A Look At Strategic Minerals' (LON:SML) CEO Remuneration

John Peters became the CEO of Strategic Minerals Plc (LON:SML) in 2015, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Strategic Minerals

Comparing Strategic Minerals Plc's CEO Compensation With the industry

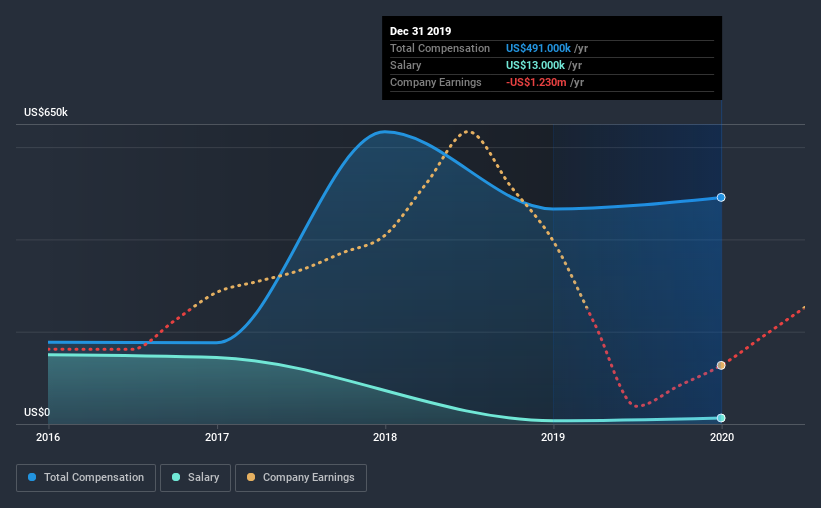

At the time of writing, our data shows that Strategic Minerals Plc has a market capitalization of UK£8.0m, and reported total annual CEO compensation of US$491k for the year to December 2019. That's a modest increase of 5.4% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$13k.

For comparison, other companies in the industry with market capitalizations below UK£148m, reported a median total CEO compensation of US$203k. This suggests that John Peters is paid more than the median for the industry. Furthermore, John Peters directly owns UK£239k worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$13k | US$7.0k | 3% |

Other | US$478k | US$459k | 97% |

Total Compensation | US$491k | US$466k | 100% |

On an industry level, around 67% of total compensation represents salary and 33% is other remuneration. Strategic Minerals has chosen to walk a path less trodden, opting to compensate its CEO with less of a traditional salary and more non-salary rewards over the last year. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Strategic Minerals Plc's Growth

Strategic Minerals Plc has reduced its earnings per share by 70% a year over the last three years. In the last year, its revenue is up 40%.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Strategic Minerals Plc Been A Good Investment?

Given the total shareholder loss of 79% over three years, many shareholders in Strategic Minerals Plc are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Strategic Minerals prefers rewarding its CEO through non-salary benefits. As we noted earlier, Strategic Minerals pays its CEO higher than the norm for similar-sized companies belonging to the same industry. At the same time, looking at EPS and total shareholder returns, it's tough to say Strategic Minerals is in a sound position, considering both metrics are down. On a more positive note, the company has produced a more positive revenue growth more recently. Most would consider it prudent for the company to hold off any CEO pay rise until performance improves.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 3 warning signs for Strategic Minerals that investors should look into moving forward.

Switching gears from Strategic Minerals, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance