LVMH Moët Hennessy - Louis Vuitton Société Européenne (EPA:MC) Has Gifted Shareholders With A Fantastic 140% Total Return On Their Investment

It hasn't been the best quarter for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (EPA:MC) shareholders, since the share price has fallen 17% in that time. But in stark contrast, the returns over the last half decade have impressed. Indeed, the share price is up an impressive 120% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for LVMH Moët Hennessy - Louis Vuitton Société Européenne

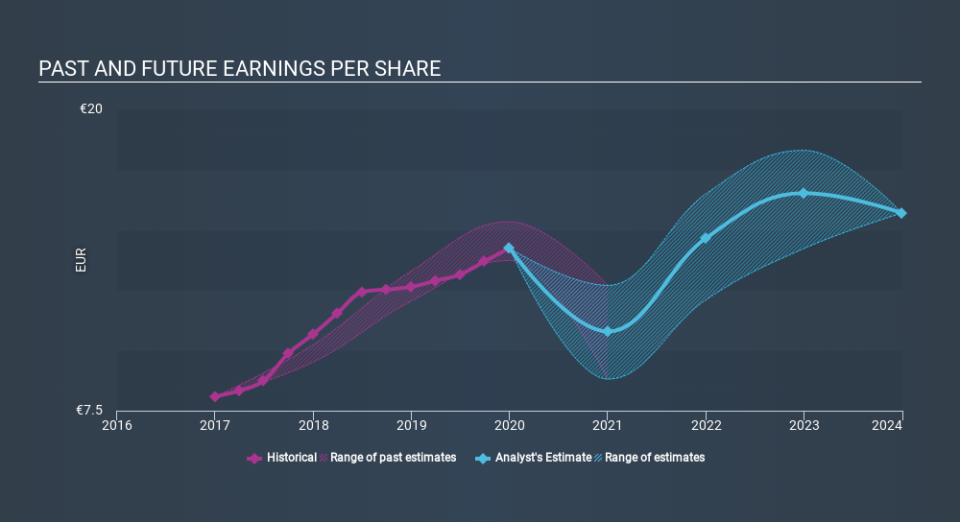

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, LVMH Moët Hennessy - Louis Vuitton Société Européenne managed to grow its earnings per share at 4.8% a year. This EPS growth is slower than the share price growth of 17% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that LVMH Moët Hennessy - Louis Vuitton Société Européenne has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for LVMH Moët Hennessy - Louis Vuitton Société Européenne the TSR over the last 5 years was 140%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that LVMH Moët Hennessy - Louis Vuitton Société Européenne shareholders have received a total shareholder return of 2.0% over one year. That's including the dividend. However, that falls short of the 19% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Is LVMH Moët Hennessy - Louis Vuitton Société Européenne cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance