Will Lower Deliveries Hurt Leggett's (LEG) Earnings in Q3?

Leggett & Platt, Incorporated LEG is set to release third-quarter 2019 results on Oct 28, after market close.

In the last reported quarter, the company came up with mixed results, wherein earnings topped the Zacks Consensus Estimate by 2% but net sales missed the same by 4.9%. Net sales increased 10%, attributed to solid contribution from the ECS acquisition, and ongoing market share and content gains in U.S. Spring.

However, earnings were flat with the prior-year level. Leggett's business has been plagued with lower deliveries from the Furniture Products segment, and weak demand in Industrial Products and Automotive units. This trend is expected to have continued in the third quarter.

How are Estimates Faring?

Let’s take a look at estimate revisions in order to get a clear picture of what analysts are thinking about the company prior to the earnings release.

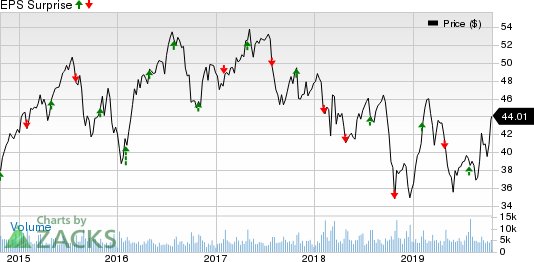

Leggett & Platt, Incorporated Price and EPS Surprise

Leggett & Platt, Incorporated price-eps-surprise | Leggett & Platt, Incorporated Quote

For the quarter to be reported, the Zacks Consensus Estimate for earnings indicates no change from the year-ago reported figure. Revenues are expected to be $1.21 billion, suggesting an increase of 11.3% year over year.

Factors at Play

Leggett’s third-quarter 2019 earnings are likely to have been negatively impacted by soft demand and lower volumes in most of the businesses. Also, volatility in raw material costs and currency headwinds are expected to have put pressure on its margins.

That said, moderating steel inflation is expected to have benefited the bottom line to some extent in the to-be-reported quarter. Initiatives like long-term strategic growth plan and acquisitions are expected to have driven top-line growth in the third quarter.

Additionally, the company is expected to have benefited from raw material-related selling price increase and disciplined capital allocation strategy during the third quarter.

What Our Model Indicates

Our proven model doesn’t conclusively predict an earnings beat for Leggett this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Leggett — which shares space with Mohawk Industries, Inc. MHK, Interface, Inc. TILE and Culp, Inc. CULP in the Zacks Textile - Home Furnishing industry — has an Earnings ESP of 0.00% and currently carries a Zacks Rank #3. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Leggett & Platt, Incorporated (LEG) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Interface, Inc. (TILE) : Free Stock Analysis Report

Culp, Inc. (CULP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance