Majestic Wine: Is it too late to join the party?

Introduction

As a middle-class wine drinker I'm only too familiar with Majestic Wine and their appeal to a specific UK demographic. Whether it's through my wife returning home with a case or two for entertainment purposes, or their free glass loan for parties, the brand feels ever-present in this neck of the woods.

Since opening its doors in 1980 the company has grown to over 200 stores in an impressively consistent expansion (although with a few hiccups along the way). Fundamental to this success is a decision not to compete head-to-head with the large supermarkets (a leading cause of off-license mortality) and focus instead on higher-end but still affordable plonk.

What has happened this century?

Since the millenium Majestic Wine has doubled its store estate, turnover has more than tripled and profits have leapt almost six-fold. By any measure this enterprise is a success story and since listing on AIM, back in 1996, it has been one of the brightest stars on the alternative market. If you'd had the good sense to invest in 2001, at around 55p, then about this time last year you might have cracked open the bubbly as your investment became a 10-bagger!

Unfortunately the party came to an abrupt halt almost exactly a year ago when the share price hit 590p and began an inexorable decline; this seems remarkably prescient given that details of challenging trading conditions didn't emerge until six months later. Either way it's been a tough year for the firm and they've been motivated (forced?) to invest in infrastructure, technology and consumer insights to support future growth.

From an investment perspective this leaves us in an interesting position: if the outlay pays off then Majestic Wine will look cheap in the rear-view mirror but if it doesn't then organic growth will remain hard to come by. To my mind the key questions are whether the business is at least holding its own in the market, at present, and whether there are any green shoots visible due to this investment?

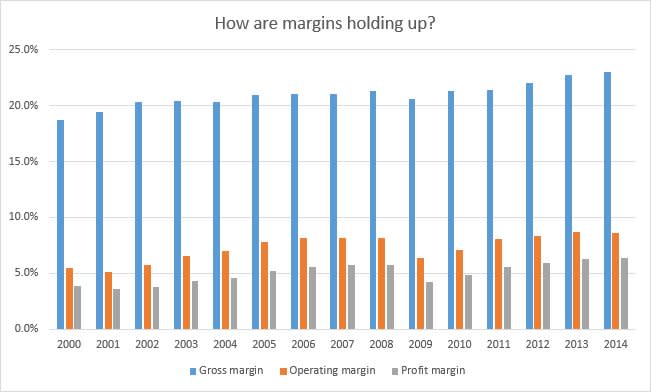

My first area of concern is over the high level of growth that management think is possible: 100 to 200 stores took 12 years but the plan is to ramp up to 330 sites in total. At the current rate of expansion (circa 12 new warehouses per annum) this will take at least a decade to achieve. There's a real chance that margins will get diluted in the process but looking at the last six years (since the current CEO took over) margins have actually improved year-on-year:

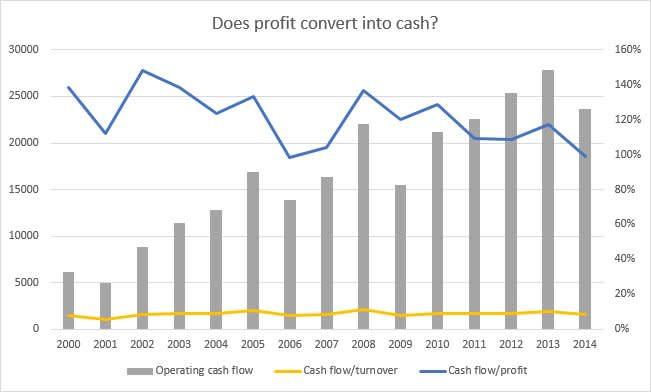

That's certainly reassuring and testament to the stability of the business model in uncertain economic times. Of course profits can be manipulated and I'm equally interested in just how much of this profit converts to cash. In the past Majestic Wine has tried to fund all expansion out of cash generated (only resorting to debt in order to fund infrequent acquisitions) and that history is fully backed-up by the numbers:

In an ideal world pretty much all profit should turn into cash (i.e. 100%) and if anything Majestic Wine looks to have been a bit conservative in the past (with a conversion rate of 120-140%) and could possibly have reported higher profits. So there's no doubt that the company can support organic expansion out of internal resources but I'm also curious as to where any other free cash goes. As it turns out anything that's left is pretty much all returned to shareholders (at least in recent years):

What's notable about this graph is that capital expenditure has always consumed a high proportion of cash flow while dividends have only come to the fore in recent years. These are a welcome source of return but Majestic Wine is now at a juncture where capex and dividends take all of the cash flow and perhaps slightly more. The obvious conclusion is that future dividend growth will remain constrained while management keep opening new stores.

Another good way to test whether capital is being spent wisely is to take a look at ROCE (Return on Capital Employed) and particularly its historical trend. With this metric higher is always better and here we have both a high average, of around 30%, and impressive stability over the years:

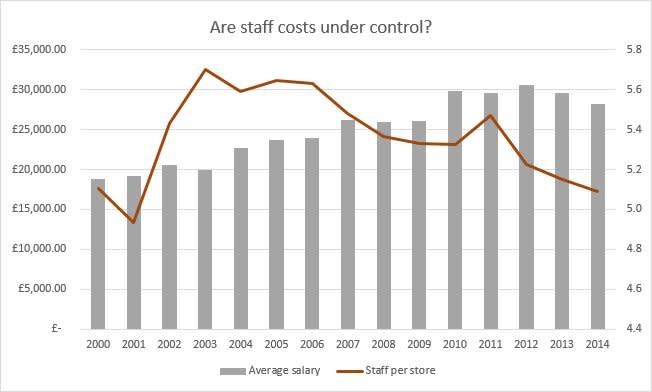

So from a historical perspective the management team seem to run a pretty tight ship. I wonder if this translates to staff and store costs since these are really the largest cash drains for a simple retailer?. In the low wage growth environment that we're living through it's reassuring to see that salary growth has been kept under control (after a bit of jump five years ago) and that staffing levels remain at amazingly low levels:

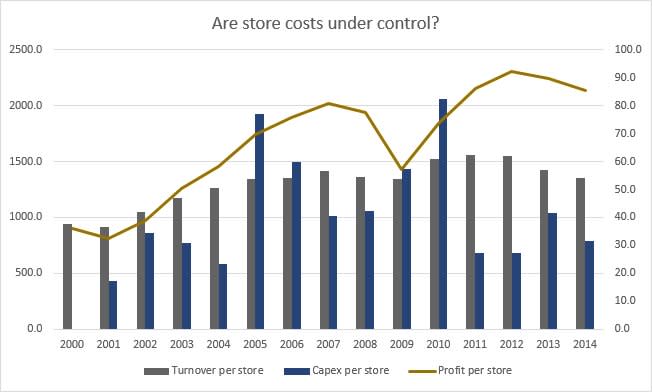

To be honest I'm quite surprised to find that stores can function with less than 5 members of staff (since administration personnel are included in this average) and looking at the company reviews on Glassdoor it's clear that this is a bone of contention. A similar picture emerges when you consider store efficiency both in terms of how much profit they generate and how much capital is required to get them off the ground:

It's clear that Majestic Wine received a much needed boost when Steve Lewis became CEO in 2009 - not least with the switch to a 6-bottle minimum purchase (the 12-bottle limit was a consequence of licensing requirements in the good old days!). There's been a real push for growth and a squeezing out of efficiency gains from the estate; the company has benefited by sticking to its core competancy, as supermarkets have suffered, and the reported margins and cash flow support this approach.

One thing that does bother me is that while the board is very stable they don't actually have much skin in the game. Only Justin Apthorp has a significant holding (over £1m) while the rest hold far more in the way of options and tend to sell them entirely as soon as they vest. Curiously enough the staff appear to have a greater appetite for company shares and injected several million pounds a year into the business in 2011-2013 although this inflow has fallen through the floor recently along with the share price; so that's a useful bit of cash that the company will have to do without.

Recent results for 2014

As mentioned earlier it's been a tough 12 months for Majestic Wine what with that profit warning and all. Trading over the 2013/14 period was essentially flat (like-for-like sales of -0.1%) although things picked up in the second half of the year (in the first six months like-for-like came in at -0.4%).

This subdued market remains centre-stage in the recently released interim results. In fact I can't really put it better than the chairman Phil Wrigley: The cost of these investments, coupled with difficult trading at Lay & Wheeler around the weak Bordeaux 2013 vintage, has seen the Group's profit before tax for the six month period ended 29 September 2014 decline to £8.5m against £9.5m for the first half of the previous financial year.

So merchandising has been problematic, heavy investment is taking place, margins are under pressure and cash flow has only remained strong as a result of favourable working-capital movements. Seems pretty bleak doesn't it? Perhaps but this is also a business that has increased market share by 0.1% to 4.3% (a record level) and achieved like-for-like growth of 2.8%. Maybe the underlying business is healthy enough after all?

This seems to make sense to me given that all of the metrics that Majestic Wineexpose are heading in the right direction. Active customer numbers are up by 1.9% to 643,000 and each customer is spending more per visit (up £3 to £130) on wine that costs more (up to an average of £8.02 compared to £7.71 in 2013). Online sales are also up by 12.3% while business-to-business sales have firmed by 4.9%.

Conclusion

It's something of a surprise but I feel really quite positive about Majestic Wine. There remain economic challenges but they've coped with them over the last five years well enough, they're not competing directly with supermarkets and the current management appear committed to maximising the potential of the business.

There are always concerns of course (are they expanding too fast, have they lost their touch, is the dividend safe) but to some degree the Christmas trading statement (due around 8 Jan 2015) will answer these questions. If you believe that the underlying business is in decent shape then a more relevant question is whether now is a good time to invest?

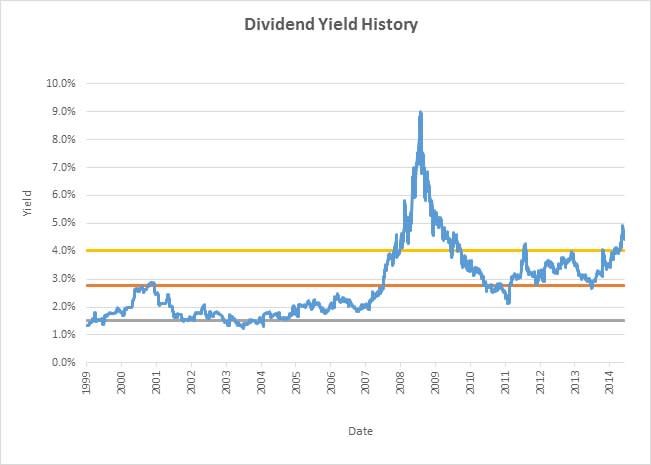

The share price chart suggests not with its relentless, unbroken downward trend but I'm more interested in testing whether the company looks good value compared to its own history. For example Majestic Wine has never been much of a high-yielding share (apart from during the Great Crash) but right now the yield is temptingly above 4%:

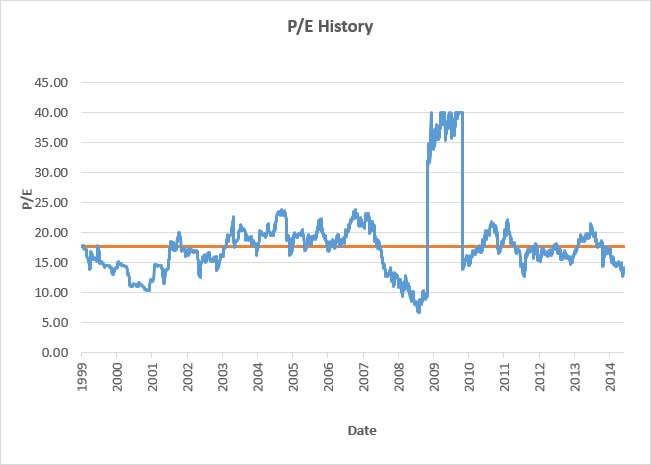

In a similar vein the P/E is also pretty low (less than 14) although it's not outstandingly low compared to supermarkets and the like. This supports my assertion that the company is paying out slightly too high a dividend, given the amount of cash that is being diverted into capex, and that other metrics don't make it look quite as cheap:

Considered in the round I believe that Majestic Wine successfully occupies a mid-market niche in the UK and that their brand has value. Recent board changes have enabled them to refresh their approach, and desire to grow, without distracting from core trading. There are continuing threats to the business model but management appear up to the challenge while keeping a close eye on costs and cash generation.

So right now I see no reason to cut my losses and sell although conversely I'm in no rush to increase my holding either; in the absence of news the share price may well continue its death spiral and I'd like to see some sort of base forming before jumping in. The catalyst for change should be the Christmas trading statement: if it's positive (in terms of like-for-like sales) then I'll probably increase my position; alternatively if it's negative then all bets are off!

Disclosure: The author holds shares in Majestic Wine.

Read More about Majestic Wine on Stockopedia

Read more investing articles & commentary from RandomAmbler

Yahoo Finance

Yahoo Finance