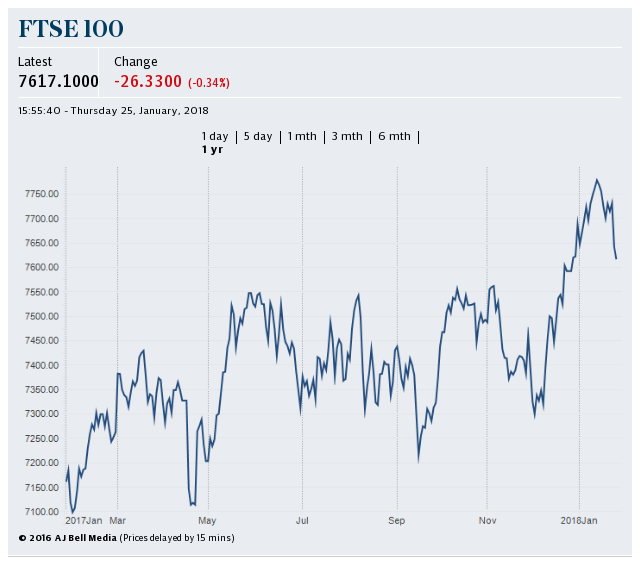

Market report: FTSE falls 121 points to 15-month low

The FTSE 100 slumped to a 15-month low after a perfect storm of weaker commodity prices, caution ahead of the Federal Reserve’s crucial meeting and a “tech wreck” on Wall Street sent global stocks sliding.

Rollercoaster trading on markets spilt over into the new week as the FANG stocks in the US – Facebook, Amazon, Netflix and Google – tumbled and risk appetite pulled back ahead of what is expected to be the Fed’s first interest rate rise in 2018.

Concerns that the Fed may start to lay the groundwork for as many as four hikes this year in Jerome Powell’s first meeting at the helm of the US central bank on Wednesday kept equities around the globe on the back foot.

Approximately $40bn (£28.49bn) was then wiped off the value of Facebook at the opening bell in New York following revelations of a major data breach with the “tech wreck” on Wall Street worsening the sour mood already dominating trading.

The FTSE 100 was hit hardest in Europe after its heavy weighting of mining and oil giants sunk on retreating metal prices.

Sliding commodity stocks dragged the FTSE 100 to a 121.21-point loss at 7,042.93, its lowest level since 2016. Miners Glencore and Anglo American slipped 16.3p to 369.3p and 74.4p to £16.95, respectively, while Micro Focus’s 46pc nosedive single-handedly shaved 14.5 points off the blue-chip index.

The pound’s surge ramped up the pressure on the benchmark index’s dollar earners after jumping as much as 1.1pc to $1.4088 against the dollar after Brexit negotiators made a transition deal breakthrough. Elsewhere, loo rolls maker Accrol plunged 17.8p to 10.3p, a fresh all-time low, on admitting that it is on the verge of breaking banking covenants after costs spiralled.

The supermarket supplier revealed the “magnitude” of the surge in costs had only just been realised by its management. Accrol briefly suspended its shares in October after issuing a profit warning and its valuation has dropped a total of 93pc, or £149m, since the update.

Real estate companies were in high demand after shopping centre owner Hammerson revealed that it has rebuffed a takeover attempt by French peer Kléppiere. Another swoop in a recent flurry of deals in the sector boosted FTSE 100 firms Land Securities and British Land 30p to 936.8p and 16p to 648p, respectively, while Intu Properties, which Hammerson is in the process of acquiring, climbed 6.5p to 210.5p.

FTSE 100 pharma giant AstraZeneca gave up early gains despite a broker upgrade to “buy” from Jefferies, dipping 19.5p to £48.48. Finally, a late surge in conveyor belt maker Fenner was followed after the close by the firm revealing that French giant Michelin has made a 610p per share offer.

Yahoo Finance

Yahoo Finance