Lyft Typo Took Short Seller on Wild 45-Minute Ride to Tiny Gain

(Bloomberg) -- The 45 minutes it took for Lyft Inc. to correct a typo in the company’s earnings release is time that trader Sinisa Sorgic won’t soon forget.

Most Read from Bloomberg

Largest Covid Vaccine Study Yet Finds Links to Health Conditions

Wall Street’s Moelis Bet Big on the Middle East. Now He’s Cashing In

Trump Keeps NY Empire Intact as Judge Rescinds Asset-Sale Order

China Stocks’ Insipid Reopen Adds Pressure on Beijing to Do More

Stocks Pause Near Record as Traders Await Catalyst: Markets Wrap

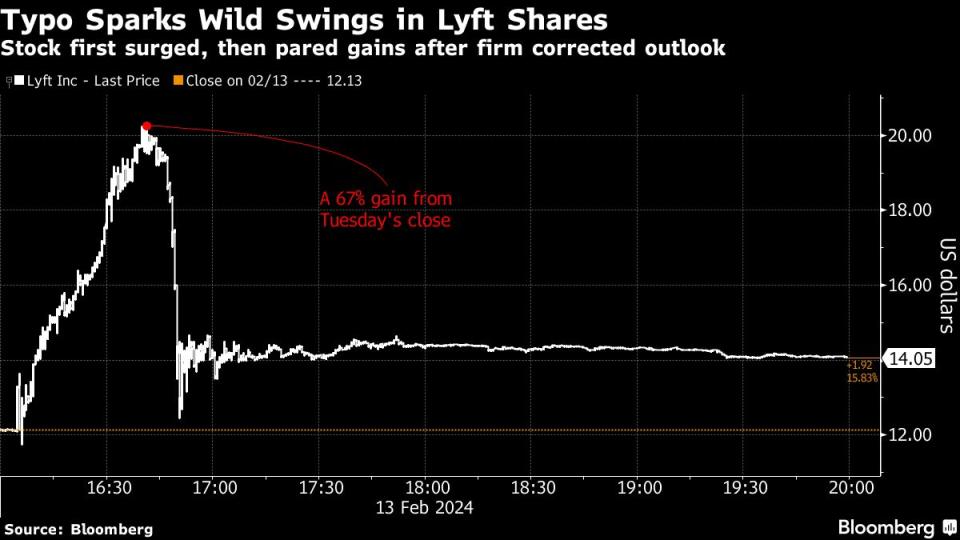

The manager at proprietary firm Bright Trading was working from home Tuesday afternoon when an alert flashed across his screen after regular trading had ended in New York: Lyft’s shares had spiked 50% after its earnings release. It was a stunning move for the ride-hailing company’s stock, prompted by a hard-to-believe prediction that its operating margin would jump 500 basis points this year.

Sorgic, a 20-year trading veteran who spoke to Bloomberg from his home in Indiana, said he sensed the exuberance was excessive. A stock that had closed at just over $12 was suddenly changing hands for north of $16, a level it hadn’t topped in over a year. He leapt into action, shorting the shares at the $16 level.

He was quickly reminded of the perils of betting against a stock that is soaring beyond reason.

By 4:40 p.m., about 35 minutes after the earnings statement was released, Lyft shares poked above $20 — a more than 60% jump from Tuesday’s close. At those levels, Sorgic said he was staring at a loss of at least $2,000, big enough to tempt him toward bailing to avoid even more pain. For some reason, despite saying he felt “mad” and “embarrassed” about his trade, he held tight.

Read more: Lyft CEO Risher Says ‘My Bad’ on Margin Error, ‘It Was One Zero’

Meanwhile, Lyft Chief Financial Officer Erin Brewer had started reviewing the results with analysts on a conference call. In her prepared remarks, she mentioned the firm’s amazing forecast for operating margins. Thing was, she clearly stated they’d grow by 50 basis points. Not the 500 printed in the release.

Finally, it was an analyst on the call — Bernstein’s Nikhil Devnani — who ventured to ask, which is it?

Brewer then confirmed it was 50 basis points. The release was wrong.

By 4:50 p.m., Lyft had plunged back to $14. Dizzied by the lurch, Sorgic saw a chance to get out and covered his position. He got out with a small profit — a little under $1,000.

“I was pissed at first,” Sorgic said. “But when a report came out that there was a typo in the earnings release, I just smiled. I’ve seen all sorts of crazy things in my career.”

“I was embarrassed to tell people about the trade because it’s a really bad trade and I could have eaten the loss sooner,” Sorgic added. “If you were short the stock, good luck! Reversals are happening in wicked fashion.”

--With assistance from Esha Dey.

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance