MAG Silver's (MAG) Q3 Earnings Beat Estimates, Increase Y/Y

MAG Silver MAG reported adjusted earnings per share of 8 cents for third-quarter 2022, missing the Zacks Consensus Estimate of 11 cents. The company had reported a loss per share of 2 cents in the year-ago quarter.

Net income for the quarter was $8.2 million against loss of $2.3 million in the third quarter of 2021. MAG Silver’s principal asset is the Juanicipio Project located in Zacatecas, Mexico.The company has 44% interest in Juanicipio, currently being developed with its operator Fresnillo Plc FNLPF, which holds the remaining 56% stake.

MAG recorded income from Juanicipio of $11.8 million compared with $1.5 million in the year-ago comparable quarter. This included 44% share of net income from the sale of pre-production development and stope material as well as loan interest earned on mining assets brought into use.

At the end of the September quarter, MAG Silver had a cash balance of $39.5 million compared with $57 billion at the end of 2021 with no long-term debt.

MAG Silver Corporation Price, Consensus and EPS Surprise

MAG Silver Corporation price-consensus-eps-surprise-chart | MAG Silver Corporation Quote

The company reported strong operational performance continued in the third quarter with record milling at the Saucito and Fresnillo operations, delivering over 2.4 million payable silver ounces. This brings MAG’s year-to-date payable silver production to over 6.8 million ounces.

The Juanicipio 2022 exploration program is currently in progress with five drill rigs on the surface running concurrently with continued underground definition and geotechnical drilling, and one rig testing the new Los Tajos target (previously known as the Cesantoni target) in the northwest part of the Juanicipio concession.

As reported by Fresnillo, on a 100% basis, 180,808 tons of mineralized material from both underground development and initial stopes Juanicipio were processed during the three months ended Sep 30, 2022, at an average head grade of 513 silver grams per ton.

MAG has started a comprehensive data review and drilling campaign on the acquired Larder Project. The Deer Trail Project 5,000m Phase II exploration program is also currently in progress.

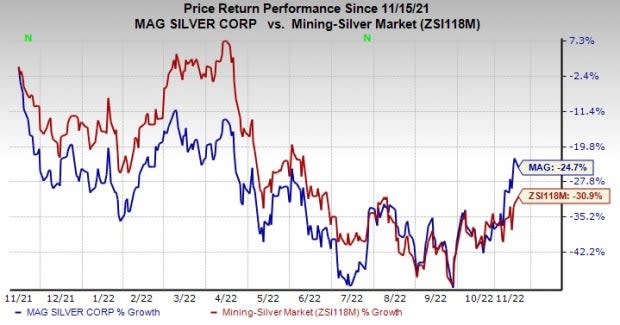

Price Performance

Image Source: Zacks Investment Research

Shares of MAG Silver have declined 24.7% in the past year compared with the industry’s decrease of 30.9%

Zacks Rank & Stocks to Consider

MAG Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include Albemarle Corporation (ALB) and Commercial Metals Company CMC and Reliance Steel & Aluminum Co. RS.

Albemarle, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 420.3% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 5.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 20% in a year.

Commercial Metals currently carries a Zacks Rank #2. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 3.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 38% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Fresnillo PLC (FNLPF) : Free Stock Analysis Report

MAG Silver Corporation (MAG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance