Low interest rates a bigger worry than Brexit for UK investors

Investors are more confident about the UK than they are about the rest of Europe, defying expectations that Brexit would scare the markets.

Instead, those buying shares, bonds and other assets are more worried about the prolonged low interest rate environment, an annual study from Legg Mason Global Asset Management has shown.

Almost two-thirds of investors in the UK are “somewhat optimistic” or “very optimistic” about returns over the next 12 months, compared with only 56pc of European investors overall.

Only those in Sweden are more upbeat than those putting their money in the UK among European investors, the survey found.

That defies recent economic growth numbers which indicate the eurozone is outstripping the UK – despite that, investors are less confident in Germany, France and Spain.

The survey found that 52pc of UK investors are concerned about low interest rates. The Bank of England’s base rate has been stuck at emergency low levels since 2009 and has not been raised since 2009.

Last year the rate was cut to a new record low of 0.25pc and economists believe it could fall a little lower if policymakers fear economic growth is slowing further.

That intensity of concern means interest rates are more of a worry than Brexit – 46pc said they fear the outcome of negotiations with Brussels could impact the performance of their UK investments.

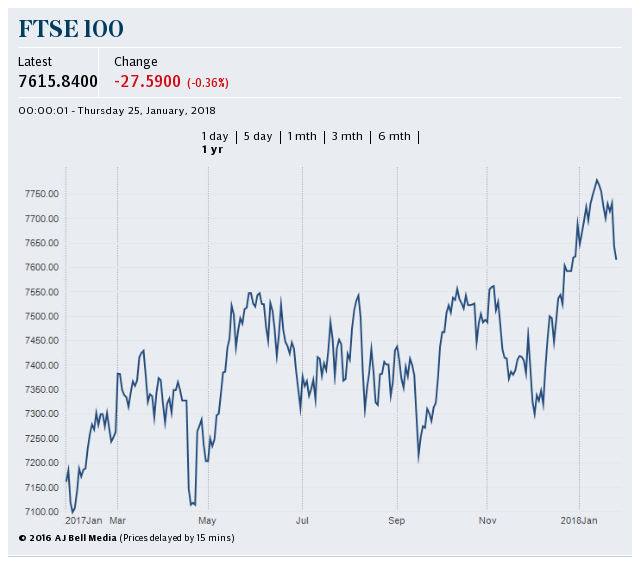

“While there has been an understandable focus on the impact of Brexit, the truly global nature of investment markets – particularly the FTSE 100 – means investors can continue to make returns irrespective of the domestic outlook,” said Justin Eede at Legg Mason.

“As such, it is perhaps unsurprising that such a positive attitude has prevailed into 2017, especially following the gains seen the previous year across some asset classes.”

The UK’s total optimism score is down a touch on the year – its 2017 figure of 63pc is below 68pc in 2016 and 66pc in 2015.

But that number has held up reasonably well, given that the overall proportion of investors globally reporting optimism has dipped from 81pc in 2015 to 75pc in 2016 and 60pc this year.

UK investors are cheerier than those in Asia – 56pc of whom are optimistic – though Americans are more positive with a score of 80pc.

Yahoo Finance

Yahoo Finance