Market report: Trump tariffs send stocks tumbling

Global stocks were dragged under by another wave of trade war worries as Donald Trump turned up the heat on China with plans to impose new tariffs on $200bn (£151bn) of goods.

Just days after firing the first shot in its trade skirmish with Beijing, the Trump administration unveiled a list of 6,000 Chinese products ranging from toilet paper to baseball gloves that will face a 10pc tariff.

The Chinese commerce ministry said that it was “shocked at the US action” and warned that it would be forced to retaliate “to protect the core interests of the nation and its people”.

Markets still reeling from the first round of tariffs between the world’s two largest economies were sent sliding by the new threats.

Chinese stocks slipped further into a bear market while the FTSE 100 was led lower by its plunging miners as copper and zinc prices fell to one-year lows. Mining giant Glencore slid 15.8p to 311.2p, a one-year low, while on the FTSE 250, copper specialist Kaz Minerals tumbled 54p to 790p, a five-month low.

The blue-chip index snapped a four-day winning streak to close 100.08 points lower at 7,591.96, and the DAX in Germany pulled back 1.5pc. The sell-off eased off on Wall Street but the Dow Jones still dropped as much as 0.7pc in early trade.

It is “hard to see how a full-blown trade war can be avoided at this stage”, warned Capital Economics’ Paul Ashworth.

“There is no one left in the administration or in Congress to rein in President Trump’s long-held protectionist beliefs, and other countries are not shying away from the fight,” he explained.

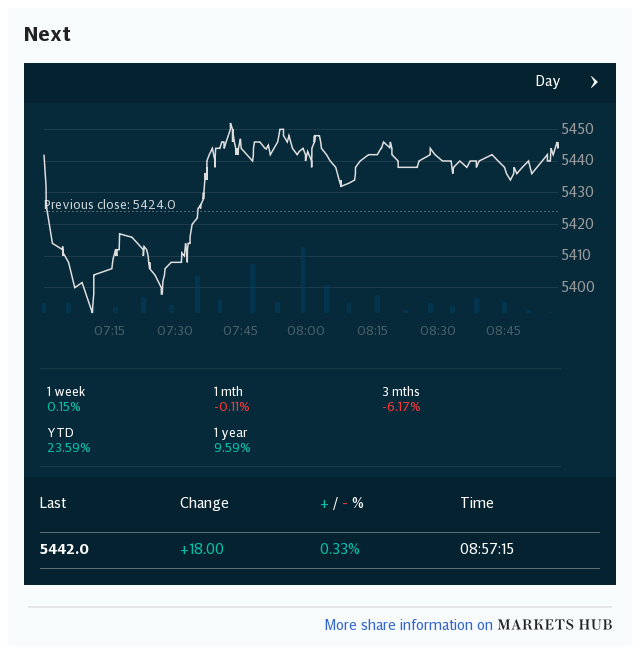

Elsewhere, Next escaped the stocks sell-off unscathed after Credit Suisse praised the revival of its online Directory division helping the FTSE 100 firm survive the high street slump.

In an upgrade to “neutral”, its analysts also found that the opening pricing point – the least costly item in a range, for example the cheapest pair of jeans – at Next has dropped markedly in three months from an average of £17.40 to £9.80 in June. Among just a handful of stocks to finish in positive territory on the blue-chip index, Next climbed 70p to £60.50.

FTSE 250 travel firm Thomas Cook nosedived to a one-year low after Morgan Stanley warned that Britons have stayed at home this summer to enjoy the longest heatwave in over 40 years and watch England reach the World Cup semi-finals.

Tour operators have told the bank’s analysts that demand for holidays has weakened. Predictions of the football and the warm weather having a “chilling effect” on Thomas Cook’s trading knocked it 5.9p to 100.1p.

Johnston Press, the troubled publisher of The Scotsman and the i plunged a further 0.5p to 2.8p, a new record low amid concerns over a £220m bond due to be repaid next year. Following a 84pc plunge since October, the newspaper publisher’s market value has shrunk to just £2.6m.

Windows manufacturer Safestyle UK nosedived 10.7p to 39p, an all-time low, after admitting that its full-year revenue would be below market expectations.

Yahoo Finance

Yahoo Finance