Loonie Struggling Amid Weaker GDP and a Cautious BoC

One of the main central banks meeting this week was the Bank of Canada (‘BoC’), which kept its target overnight rate at 5% and downplayed rumours of a cut in March next year. Although Canada’s balance of trade was good news, the loonie’s correlation with oil has been in more focus in recent days and USDCAD in particular has started to make gains again. This article summarises recent economic data from Canada and looks briefly at the charts of USDCAD and EURCAD.

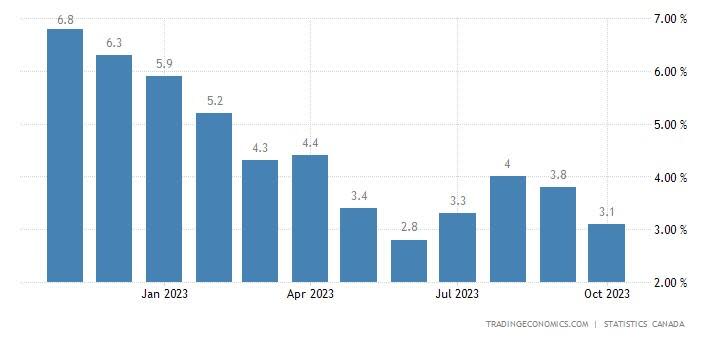

Like most major central banks apart from the Bank of Japan, the BoC has retained its restrictive policy for some months now and made quite good progress on inflation:

Headline inflation seems likely to hold below 4% for the next several months and possibly into the middle of next year as well. The target overnight rate of 5% has been higher than this measure of inflation consistently since May, so participants don’t seem to be taking seriously the BoC’s hints of another possible hike in the first quarter of next year.

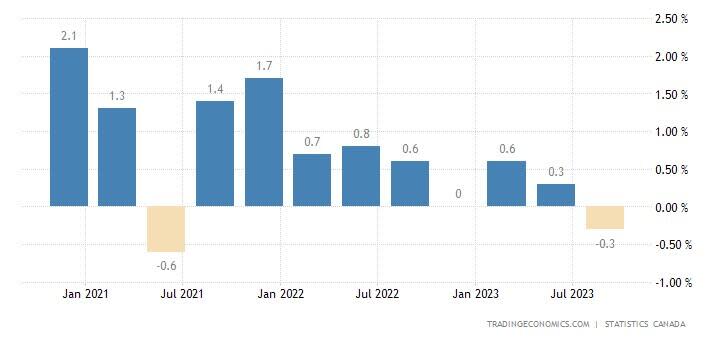

On the contrary, some expect that the BoC will act similarly to the Federal Reserve (‘the Fed’) in that a pivot might start in March. There’s some pressure on the BoC to start cutting rates sooner than the Fed because on the whole Canadian economic data are worse than the USA’s:

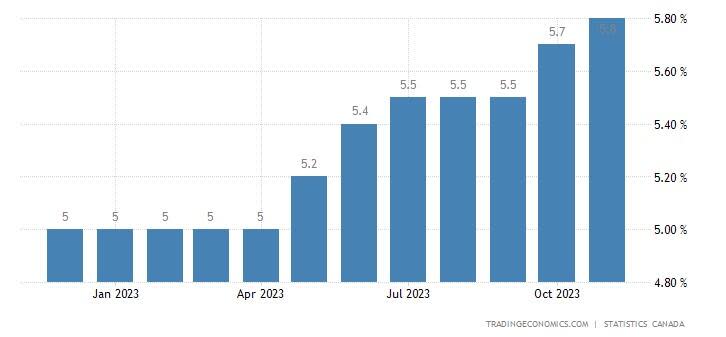

Last quarter saw the first contraction in the Canadian economy in two years. Coming in the context of an overall downward trend in the pace of growth, sentiment took a hit at the very end of last month as traders were surprised by the negative release and the possibility of a technical recession starting this quarter seemed to increase. The picture from employment is also somewhat negative:

From the trough of 5% where unemployment held for some time since the end of last year, the rate has now risen higher and more quickly compared to the USA. This is related partially to demographics but it’s also seemingly a function of the Canadian economy’s lower resilience.

Economic conditions overall in Canada certainly seem to be worse than the USA; for the time being, very few traders expect the base rate in the former actually to rise further. More hints on the possibilities for monetary policy next quarter might come from November’s inflation from Canada, to be released on Tuesday 19 December. If the annual non-core figure drops below 3%, it would seem almost certain that the terminal rate for this cycle has been reached.

US Dollar-Canadian Dollar, Daily

Negativity on the greenback in the last few weeks as the Fed’s expected pivot began to be plotted much earlier has given way in the last few sessions to renewed strength in various pairs including USDCAD. Oil meanwhile has made very strong losses this week, with American light oil reaching five-month lows below $70 a barrel. TA seems to support the positive impression from fundamentals for dollar-loonie.

The current bounce originated slightly above the key support from the 23.6% weekly Fibonacci retracement around $1.345, which was also the limit of September’s retracement. The slow stochastic has completed a crossover within oversold.

However, the price is now approaching the 20-day and 100-day moving averages, so it might be difficult to break above there without a significant catalyst from the NFP. Apart from the job report later today, next week there’s also American inflation on Tuesday plus Wednesday’s meeting of the Fed, which is crucial for hints on how long the funds rate might stay at 5.25-5.5%. This is a very busy few days of data from the USA: volatility for USDCAD and other majors with the US dollar might increase significantly.

Euro-Canadian Dollar, Daily

The situation for euro-loonie is somewhat different because there’s also evidence that most of the major economies in the eurozone, especially Germany, are struggling to a degree. However, from a technical perspective, the potential entry to buy here seems to be better than for USDCAD. The price has yet to emerge from oversold based on the slow stochastic but it’s also still above both the 100 and 200 SMAs.

Similarly to USDCAD, the potential target for buyers of EURCAD would be the latest high, here around $1.50. That’s likely to be an extremely strong psychological area which almost certainly won’t be broken unless there’s a notable surprise from the ECB’s meeting on Thursday 14 December, Canadian inflation on 19 December or other major new information reaching markets.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance