A Look At RBG Holdings' (LON:RBGP) Share Price Returns

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in RBG Holdings plc (LON:RBGP) have tasted that bitter downside in the last year, as the share price dropped 37%. That's well below the market decline of 5.5%. RBG Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

View our latest analysis for RBG Holdings

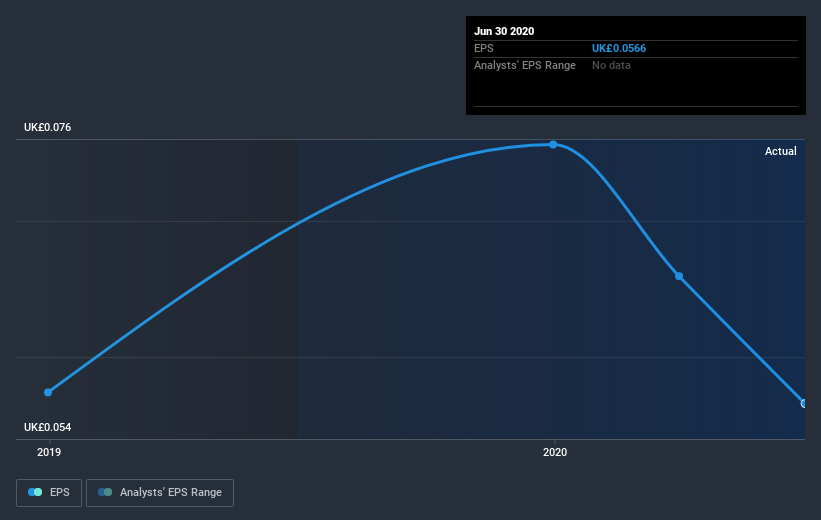

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately RBG Holdings reported an EPS drop of 15% for the last year. This reduction in EPS is not as bad as the 37% share price fall. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 10.42.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We doubt RBG Holdings shareholders are happy with the loss of 36% over twelve months (even including dividends). That falls short of the market, which lost 5.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 11% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with RBG Holdings , and understanding them should be part of your investment process.

But note: RBG Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance