What to Watch: Credit Suisse and Standard Chartered beat forecasts, Santander counts PPI costs

Here are the top business, market, and economic stories you should be watching today in the UK, Europe, and abroad:

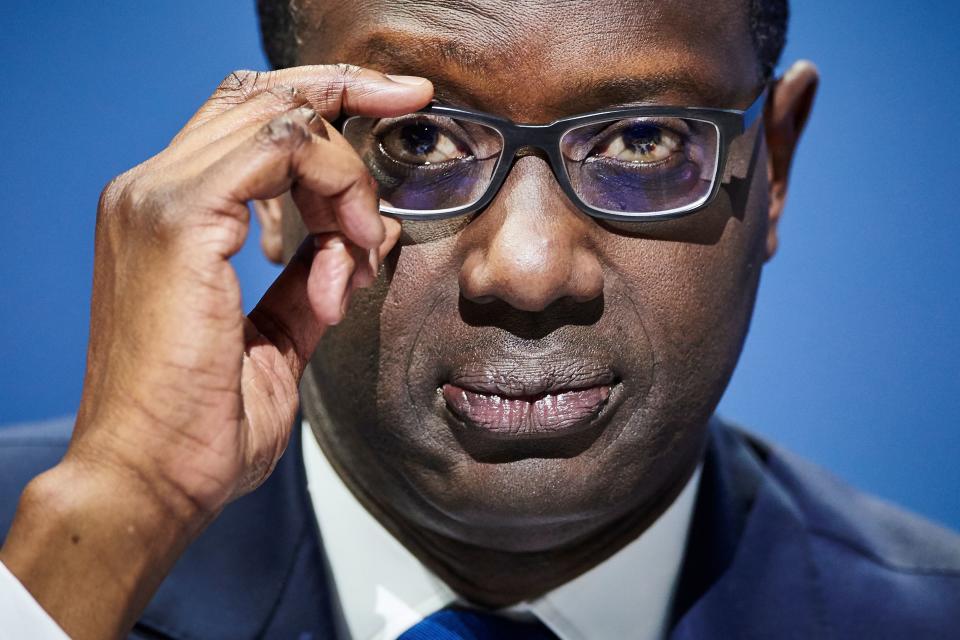

Credit Suisse beats forecasts

Credit Suisse (CS) beat analyst forecasts with third-quarter earnings, as pre-tax jumped 70%.

The Swiss bank reported pre-tax profit of CHF 1.1bn (£860m) in the third quarter, against a consensus forecast of CHF 1bn (£780m). Revenue was CHF 5.3bn (£4.1bn), against a forecast of CHF 5.2bn (£4bn).

“During the third quarter of 2019, we continued to implement our strategy of being a leading wealth manager with strong investment banking capabilities,” CEO Tidjane Thiam said.

“We have continued, in a challenging environment, to grow our wealth management franchises, increasing our revenues and gathering record net new assets of CHF 72 billion across the Group year to date.”

The bank said it expects “the usual seasonal slowdown as a result of the holiday season” in the fourth quarter and also flagged “headwinds from the ongoing challenging geopolitical environment, most notably the US-China trade dispute and Brexit.”

“This is likely to lead to more cautious capital expenditure and investment decisions, specifically looking forward to 2020 and 2021,” the bank said.

However, Thiam added: “We believe that we are well-positioned to achieve further profitable growth.”

Standard Chartered shrugs off Hong Kong disruption

Emerging markets-focused bank Standard Chartered (STAN.L) beat forecasts with its third-quarter results, despite ongoing disruption in its key market of Hong Kong.

Revenue rose 6% year-on-year to $3.9bn (£3bn) and pre-tax profit jumped by 15% to $1.2bn (£980m). Revenue grew in its Hong Kong franchise despite the ongoing pro-democracy protests across much of the city.

CEO Bill Winters flagged a “more challenging external environment” due to slowing global growth, the US-China trade war, and low and falling interest rates.

However, the bank said it was well-positioned to tackle the issues and reaffirmed its target of hitting 10% return on tangible equity by 2021, a key measure of banking profitability.

Shares rose 2.2%.

Santander counts cost of PPI

Santander’s (SAN.MC) UK pre-tax profit crashed 43% in the third quarter as the bank was hit by a spike in payment protection insurance (PPI) mis-selling claims.

The Spanish bank took a £169m charge for PPI costs in the third quarter, provoked by a spike in compensation claims around the 29 August deadline. The charge pushed profits down to £785m.

“Our profitability for the first nine months of 2019 has been impacted by ongoing competitive income pressure, additional PPI costs as well as transformation programme investment,” Santander UK CEO Nelson Bostock said.

The bank invested £127m in the quarter on restructuring its branch network.

“Despite this, we delivered our strongest quarterly net mortgage growth in almost ten years, driven by a focus on customer service and retention,” Bostock said. “We have also increased customer deposits across the business, with further improvement in customer loyalty."

Santander added £3.6m in net new mortgages in the quarter and grew customer deposits to £4.2bn.

Deutsche Bank reassures on turnaround plan

Deutsche Bank (DBK.DE) CEO Christian Sewing on Wednesday reassured investors that the banks sweeping overhaul remains on track, as the bank delivered third-quarter results.

Deutsche Bank’s revenue in the third quarter was €5.3bn and it made a pre-tax loss of €687m. Loss attributable to shareholders was €832m. Return on tangible equity, a key measure of bank performance, was negative 7.3%.

The quarterly figures represent the first full quarter since Deutsche Bank announced a radical restructure of the bank in July aimed at returning the profit to consistent growth and profit. The plan involves shutting Deutsche Bank’s stock trading business and cutting 18,000 jobs globally. CFO James von Moltke said on Wednesday that around 1,500 jobs were cut in the third quarter.

Fiat Chrysler holds merger talks with Peugeot

PSA Group (UG.PA), the French owner of Peugeot, is considering a merger with Italian-American Fiat Chrysler (FCAU) in a move that would create a car giant worth nearly $50bn, the companies confirmed on Wednesday.

Both firms said that the discussions were focused on creating one of the “world’s leading automotive groups.”

The news comes after talks about a proposed merger between Fiat Chrysler and Renault collapsed earlier this year.

Fiat Chrysler has long signalled that it believes consolidation to be necessary in the car industry, which is contending with trade war headwinds and the rise of the climate change movement.

According to reports, the deal could come in the form of an all-stock merger, which would create a combined group with a market capitalisation of around $47bn (£36bn).

Airbus cuts production targets

Airbus (AIR.PA) has slashed its production targets for commercial aircraft this year, despite hopes of capitalising on the troubles of its US rival Boeing (BA).

Europe’s largest plane maker said in its latest results it is now planning to only build around 860 jets in 2019, when it was reported to have previously been targeting up to 890.

The company’s chief executive Guillaume Faury said the figures reflect “underlying actions to secure a more efficient delivery flow.”

Airbus is said to have been struggling with problems at its newly expanded plant in Hamburg, Germany, including supplier delays, staffing issues and production snags, according to Reuters.

Next sales rise

High street retailer Next (NXT.L) reported rising sales in the three months to 26 October, boosted by the recent cooler weather.

Sales rose 2% after strong October trading, slightly better than Next had expected. Retail sales fell 6.3% in the quarter but a 9.7% jump in online sales offset the slump.

“We believe the improved sales growth in October recouped some of the lost sales in September and we do not expect sales growth for the rest of the year to be as strong as October,” the company said.

Shares fell 2.3%.

Pound, stocks mixed as UK heads for election

UK stocks were mixed on Wednesday after politicians voted on Tuesday night to hold a general election on December 12.

The pound rose on Tuesday evening on the news and continued to hold near 5-month highs on Wednesday morning. Sterling was flat against the euro at €1.158 (GBPEUR=X) and flat against the dollar at $1.2876 (GBPUSD=X). The FTSE 100 (^FTSE) was down 0.1%.

German stocks were under pressure after a survey of German factories found the sector is as pessimistic as it was in 2008. Germany’s DAX (^GDAXI) was down 0.2%.

France’s CAC 40 (^FCHI) was flat and the Euronext 100 (^N100) was up by 0.1%.

Overnight in Asia, Japan’s Nikkei (^N225) closed down by 0.5%, the Hong Kong Hang Seng Index (^HSI) was down 0.4%, and China’s Shanghai Composite (000001.SS) was down by 0.5%.

What to expect in the US

US stocks futures are pointing to a quiet open. S&P500 futures (ES=F), Dow Jones futures (YM=F), and Nasdaq futures (NQ=F) were all flat. All eyes are on the US Federal Reserve, which will deliver its latest interest rates decision later today. Markets are expecting a 25 basis point cut to rates.

It’s a busy day for earnings. Companies reporting in the US later today include:

Apple (AAPL)

Molson Coors Brewing (TAP)

Yum! Brands (YUM)

CME Group (CME)

GE (GE)

Hyatt Hotels (H)

Starbucks (SBUX)

Sotheby’s (BID)

Yahoo Finance

Yahoo Finance