Looking for top FTSE 100 value shares? Here’s one I’d buy without hesitation

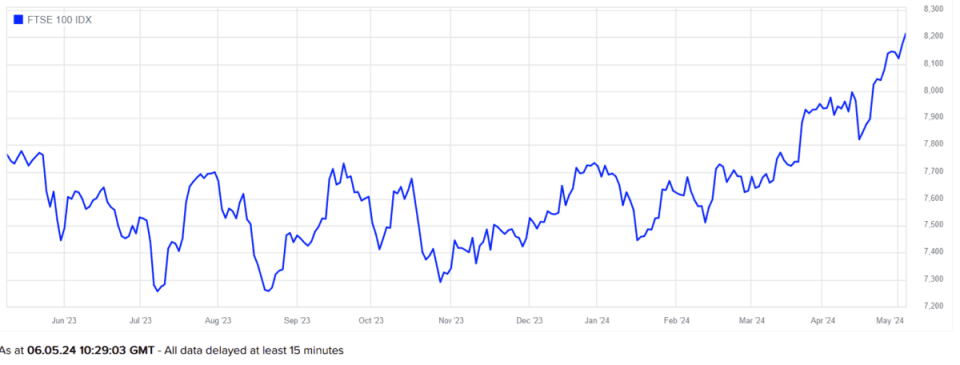

FTSE 100 shares are rocketing again, boosted by hopes over interest rate cuts and fresh weakness in the pound. With 75% of its aggregate earnings coming from abroad, the Footsie receives a boost from a weakening UK currency.

London’s premier index is up 6% since the start of 2024. It also continues to print new records on an almost-daily basis. Yet it remains jam-packed with brilliant bargains that could help investors turbocharge their returns.

The wisdom of value investing

Value investing involves picking stocks trading below what they’re worth. The theory is that these shares could deliver market-beating returns once the market wises up to their cheapness and their share prices re-rate.

This is a common occurrence. And it explains why value stocks have historically outperformed growth shares over the long term.

Such outperformance is also because, while growth stocks perform strongly during bull markets, value stocks tend to offer more stability and resilience during market downturns. This reflects the margin of safety their discounts provide which, in turn, limits downside risk.

Investing in value stocks can be risky. Some companies are cheap for a reason due to their high risk profiles, low growth potential, or both.

However, with detailed research and analysis, it’s possible to separate the winners from the losers and make truly spectacular returns.

A top value stock

GSK‘s (LSE:GSK) one top share I’ll be keen to buy at the next opportunity. Concerns over the depth of its drugs pipeline means the pharmaceuticals giant trades at a massive discount to the broader industry.

A discount’s understandable. But I’d argue its size is hard to justify. And especially as the FTSE company’s showing encouraging signs of a turnaround on this front.

Pharma sector P/E ratios. Chart by TradingView

As the chart above shows, GSK’s share price now trades on a forward price-to-earnings (P/E) ratio of 9.6 times. This is far below the corresponding readings for its rivals (in descending order) Eli Lilly, Merck, Pfizer and AstraZeneca.

On top of this, the company’s prospective dividend yield sits at a healthy 3.5%. Only Pfizer, with a yield of 6%, beats GSK here.

Winds of change

GSK’s share price. Chart by TradingView

As I say, GSK’s efforts to boost its product pipeline is really starting to pay off, as first-quarter financials showed last month.

It has had four positive phase III test results so far in 2024 which, in turn, helped its share price gain rebound. And there could be more good news to come.

Analyst Adam Vettese of eToro notes that “[GSK’s] move to focus more heavily on vaccines is proving to be a smart one with several new launches on the pipeline.” He even notes that the business “actually has its nose in front [of AstraZeneca] in terms of performance this year.”

Healthcare stocks like this have enormous growth potential as drugs demand increases. I like it and I think GSK shares might be an attractive way for other investors to capitalise on this opportunity.

The post Looking for top FTSE 100 value shares? Here’s one I’d buy without hesitation appeared first on The Motley Fool UK.

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended AstraZeneca Plc and GSK. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance