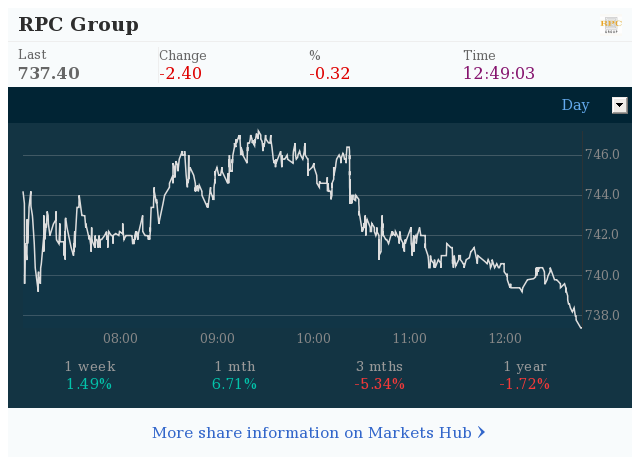

Market report: RPC shares fall as investors disagree over spending spree

Plastics packaging giant RPC was thrust back under the City’s spotlight after its chairman admitted that the company is at loggerheads with shareholders over a debt-fuelled spending spree, and an analyst claimed the company was using aggressive accounting to flatter its growth.

Chairman Jamie Pike warned that “differing investor views on the appropriate level of leverage” was stopping it from making “attractive” purchases to boost growth.

It is understood that some of its US shareholders are more comfortable with higher leverage levels to fund an acquisition spree compared to RPC’s UK investor base.

Northern Trust Capital Markets analyst Paul Moran, who has questioned how RPC accounts for acquisitions before, argued that earnings growth has been flattered through the way the company books its deals.

Mr Moran added that a lack of “big M&A … is the only way that shareholders will truly be able to judge the underlying profit growth”. RPC declined to comment on the claims.

Rumblings of discontent among its shareholders put renewed pressure on its share price, knocking it 27.6p to 747.4p.

Elsewhere, easyJet flew to a higher altitude after the budget airline raised its profit guidance despite taking a £25m hit from strike action costs. The company upped its guidance to between £550m and £590m, citing a “benign competitor environment” after Monarch’s collapse, and “robust” demand. EasyJet climbed 35.5p to £16.89.

Aggreko surged 40.8p to 697.6p, its strongest gain in over two years, amid City whispers of an incoming takeover bid.

The generator rental company has been made vulnerable to an approach by a 33pc share price slump since November. With trading volumes high, rumours speculated the struggler could be in the crosshairs of FTSE 100 rival Ashtead, or one of its US peers such as United Rentals.

Royal Mail tumbled 22p to 467.5p after City analysts trimmed their target prices for the parcel deliverer in the wake of its GDPR-hit results on Tuesday. Cutting its target price from 590p to 550p, Bernstein warned clients that its margins will come under pressure.

Fast fashion e-tailer Boohoo advanced 4.3p to 211.9p after Liberum upgraded it to “buy”, citing the Aim-listed company’s improving sales retention figures.

Federal Reserve chairman Jerome Powell’s bullish outlook for the US economy amid the threat of trade wars pushed up European markets, helping the blue chip FTSE 100 index climb by 49.95 points to close at 7,676.28.

Yahoo Finance

Yahoo Finance