MarketAxess Holdings Inc. Earnings Rise Despite Tepid Trading Environment

MarketAxess Holdings (NASDAQ: MKTX) reported third-quarter results on Oct. 25. The trading platform for corporate bonds and other fixed-income securities is steadily expanding its share of the massive global debt market.

MarketAxess: The raw numbers

Metric | Q3 2017 | Q3 2016 | Year-Over-Year Change |

|---|---|---|---|

Revenue | $96.701 million | $90.271 million | 7.1% |

Pre-tax income | $47.217 million | $46.354 million | 1.9% |

Earnings per share | $0.90 | $0.82 | 9.8% |

Data source: MarketAxess Q3 2017 earnings press release.

Image source: MarketAxess.

What happened with MarketAxess this quarter?

MarketAxess' share of the U.S. high-grade credit market improved to an estimated 17.2%, up from 16% in the year-ago quarter.

Image source: MarketAxess Q3 2017 earnings presentation.

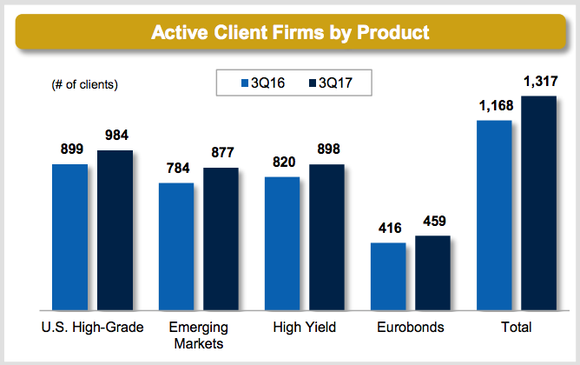

The bond-trading network continues to garner new customers, and more than 1,300 institutional investor and broker-dealer firms now use its platform.

Image source: MarketAxess Q3 2017 earnings presentation.

MarketAxess' total trading volume rose 7.6% year over year to $346.8 billion. Yet variable transaction fees increased only 1.9%, to $65.9 million, as MarketAxess' average transaction fee per million declined 5.5% to $190.

All other revenue increased 18% to $10.4 million, mostly because of higher information services revenue and investment income.

In all, MarketAxess' total revenue rose 7.1% year over year to $96.7 million.

Growth in total expenses, however, outpaced revenue growth, rising 12.7% to $49.5 million. Expenses were driven higher primarily by higher employee compensation, consulting, and technology costs. In turn, MarketAxess' pre-tax income increased only 1.9% to $47.2 million, as pre-tax margin fell to 48.8% from 51.3% in the prior-year period.

All told, net income, boosted by a lower effective tax rate, jumped 10.4% to $34.1 million, and earnings per share grew 9.8% to $0.90.

"Revenue and profitability held up well in the third quarter in spite of the continued low-volatility and low-yield environment," Chairman and CEO Richard McVey said in a press release.

Looking forward

MarketAxess' cash generation remains strong, to the tune of $96 million in free cash flow so far in 2017. The company also possesses a fortress-like balance sheet, including $376.2 million in cash and investments as of the end of the third quarter. Together, these factors are allowing MarketAxess to invest aggressively in the expansion of its international operations.

"We are especially encouraged by the growth in our international business, led by emerging-markets trading," McVey added. "We continue to increase our investment in technology solutions for our clients to help them meet their regulatory requirements and expand their trading opportunities."

More From The Motley Fool

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool recommends MarketAxess Holdings. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance