Many over-55s could be heading for retirement income shortfall, says survey

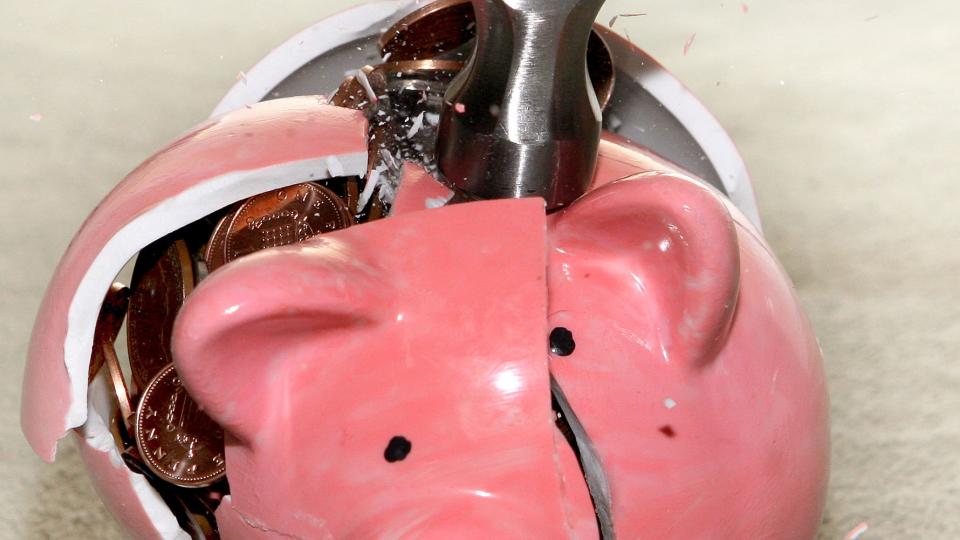

Many over-55s who are approaching retirement risk exhausting their pension savings early, a survey suggests.

A quarter (25%) of those aged 55 to 64 who are still working said they were only budgeting for their retirement income to last 10 years or less, Standard Life found.

One in eight (12%) are planning for their retirement income to support them for just one to five years.

Three in 10 (29%) over-55s expect to need the same amount of cash each year throughout their retirement.

Just over a quarter (27%) are not sure of their retirement income needs and how they will change.

John Tait, retirement advice specialist at Standard Life, said: “Many people are struggling to think more than five or 10 years ahead, meaning they’re not only at risk of not saving enough for retirement, but also might not be taking into account how their needs could change.

“Some people will spend more in their early years as they travel or treat themselves with a big purchase, meaning their income needs will probably flatten out over time. However, costs can also rise in later life, driven by factors such as care needs or assisted living.

“When preparing to retire as an individual we recommend ensuring you have an income to support you until age 95, or to age 90 if you are planning your finances as a couple. That might seem like an excessive age to base a plan on, but the reality is people are living longer and one in four people approaching retirement now can expect to live until then.”

Eight in 10 (80%) over-55s have not yet sought financial advice about their retirement income needs and 46% have no intention to, Standard Life found.

Mr Tait added: “Taking financial advice from an expert adviser can be helpful when it comes to thoroughly planning for retirement. They can assess your income sources and savings, consider your retirement goals and, perhaps most importantly, explore what costs you might need to prepare for in the future.”

Some 1,000 people who are aged over 55 and still working were surveyed across the UK in February.

Phil Brown, director of policy at the People’s Pension, said: “These findings back up the research we published early this year which showed that a significant number of people are sleepwalking into retirement and would benefit from better guidance.

“Our joint new choices, big decisions report shows why policymakers must require pension schemes to guide members to products which match retirement risks, including living longer than they had planned for, and which will ensure that defined contribution pension savers have an income throughout their retirement.”

Yahoo Finance

Yahoo Finance