LyondellBasell Industries NV (LYB) Q1 2024 Earnings: Consistent with Analyst Projections

Net Income: Reported at $473 million, slightly below the estimate of $454.19 million.

Earnings Per Share (EPS): Achieved $1.44, surpassing the estimated $1.37.

Revenue: Recorded $9,925 million, exceeding the forecast of $9,730.22 million.

Dividends: Returned $408 million to shareholders in the form of dividends.

Operating Cash Flow: Used $114 million in operating activities during the quarter.

Capital Expenditures: Invested $483 million in business expansions and improvements.

Cash and Liquidity: Ended the quarter with $2.3 billion in cash and short-term investments and $6.5 billion in available liquidity.

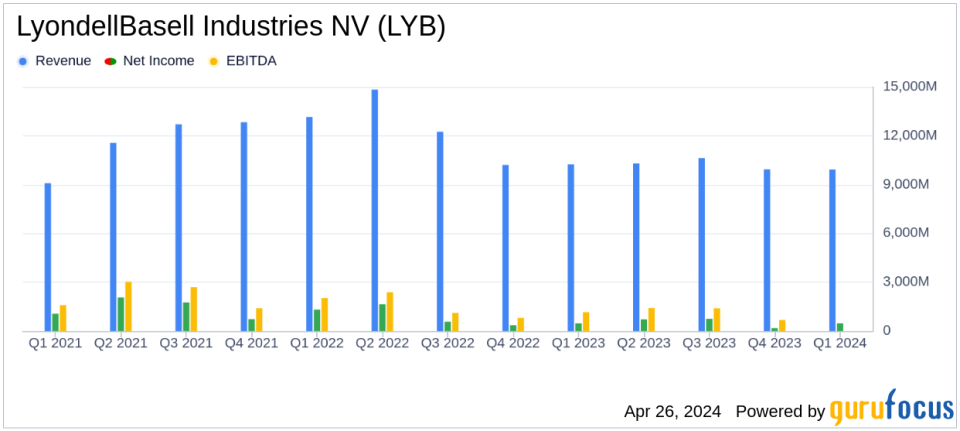

On April 26, 2024, LyondellBasell Industries NV (NYSE:LYB) released its 8-K filing, revealing a first-quarter net income of $473 million, or $1.44 per diluted share. These figures align closely with analyst estimates, which projected earnings of $1.37 per share and a net income of $454.19 million. The company's reported revenue for the quarter was $9,925 million, slightly surpassing the expected $9,730.22 million.

LyondellBasell, a leading global petrochemical producer, is known for its significant presence in the production of polypropylene and polyethylene. The company operates primarily in North America but maintains a robust global footprint across Europe and Asia. This geographical diversity supports its resilience against regional economic fluctuations.

Quarterly Financial Highlights

The first quarter saw LyondellBasell achieving an EBITDA of $1.0 billion, with an adjusted figure of $1.1 billion after accounting for identified items such as refinery exit costs. Despite a challenging market environment characterized by tepid global demand for durable goods, the company benefited from lower natural gas-based feedstock costs in North America, which bolstered margins for olefins and polyolefins.

However, the company faced operational constraints due to downtime across several units, including olefins and polyolefins. In Europe, logistical disruptions in the Red Sea posed challenges, although they were partially offset by increased local production volumes. The company's strategic focus remains on its Circular & Low Carbon Solutions (CLCS) business, which has seen significant growth in recycled and renewable-based polymers.

Strategic Developments and Future Outlook

LyondellBasell's CEO, Peter Vanacker, emphasized the company's commitment to its strategic initiatives, particularly the expansion of its CLCS business. The company expects continued benefit from low natural gas costs and anticipates improved seasonal demand across most of its business segments going into the second quarter.

Financially, LyondellBasell is in a robust position, with $2.3 billion in cash and short-term investments and $6.5 billion in available liquidity at the quarter's end. The company's disciplined capital allocation strategy included returning $408 million to shareholders through dividends and investing $483 million in capital expenditures.

Investor and Analyst Perspectives

From an investment standpoint, LyondellBasell's consistent financial performance, aligned with analyst expectations, provides a stable outlook for investors. The company's strategic advancements in CLCS and effective management of operational and market challenges underscore its potential for sustained growth. Investors and analysts might find reassurance in the company's proactive strategies and solid financial positioning amidst uncertain market conditions.

For more detailed information on LyondellBasells financial metrics and strategic initiatives, please refer to their official earnings page.

As LyondellBasell continues to navigate through fluctuating market landscapes, its focus on innovation and sustainability is likely to play a pivotal role in shaping its future trajectory in the highly competitive chemical industry.

Explore the complete 8-K earnings release (here) from LyondellBasell Industries NV for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance