‘I was made redundant. Will I still be able to buy a £250k house next year?’

Almost four million workers have been temporarily spared from redundancy by the Government’s job retention scheme. Yet those who fell out of work before the pandemic have been cut off from support.

Neil Sedani, 28, lost his job at an energy company at the start of the year, forcing him to give up his rented home in Nottingham and move in with his parents. “I wasn’t eligible for Universal Credit, as I have some savings that I was hoping to use to buy a home next year,” Mr Sedani said.

“When coronavirus hit, I was so worried it would mean I’d be out of work for months and have to dip into my savings.”

Luckily, he has just managed to find a new job. However, the pay is slightly less than he was earning before, at around £30,000 a year. “I’m no longer sure I’ll be able to buy a house next year,” Mr Sedani said. He is about to move back to Nottingham, where he will be paying £500 a month in rent and bills.

He already has around £7,000 in a Help to Buy Isa that pays 2.07pc interest. He plans to continue saving into this until he reaches £12,000, which will earn him a £3,000 bonus when he comes to buy his home. He has an extra £10,000 in savings, giving him £25,000 to put down as a deposit. He hopes to buy a property worth around £250,000 and has no debts apart from his student loan.

“I spend about £1,250 a month and would like to cut this down. On top of my rent and bills, I usually spend about £200 a month on medical insurance and subscriptions, £200 on weekends away, £100 on my car and £250 on food and going out,” he said. “I want to work out how much I can save and when I’ll be able to buy a house.”

Finn Houlihan, director at wealth manager Arlo Wealth, said:

After tax and student loan repayments, Mr Sedani has an income of £1,924 a month. Based on his spending habits, he should be able to save about £8,000 over the next year. In less than eight months he’d have put away the £5,000 needed to reach his goal.

Unfortunately, timing is not on his side as lenders have withdrawn many of their mortgages for people with only a 10pc deposit.

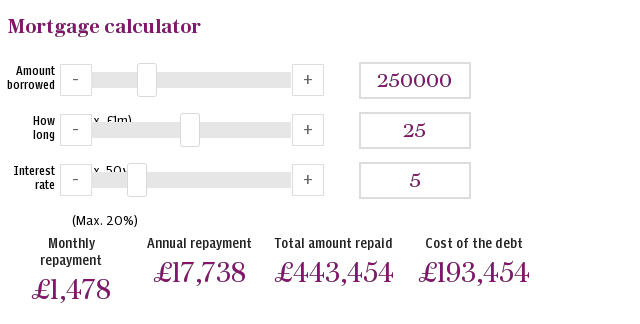

This means that, unless he wants to consider borrowing from a specialist lender, he is going to need around 20pc for his deposit, doubling his savings target from £25,000 to £50,000. He’d therefore need another £30,000, pushing out his timeline from eight months to almost four years. If he does reach the 20pc deposit, he will qualify for much more attractive mortgage rates.

He could reduce his spending to save more. By cutting out weekends away and reviewing his subscriptions, Mr Sedani could save up to an extra £400 a month, making a £30,000 target achievable in just over two years. In the meantime 10pc deposit mortgages may become more available.

Although private medical insurance can be useful, if Mr Sedani is set on buying a house this may not be the most efficient use of his funds. He should consider a combination of critical illness cover and income protection. The former would guarantee his mortgage payments were he to fall ill and the latter would pay him an income should he lose his job.

Anthony Emmerson, director of mortgage broker Trinity Financial, said:

Mr Sedani is unlikely to find a lender that will fund a £250,000 purchase based on his current salary and a 10pc deposit. Banks usually lend only up to five times your salary, so he could feasibly borrow a maximum of £150,000.

Most banks and building societies are also asking borrowers to put down a 15pc deposit or more. Accord Mortgages and HSBC are the biggest lenders to offer 10pc deposit rates, but HSBC has been limiting the number of low-deposit mortgages it provides.

He could save for longer, buy a cheaper property or look for government schemes that might help him. If he can, it may be better to buy sooner, while mortgage rates remain low.

The average property price in Nottingham is £203,684, according to Zoopla, a property website. Flats sell for an average of £141,712, so he could buy a cheaper property.

He should also consider moving his £10,000 savings that sit outside his Help to Buy Isa. If Mr Sedani has a year to go until he buys his property, he could put some of this into a Lifetime Isa.

You can contribute up to £4,000 each year and the Government will add a 25pc bonus to your savings, up to a maximum of £1,000 per year. You must use the money to buy a first home or for retirement and have opened the Isa at least a year before you withdraw the funds.

Mr Sedani could put £4,000 into a Lifetime Isa this year and have a free £1,000 to put towards his property fund.

He should also consider using a Help to Buy “equity loan”, which lends you 20pc of the cost of a new-build home. Based on a salary of £30,000 with a £25,000 deposit and no debts, he would be able to afford a property worth £200,000.

Yahoo Finance

Yahoo Finance