Madison Square Garden Entertainment Corp. Reports Fiscal Q3 Earnings: A Detailed Analysis

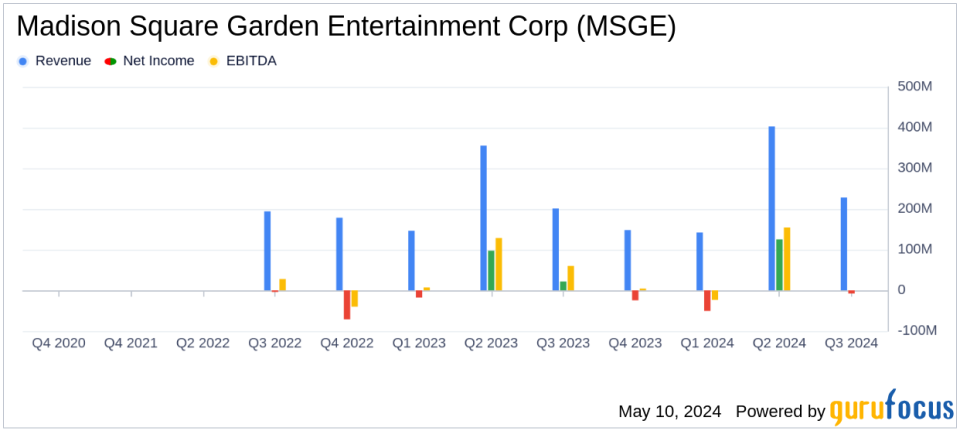

Revenue: Reported $228.3 million for the fiscal third quarter, marking a 13% increase year-over-year, exceeding the estimated $226.55 million.

Net Income: Achieved $2.8 million, significantly below the estimated $8.56 million for the quarter.

Earnings Per Share (EPS): Recorded at $0.06, falling short of the estimated $0.17.

Operating Income: Declined by 32% year-over-year to $16.8 million, reflecting increased operational costs and higher selling, general, and administrative expenses.

Adjusted Operating Income: Decreased by 23% to $38.5 million from the previous year, impacted by higher expenses despite revenue growth.

Financial Guidance: Narrowed FY24 revenue forecast to $940-950 million and increased operating income outlook to $100-110 million, indicating positive business momentum.

Operational Highlights: Noted a low double-digit percentage increase in booking events, driven by a robust growth in concert numbers at company venues.

On May 9, 2024, Madison Square Garden Entertainment Corp. (NYSE:MSGE) released its 8-K filing, detailing the financial outcomes for the fiscal third quarter ended March 31, 2024. The report reveals a mix of growth in revenue alongside challenges in operating and adjusted operating income.

Madison Square Garden Entertainment Corp. is renowned for its dynamic portfolio of iconic venues and entertainment offerings. With properties like New Yorks Madison Square Garden and Radio City Music Hall, MSGE specializes in live events ranging from sports to concerts, which attract millions annually. This quarter, the company reported a revenue increase to $228.3 million, up 13% from the previous year, primarily driven by a rise in the number of concerts and events.

Financial Performance Overview

Despite the increase in revenue, MSGE faced a downturn in both operating income and adjusted operating income, which decreased by 32% and 23% respectively. The company cited higher selling, general, and administrative expenses as the primary reasons for these declines. Specifically, operating income stood at $16.8 million, a decrease from the previous year's $24.7 million. Adjusted operating income was reported at $38.5 million, down from $50.2 million in the prior year quarter.

Revenue Streams and Operational Costs

MSGE's revenue boost was attributed to a robust performance in its bookings business, with significant contributions from the entertainment offerings which generated $146.2 million, marking a 13% increase. This segment benefited from higher event-related revenues and suite license fee revenues, reflecting the company's strong operational execution and strategic positioning.

However, the cost associated with these revenues also rose. Direct operating expenses related to entertainment offerings, arena license fees, and other leasing surged by 25% to $113.0 million. This increase was primarily due to the higher number of concerts and the associated expenses per event.

Strategic Adjustments and Forward Outlook

In response to the current performance trends, MSGE has adjusted its fiscal 2024 guidance. The company now anticipates revenues between $940 million to $950 million, tightening the previous forecast range. Moreover, both operating income and adjusted operating income projections for the year have been increased to ranges of $100-110 million and $200-210 million respectively.

James L. Dolan, Executive Chairman and CEO, expressed confidence in the company's trajectory, stating, "Our business continues to outperform our original expectations for fiscal 2024, and we are on track to generate robust growth in our first full year as a standalone public company."

Investor and Market Implications

While the increase in revenue is a positive indicator of MSGE's ability to attract large audiences and host successful events, the decline in profitability metrics like operating income poses concerns. Investors might be cautious, focusing on how the company plans to manage its expenses and whether it can sustain its revenue growth while improving profitability.

Overall, Madison Square Garden Entertainment Corp.'s fiscal third-quarter report paints a picture of a company successfully growing its top line through increased event activity, yet facing challenges in translating this growth into net income improvements. The adjustments in financial guidance reflect management's proactive stance in navigating these challenges while aiming to enhance shareholder value in the forthcoming periods.

Explore the complete 8-K earnings release (here) from Madison Square Garden Entertainment Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance