Market Still Lacking Some Conviction On LSL Property Services plc (LON:LSL)

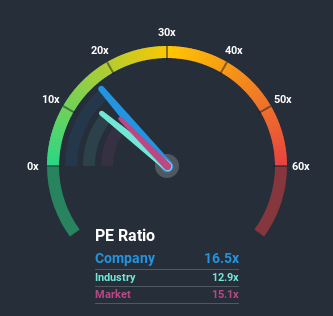

With a median price-to-earnings (or "P/E") ratio of close to 15x in the United Kingdom, you could be forgiven for feeling indifferent about LSL Property Services plc's (LON:LSL) P/E ratio of 16.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, LSL Property Services' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for LSL Property Services

How Does LSL Property Services' P/E Ratio Compare To Its Industry Peers?

An inspection of the typical P/E's throughout LSL Property Services' industry may help to explain its fairly average P/E ratio. The image below shows that the Real Estate industry as a whole has a P/E ratio lower than the market. So it appears the company's ratio isn't really influenced by these industry numbers currently. Ordinarily, the majority of companies' P/E's would be compressed by the general conditions within the Real Estate industry. Whilst this can be a heavy component, industry factors are normally secondary to company financials and earnings.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LSL Property Services.

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like LSL Property Services' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. As a result, earnings from three years ago have also fallen 74% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the twin analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 8.8% per annum, which is noticeably less attractive.

In light of this, it's curious that LSL Property Services' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On LSL Property Services' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of LSL Property Services' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with LSL Property Services, and understanding these should be part of your investment process.

You might be able to find a better investment than LSL Property Services. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance