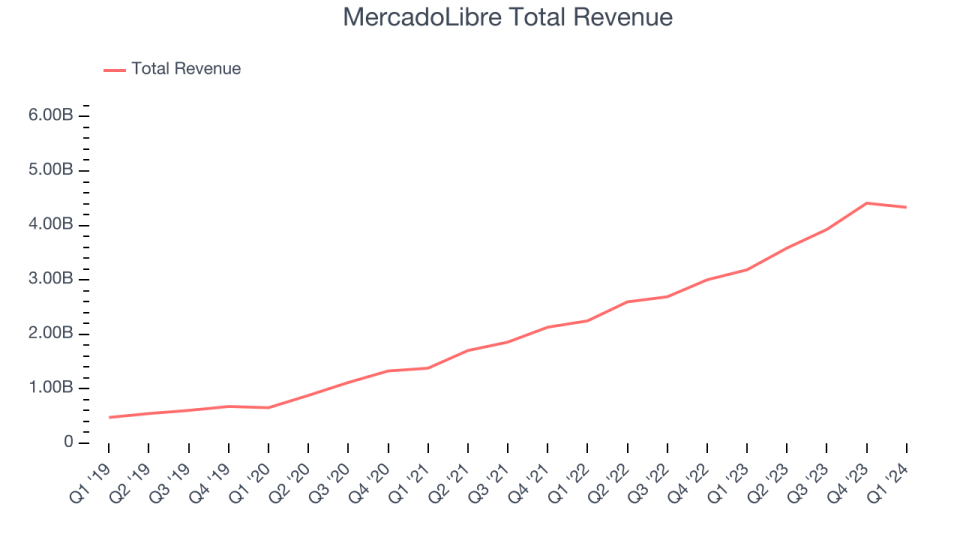

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $4.33 billion, up 36% year on year, outperforming analysts' expectations by 12.1%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue estimates and exceptional revenue growth.

The stock is up 12.5% since the results and currently trades at $1,695.99.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.24 million, down 43.1% year on year, falling short of analysts' expectations by 12.6%. It was a weak quarter for the company, with a decline in its users and slow revenue growth.

Skillz had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 43.5% year on year. The stock is down 3.3% since the results and currently trades at $6.2.

Read our full analysis of Skillz's results here.

Robinhood (NASDAQ:HOOD)

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $618 million, up 40.1% year on year, surpassing analysts' expectations by 11.4%. It was a very strong quarter for the company, with an impressive beat of analysts' revenue estimates and exceptional revenue growth.

The company reported 23.9 million users, up 3.5% year on year. The stock is up 15.7% since the results and currently trades at $20.66.

Read our full, actionable report on Robinhood here, it's free.

Sea (NYSE:SE)

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $3.86 billion, up 26.9% year on year, surpassing analysts' expectations by 6.5%. It was a very strong quarter for the company, with impressive growth in its users and a solid beat of analysts' revenue estimates.

The company reported 48.9 million users, up 30.1% year on year. The stock is up 11.4% since the results and currently trades at $71.78.

Read our full, actionable report on Sea here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance