Macerich's (MAC) Q1 FFO Beats, Revenues Lag, Stock Down

The Macerich Company MAC reported funds from operations (FFO) per share of 50 cents, excluding financing expenses in relation to Chandler Freehold, surpassing the Zacks Consensus Estimate of 46 cents.

However, Macerich generated revenues of $216.1 million in the first quarter, lagging the Zacks Consensus Estimate of $222.2 million. MAC also tweaked its 2022 guidance.

Shares of MAC have lost 2.74% since the release of first-quarter 2022 results.

Nevertheless, FFO per share compared favorably with the year-ago quarter’s 45 cents. Also, revenues increased 13.5%.

In the first quarter, robust leasing demand and tenant sales continued to gain momentum. The portfolio comparable tenant sales from spaces less than 10,000 square feet were 14.5% higher year over year. Moreover, MAC’s portfolio tenant sales per square foot for spaces less than 10,000 square feet in the trailing 12 months ended Mar 31, 2022, touched $843, taking it to a record high.

Behind the Headlines

As of Mar 31, 2022, portfolio occupancy was 91.3%, up 2.8% from 88.5% at Mar 31, 2021.

For the 12 months ended Mar 31, 2022, re-leasing spreads were 1.3% more than the expiring base rent.

Same-center net operating income (NOI), including lease termination income, increased 30.2% year over year.

During first-quarter 2022, the company signed 220 leases encompassing 617,000 square feet, representing a 22% increase in the number of leases signed year over year. Also, it opened 188,000 square feet of new stores and uses during this period.

Balance Sheet

As of Mar 31, 2022, it had cash and cash equivalents of $128.2 million.

As of May 9, MAC had roughly $628 million of liquidity, including unrestricted cash in hand, aggregating more than $200 million. The balance represented available capacity on its revolving line of credit.

As of Mar 31, 2022, the total debt inclusive of pro-rata share of joint ventures was $6.91 billion with a weighted average annual effective interest rate of 3.86%.

Guidance

Macerich tweaked its 2022 guidance.

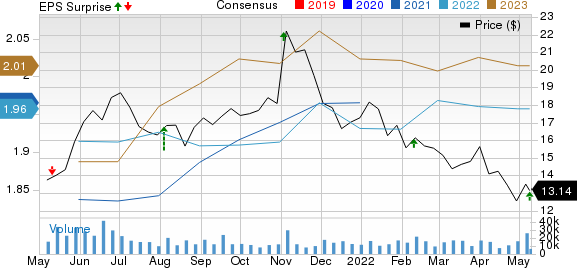

It now expects 2022 FFO per share, excluding financing expenses in relation to Chandler Freehold, in the range of $1.90-$2.04, revised from the earlier projection of $1.85-$2.05. The Zacks Consensus Estimate for the same is currently pegged at $1.96.

Dividend Update

On May 9, concurrently with the earnings release, Macerich announced a quarterly cash dividend of 15 cents per share. The dividend will be paid out on Jun 3 to shareholders on record as of May 20, 2022.

Currently, Macerich carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Macerich Company The Price, Consensus and EPS Surprise

Macerich Company The price-consensus-eps-surprise-chart | Macerich Company The Quote

Performance of Other REITs

Kimco Realty Corp.’s KIM first-quarter 2022 NAREIT FFO came in at 39 cents per share, surpassing the Zacks Consensus Estimate of 37 cents. This figure also grew 18.2% from the year-ago quarter.

Results reflect better-than-anticipated revenues. Kimco also issued a revised 2022 FFO outlook.

KIM generated revenues of $427.2 million, beating the consensus mark of $422.2 million. Quarterly revenues jumped 51.3% year over year.

KIM currently carries a Zacks Rank #3.

Federal Realty Investment Trust’s FRT first-quarter 2022 FFO per share of $1.50 surpassed the Zacks Consensus Estimate of $1.44. This also compares favorably with the year-ago quarter’s tally of $1.17.

Results reflect better-than-anticipated revenues. This retail REIT also raised its guidance for 2022 FFO per share.

Quarterly revenues of $256.8 million topped the consensus mark of $251.8 million and improved 17.7% from the year-ago quarter’s tally.

FRT presently carries a Zacks Rank #3.

Realty Income Corporation’s O first-quarter 2022 adjusted FFO per share of 98 cents marginally surpassed the Zacks Consensus Estimate of 97 cents. The reported figure increased 14% from the prior-year quarter’s 86 cents.

Results reflect a better-than-expected improvement in revenues. The company benefited from expansionary effects and a healthy pipeline of opportunities globally.

O’s total revenues in the reported quarter came in at $807.3 million, exceeding the Zacks Consensus Estimate of $761.2 million. The top line also jumped 82.5% year over year.

O currently carries a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Macerich Company The (MAC) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance