Manufacturing sector shrinks for first time since May 2020 as recession looms

For the first time since workers were forced to down tools in the early days of the pandemic, production at the UK’s factories is falling, a new study has suggested.

The Purchasing Managers’ Index (PMI) for the manufacturing sector fell to its lowest level in 27 months for August as the UK heads towards a recession.

The score of 47.3 means that the sector has contracted for the first time since May 2020.

Anything above 50 is considered to show growth and in July the survey returned a score of 52.1.

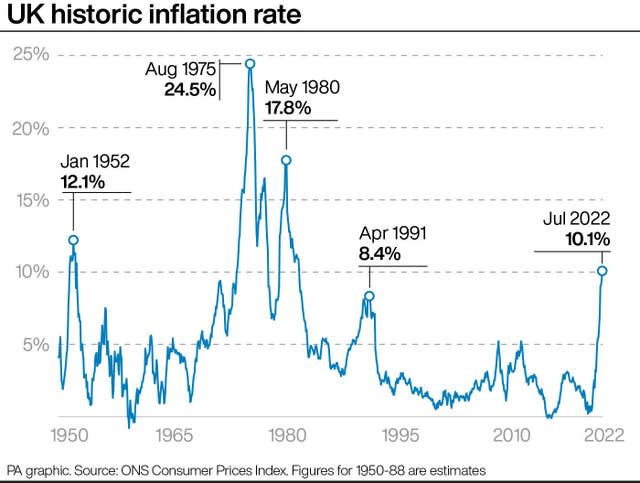

“The inflationary clouds that have been building over the UK manufacturing industry have finally burst, with a dramatic fall in demand creating the sharpest reduction of new orders since May 2020,” John Glen, chief economist at the Chartered Institute of Procurement and Supply, said.

Rob Dobson, director at S&P Global Market Intelligence, which compiles the survey, said: “August saw the UK manufacturing sector suffer its steepest downturn since the first Covid-19 lockdown.”

Both buyers in the UK and those abroad were ordering fewer products from the country’s factories.

“There is no escape from plummeting new orders for UK manufacturers. Clients at home and abroad in the US, EU and China are looking to cut their costs, with reports of cancelled and postponed contracts this month, Mr Glen said.

“Disruption at the UK’s busiest container port in August has certainly not helped exporters.”

Mr Dobson said that respondents had reported their clients cancelling, postponing or rescheduling agreements because of economic uncertainties.

Problems in the ports and Brexit complications made matters worse.

However, the experts pointed to some shoots of optimism that they had spotted in the survey.

The worst of the supply chain disruption might have passed, Mr Glen said.

The prices of raw materials may still be rising, but those rises have slowed. Meanwhile, backlogs of work are declining.

“UK manufacturers will be hoping that supply chain disruption eases long enough to drive down costs for good,” he said.

Economists have warned that the UK is heading towards a recession.

The Bank of England forecast last month that a recession would start in the fourth quarter of this year, and continue through the rest of next year.

Yahoo Finance

Yahoo Finance