What Makes Knowles (KN) an Enticing Investment Bet Now?

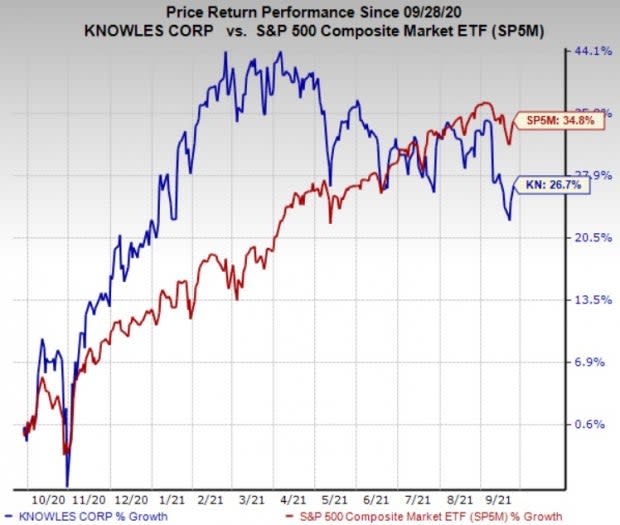

Shares of Knowles Corporation KN are up 26.7% over the past year, driven by healthy revenues on the back of a flexible business model and quick time-to-market schedule to meet clients’ evolving needs. Earnings estimates for the current fiscal have increased 23.9% over the past year and 16.2% for the next fiscal year since October 2020, implying robust growth potential. With healthy fundamentals, this Zacks Rank #2 (Buy) communication components manufacturer appears to be a solid investment option at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in Itasca, IL, Knowles is a premier provider of advanced micro-acoustic, audio processing and precision device solutions, serving the mobile consumer electronics, communications, medical, defense, automotive and industrial markets. Leveraging its leading position in MEMS (micro-electro-mechanical systems) microphones and strong capabilities in audio processing technologies, the company optimizes audio systems and improves user experience in mobile, ear, and IoT applications. Knowles also offers acoustic components, high-end capacitors, and mmWave RF solutions for diverse markets.

Voice-powered interactions are fast emerging as a critical and necessary feature as consumers tend to engage with technology through natural, spoken commands across the mobile, ear and IoT platforms. This has led to a wide proliferation of products ranging from mobile phones to headsets, and from smart speakers to household appliances. Knowles aims to capitalize on its unique capabilities in acoustics, digital signal processing, and algorithms to cater to these demands. The acquisition of Audience further helped the company gain essential digital signal processing and algorithm capabilities. Strong business focus, disciplined capital management, and continuous R&D (research & development) initiatives have helped Knowles to command a leading market position in MEMS microphones, balanced armature speakers, edge processors, high performance capacitors, and radio frequency filtering solutions. MEMS microphones are the smallest of its kind with the highest signal to noise ratio at the lowest power while the balanced armature speakers offer the greatest output at the lowest power.

Proprietary manufacturing techniques and global scale of operations have facilitated the company to fine tune its business with the evolving customer demands and invest in high-value solutions. The transformation from an acoustic component supplier to an audio solutions provider has enabled the company to migrate to higher-value solutions and increase content per device. This, in turn, has empowered it to capitalize on the positive macro trends in audio and edge processing solutions.

Knowles boasts integrated design and manufacturing scale of operations. The company has a unique ability to balance and shift between full and semi-automation to optimize the efficiency of the operations and reduce operating expenses. For products that were introduced more than 18 months ago, Knowles strives to offset expected price erosion through bill of material cost reductions, yield improvements, equipment efficiency, and movement to lower-cost manufacturing locations.

With a VGM Score of A, the stock delivered an earnings surprise of 10.8%, on average, in the trailing four quarters. The stock appears to be an enticing investment proposition with long-term earnings growth expectations of 10%.

Other Key Picks

Some other top-ranked stocks in the industry are Ooma, Inc. OOMA, SeaChange International, Inc. SEAC, and Sensata Technologies Holding N.V. ST, each carrying a Zacks Rank #2.

Ooma delivered an earnings surprise of 55.2%, on average, in the trailing four quarters.

SeaChange International has a long-term earnings growth expectation of 10%. It delivered an earnings surprise of 28.9%, on average, in the trailing four quarters.

Sensata has a long-term earnings growth expectation of 11%. It delivered an earnings surprise of 13.2%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sensata Technologies Holding N.V. (ST) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Knowles Corporation (KN) : Free Stock Analysis Report

Ooma, Inc. (OOMA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance