Macquarie (MIC) Q1 Earnings and Revenues Beat Estimates

Macquarie Infrastructure Corporation MIC reported better-than expected first-quarter 2021 results wherein both earnings and revenues surpassed estimates.

On an adjusted basis, the company’s earnings were 60 cents per share, beating the Zacks Consensus Estimate of 48 cents by 25%. However, the bottom line declined from $1.08 per share reported in the prior-year quarter.

Notably, the company’s shares rose 4.1% in the past couple of days to eventually close the trading session at $127.04 on Wednesday.

In the first quarter, Macquarie generated revenues of $264.2 million, down 7.1% year over year. The decline was attributable to lackluster performance across its Atlantic Aviation and MIC Hawaii segments. Product revenues were $54.6 million, marking a decrease of 9.8% year over year. Service revenues declined 6.4% to $209.6 million. Notably, the top line beat the Zacks Consensus Estimate of $241 million by 9.6%.

Segment Details

Atlantic Aviation generated revenues of $209.6 million, down 6.4% year over year and accounted for 79.3% of the company’s overall revenues. The segment’s EBITDA increased 2% to $67.3 million.

Revenues in MIC Hawaii were $54.6 million, down 9.8% year over year. It represented 20.7% of overall quarterly revenues. The segment’s EBITDA declined 11% to $13.6 million.

Operating Costs

In the first quarter, Macquarie’s cost of services decreased 13.2% to $82.2 million on a year-over-year basis, whereas cost of product sales decreased 16.9% to $34.8 million.

Selling and administrative expenses were $77 million, down 12.1% year over year. Overall, operating expenses declined 13.4% to about $227 million.

Liquidity & Cash Flow

As of Mar 31, 2021, the company had cash and cash equivalents of $529.6 million, down from $1,828.1 million on Dec 31, 2020. Long-term debt (net of current portion) was $1,103.9 million, down from $1,554.4 million recorded at the end of 2020. In the first three months of 2021, the company generated net cash of $40 million from operating activities, down 22.3% year over year. In the quarter, the company paid out dividends amounting to $961 million.

Guidance

The company stated that it remains confident in the outlook for its operating businesses as the end markets recover from the effects of the coronavirus outbreak.

For 2021, the company anticipates generating adjusted EBITDA in the range of $245-$260 million for Atlantic Aviation. For the MIC Hawaii segment, it expects to generate adjusted EBITDA in the range of $35-$45 million.

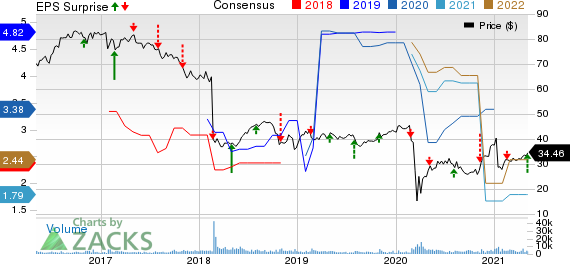

Macquarie Infrastructure Company Price, Consensus and EPS Surprise

Macquarie Infrastructure Company price-consensus-eps-surprise-chart | Macquarie Infrastructure Company Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are Alcoa Corporation AA, Applied Industrial Technologies, Inc. AIT and Lakeland Industries, Inc. LAKE. While Alcoa and Applied Industrial currently sport a Zacks Rank #1 (Strong Buy), Lakeland Industries carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alcoa delivered an earnings surprise of 56.78%, on average, in the trailing four quarters.

Applied Industrial delivered an earnings surprise of 30.33%, on average, in the trailing four quarters.

Lakeland Industries delivered an earnings surprise of 230.73%, on average, in the trailing four quarters.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alcoa Corp. (AA) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Macquarie Infrastructure Company (MIC) : Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance