US stocks surge after White House delays key tariffs on China: as it happened

US indices climb sharply on hopes of trade war breakthrough

Talks set to proceed in September

Delayed tariffs apply to crucial items such an electronics and clothes

Read more: Spoofing, Twitter and 'illegal market manipulation': does Burford have a case against Muddy Waters?

US stocks surged on Tuesday afternoon after a US decision to delay or cancel some of its impending tariffs on Chinese exports rekindled hopes of a trade war truce.

The Dow Jones Industrial Average, S&P 500 and Nasdaq all rose sharply on the announcement, converting low gains into an almost-immediate rally of more than 1.5pc each.

The Office of the US Trade Representative said tariffs would be cancelled on certain goods because of “health, safety, national security and other factors”, and said a levy on good including “cell phones, laptop computers, video game consoles, certain toys, computer monitors, and certain items of footwear and clothing” would be pushed back to the 15th December.

China’s Xinhua news agency reported that US Trade Representative Robert Lighthizer and Treasury Secretary Steve Mnuchin would continue trade talks with Chinese vice-premier Liu He next month.

The prospects for further talks had been thrown into doubt in recent weeks, after US President Donald Trump announced plans to add a 10pc tariff to a further $300bn of Chinese goods, effectively meaning all Chinese exports to the US would have been levied.

That announcement sent global indices to their worst week of 2017, with investors rushing to safe-haven assets such as gold and the Japanese yen to avoid the fallout from an escalating trade clash between the world’s two biggest economies.

Wrap-up: US resurgent as trade war fears subside, strong wage data does little to calm Brexit worries

The FTSE closed 0.33pc up, still showing less elasticity than its continental peers, with France’s CAC stopping inches short of a 1pc rise. US markets look set to chug on happily into the night, with the tech-heavy Nasdaq up over 2pc currently.

Tomorrow will bring GDP figures from Germany. It’s almost certain that Europe’s largest economy contracted in the second quarter, so analysts will be looking closely to see if it can avoid a recession. We’ll also get inflation figures from the UK.

That’s all from me today. I’ll be back from tomorrow morning, as we check in on Germany’s economy, assess the damage from tonight’s events in Hong Kong, and see if the US can maintain its markets euphoria. See you then!

Police drive demonstrators out of Hong Kong airport

It’s nearly midnight in Hong Kong, and riot police have moved in to begin forcing protesters out after a second day of disruption. The demonstrations at the airport have sent shares in airline Cathay Pacific sharply down, and added to the drag on Hong Kong’s stock.

Gone 11pm in Hong Kong and police wielding batons are now clearing protesters from the airport - people being arrested and tear gassed right in front of TV cameras live on air

— Julia Macfarlane (@juliamacfarlane) August 13, 2019

Please note the following tweet contains violence:

Police officer had his baton taken from him and was attacked with it. Drew his pistol and aimed at protesters. Astonished nobody killed here tonight. pic.twitter.com/Wox8yziDnz

— Mike Bird (@Birdyword) August 13, 2019

Round-up: German confidence slips, ENRC tries to stop corruption charges and Card Factory promises shareholder payouts

Here are three of today’s top stories:

Shock slump in German confidence adds to recession fears: Confidence in the German economy has crashed to its lowest level since the depths of the eurozone debt crisis, fuelling fears of a recession.

Mining giant ENRC makes new bid to halt corruption charges: The Kazakh mining giant ENRC has begun a new attempt to frustrate a criminal investigation of alleged corruption in its African business.

Card Factory promises more cash for shareholders as sales defy high street downturn: Card Factory has bucked the decline on the high street with rising sales and the promise of a special dividend for its shareholders.

US tariff delay reaction: ‘We’re only ever a tweet away from the next market downturn or massive rally’

Reacting to the US’s decision to cancel or delay some of its planned tariffs, Markets.com’s Neil Wilson writes:

I buy the argument that Trump didn’t like the way markets have turned and thought he should do something about it. Was he worried about the CPI print? Possibly; it certainly has complicated things for the Fed, but ultimately it just looks like it was an easy win for Trump.

The White House will delay some tariffs on China until December 15th, and has removed some items for its hit list on health, safety and national security grounds. This has boosted sentiment – but can it last? When do we get the next bearish signal on trade? We’re only ever a tweet away from the next market downturn or massive rally. It only shows how tough it is out there and how susceptible the market is to unpredictable news flow about trade.

Can't wait for the Fed, just say something good about trade pic.twitter.com/9BJUEV0P2L

— Neil Wilson (@marketsneil) August 13, 2019

Rolls-Royce holds flat despite Moody’s downgrade

Rolls-Royce remains flat on the FTSE 100 today, despite being downgraded by Moody’s analysts. My colleague Alan Tovey writes:

Rolls-Royce has suffered another blow with Moody's downgrading the blue-chip engineer’s debt, citing concerns about cash flow.

The rating agency cut the rating on Rolls’s long-term debt from Baa1 to A3, just three notches about “junk” status, with the outlook classed as stable from the previous negative.

Moody’s said its worries included Rolls’s “target free cash flow in 2019 will include working capital gains, which are not considered sustainable, and that 2020 target free cash flow may similarly be supported by working capital gains”.

The rating did, however, note Rolls’s “improving performance, expected growth in aftermarket earnings and long-term stability of engine programmes”.

The downgrade comes just days after an airliner taking off from Rome had to make an emergency landing when parts appeared to fall from its engine, a Rolls Trent 1000, a type which the company has faced a run of problems with.

European stocks reverse losses on hopes of trade breakthrough

The positive sentiment has quickly crossed the Atlantic, pushing European indices to reverse their losses. France’s CAC 40 is leading climbers at 0.96pc up, while the FTSE is up 0.22pc.

Full statement on tariff pushbacks

Here’s the full statement on those tariff delays, from the Office of the United States Trade Representative:

The United States Trade Representative (USTR) today announced the next steps in the process of imposing an additional tariff of 10 percent on approximately $300 billion of Chinese imports.

On May 17, 2019, USTR published a list of products imported from China that would be potentially subject to an additional 10 percent tariff. This new tariff will go into effect on September 1 as announced by President Trump on August 1.

Certain products are being removed from the tariff list based on health, safety, national security and other factors and will not face additional tariffs of 10 percent.

Further, as part of USTR’s public comment and hearing process, it was determined that the tariff should be delayed to December 15 for certain articles. Products in this group include, for example, cell phones, laptop computers, video game consoles, certain toys, computer monitors, and certain items of footwear and clothing.

USTR intends to conduct an exclusion process for products subject to the additional tariff.

The USTR will publish on its website today, and in the Federal Register as soon as possible, additional details and lists of the tariff lines affected by this announcement.

US shares bounce after tariff delay

Signs that trade talk are proceeding have been jumped on by US investors, with the Dow Jones Industrial Average, S&P 500 and Nasdaq all seeing gains clear of 1.5pc. Many traders who have been piling into safe-haven assets in recent days might take this as an opportunity to dip a toes back into equities.

US to delay some tariffs until December

Some new lines emerging from the US and China. China’s Xinhua news agency reports that Chinese vice-premier Liu He spoke to US trade representative Robert Lighthizer and Treasury Secretary Steve Mnuchin on the phone, and said talk are set to proceed in a fortnight.

Meanwhile, the US has said it will delay putting tariffs on some items, including “cell phones, laptop computers, video game consoles, certain toys, computer monitors, and certain items of footwear and clothing," until 15th December.

Aston Martin’s share skid will continue, say analysts

Aston Martin’s time as a listed company has been nasty, brutish and short.

After skidding to a halt short of its £19 per share target at IPO, the luxury carmaker has been in reverse, and is currently trading at measly 483.9p.

Shares might now be trying to find a parking spot, with Credit Suisse analysts slashing its target price to a third of its previous value, down to 529p from £16.30. They wrote:

If the economic environment deteriorates further, a capital increase might be needed to deleverage the balance sheet

Panmure analyst Sanjay Jha thinks the skid will continue, however, setting a target price of 327p, down from 543p — which would mean another third comes off the struggling car firm’s share price.

Combined, those notes have sent shares down another 5.4pc today.

The ride may not be over.

Broken down: Trump seizes on inflation figures, denies inflation is occurring

US President Donald Trump has tweeted, apparently in a partial reaction to those inflation figures.

Through massive devaluation of their currency and pumping vast sums of money into their system, the tens of billions of dollars that the U.S. is receiving is a gift from China. Prices not up, no inflation. Farmers getting more than China would be spending. Fake News won’t report!

— Donald J. Trump (@realDonaldTrump) August 13, 2019

It’s quite a mangled tweet, so I’ll try my best to break it down here:

Through massive devaluation of their currency and pumping vast sums of money into their system,

Mr Trump is referring to the activities of the People’s Bank of China, which notably seems to be slowly pulling the value of the yuan down, prompting the US to accuse it of currency manipulation last week. Devaluation allows China to make its exports cheaper, reducing the impact of tariffs on the goods it sells to Americans. As a side point, it is true to say China has manipulated its currency directly via its vast reserves of foreign currency, but the White House is quite late to the party, and Beijing is intervening far less than it once did.

the tens of billions of dollars that the U.S. is receiving is a gift from China.

Here, Mr Trump seems to be repeating a fallacy he has made before. The US President appears to believe the tariffs he imposed are paid by China itself. This is untrue, as tariffs are actually paid by the importer: in this scenario, US firms.

Prices not up, no inflation.

This is a lie, given the stats that were just released. Year-on-year CPI inflation (at 1.7pc) is below the Fed’s target, however.

Farmers getting more than China would be spending.

Mr Trump is suggesting here that relief measures introduced by his administration (and funded, he claims, by tariffs) to counterbalance the impact of tariffs on US farmers (who are being outcompeted by Chinese rivals) means they are doing better than they would if there were no tariffs. Analysis of the payments suggests that is not true.

Fake News won’t report!

I tried my best!

US inflation rises

Consumer Price Index inflation in the US rose 0.3pc month-on-month, according to data from the Bureau of Labor Statistics.

That’s in line with expectations, and can be added to ‘reasons not to cut interest rates’ pile at the Federal Reserve.

The growth was underpinned by higher fuel prices and rental costs, and means core inflation is at a six-month high.

BREAKING! US headline and core #inflation higher than expected. Headline 1.8%, core 2.2%, no real need for #FederalReserve rate cuts from this angle. pic.twitter.com/4Ny5JufvVR

— jeroen blokland (@jsblokland) August 13, 2019

Of course, there’s plenty on the other pile as well...

Classic U.S. recession alarm bell about to start ringing ... U.S. 2s/10s yield curve only 5 bps from inverting. Would be first inversion since early 2007, just before the last recession and GFC. Inverted curve has preceded all 5 U.S. recessions since the 1970s. pic.twitter.com/r6OEHuW25r

— Jamie McGeever (@ReutersJamie) August 13, 2019

Crashed out: How no-deal could impact the UK’s automotive industry

As part of a new series, Telegraph industry editor Alan Tovey has examined the impact a no-deal Brexit would have on Britain’s automotive sector. He writes:

The industry – which employs 186,000 people directly in manufacturing and 856,000 across the wider automotive sector – has been one of the most vocal in warning about the problems posed by Britain quitting the EU without a trade deal.

As that eventuality now looks increasingly likely, what does the future hold for the country’s automotive sector?

You can the first article in the series here: How a no-deal Brexit could mean ‘death by a thousand cuts’ for the UK’s car industry

Fresnillo shines again as gold rush continues

As gold continues to make gains from global markets’ confidence crisis — hitting a fresh six-year high of $1,535.14 earlier — gold miner Fresnillo is once again reaping the rewards on the stock exchange, leading risers currently.

That’s not enough to offset a longer-term decline, however, and Fresnillo is one of the FTSE 100’s worst-performing stocks so far this year.

How high can gold push gains? Oanda’s Craig Erlam says its price is heading towards turnaround territory, as it inches ever-closer to highs reached in 2013:

As ever, the winner in all of this turmoil is gold which is benefiting from its role as a safe haven. Everything is lining up nicely for the yellow metal, whether it be negative bonds yields, risk-aversion, a softer dollar or central bank easing. We're now clear above $1,500 and into the area between $1,520 and $1,560 which was previously a pivotal area for gold.

Momentum remains with the rally as it continues to tear higher, extending its gains to more than 20% since the end of May. It will be interesting to see if this continues to be the case or whether history will repeat itself and profit taking kicks in.

NMC Health leads FTSE fallers

Fourth-fifths of FTSE 100 stocks are in the red today, with consumer goods companies and industrials weighing most heavily.

NMC Health is the biggest faller, re-taking its increasingly-common spot at the bottom of the blue-chip movers.

The Abu Dhabi-based hospital operator and healthcare provider is now 56pc down from its all-time high last September, and down nearly 30pc on the month.

It took a sharp hit last week after apparently being misidentified as the target of a highly-anticipated short seller attack, of which Burford Capital was the actual victim, and has continued to slide since then. The drop has continued despite an upbeat Barclays note last week that said the stock’s “fundamentals are robust”.

Update: Some departing flights still running in Hong Kong

Hong Kong airport has now altered its official statement, and now says that some outbound flights are still in operation despite protests. Its website, which previously said “all departure flights have been cancelled), now says (my emphasis):

Terminal operations at Hong Kong International Airport have been seriously disrupted, and all check-in processes have now been suspended. All passengers are advised to leave the terminal buildings as soon as possible. Affected passengers please contact their respective airlines for flight arrangement.

The Wall Street Journal’s Mike Bird is among those at the airport:

A bird's eye view. Hasn't taken many to shut the entire thing down. No police here, many tourists clearly not following instructions to leave. pic.twitter.com/GUjC4x8Nq4

— Mike Bird (@Birdyword) August 13, 2019

Full report: Hong Kong airport closed for second day as protests roll on

Speaking of Hong Kong’s stock woes, here’s our full report on the situation at its airport:

Wage data does little for ailing pound

A significant bounce was too much to hope for, but it looks like the pound is barely shifting at all based on this morning’s better-than-expected wage growth figures — sat pretty flat on the day.

The FTSE is looking even less happy, roughly finding parity with other European blue-chips at about 0.5pc down. The exception is Germany’s DAX, which is now off about 1pc. As of about 15 minutes ago:

The FTSE 100 was 0.54pc down at 7,193.65

France’s CAC 40 was 0.53pc down at 5,281.84

Germany’s DAX was down 0.93pc at 11,571.33

Spain’s IBEX was down 0.56pc at 8,627.9

Italy’s FTSE MiB was down 0.59pc at 20,144.61

The day’s biggest loser so far in Hong Kong’s Hang Seng Index — after falling 2.1pc in the most-recent session, the bourse is now below where it started the year.

Full report: Wages keep rising in tight UK job market

Here’s our full report on this morning’s labour figures, by Telegraph deputy economics editor Tim Wallace:

German investor outlook figures ‘dreadful’

Here’s more on the ZEW expecations index on German economic sentiment, published this morning. Pantheon Macroeconomics’s Claus Vistesen writes:

This is a dreadful headline, similar to the depths reached during the financial crisis in 2008 and in late 2011, when the U.S. debt ceiling crisis roiled markets. On this occasion, however, it seems as if investors are anticipating chaos — a US-Sino currency war, Brexit etc—or at least ascribing a very high probability to an accident. In other words, there is little current justification in the equity market, which is usually the best short-term gauge for the ZEW, for this crash.

As anticipation builds for tomorrow’s German GDP data, ING’s Carsten Brzeski has focused on the country’s car industry. He writes:

The German economy appears to be stuck between solid domestic fundamentals and external risks. The industrial slowdown is beginning to have an impact on the domestic economy while the entire economy seems to be flirting with recession...

So, we think the current crumbling of the Chinese car market appears to be a simultaneous combination of cyclical factors, one-off effects and structural changes.

And for the German economy, it's not actually the trade conflict which is most concerning but the structural shifts in the Chinese automotive market, which could turn out to be one of the biggest threat in the years ahead.

Round-up: High street retailers beg for relief, Plus500 profits fall and Next boss downplays no-deal dangers

With that flurry of economic data behind us, here are some of the biggest stories from this morning:

Stop killing the high street: big retailers and small businesses beg politicians for tax relief: Surging wages and bumper tax bills are killing the high street, threatening jobs and crushing investment, according to two of the country’s biggest business groups.

Plus500 profits knocked by spread betting crackdown and stable markets: Spread betting firm Plus500 suffered a precipitous slump in revenues and profits in the first six months of the year as a lack of volatility in markets and a regulatory crackdown on its products hit home.

Next boss Lord Wolfson says no-deal Brexit would not lead to disorder and chaos: Next boss Lord Simon Wolfson has said that no-deal contingency planning by Boris Johnson’s government means the UK will not suffer disorder and chaos if it fails to secure a Brexit deal with the EU.

Hong Kong flights suspended for second day

Flights to and from Hong Kong’s international airport have been suspended for a second day, according to multiple reports.

Hong Kong Protesters Overwhelm Airport for Second Day https://t.co/Q3F8eUsfdf

— Mike Bird (@Birdyword) August 13, 2019

*CATHAY PACIFIC SUSPENDS ALL CHECK-INS DUE TO AIRPORT PROTESTS https://t.co/WyXHhYIS0j

— Joe Weisenthal (@TheStalwart) August 13, 2019

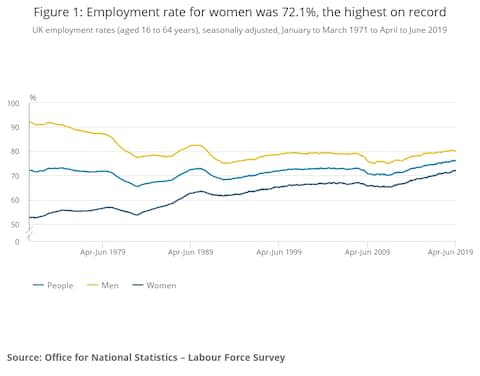

Rudd welcomes labour market data

MP Amber Rudd, who is now Secretary of State for Work and Pensions and Minister for Women and Equalities, welcomed this morning’s labour market figures on Twitter:

NEW

�� Highest rate of women in work.

�� Continuing record high employment with 115,000 more people in work.

�� Wages up year on year, outstripping inflation.

�� More people in work means more people in the UK are earning a secure income and have more money in their pockets. https://t.co/gNdXtHZneg— Amber Rudd MP (@AmberRuddHR) August 13, 2019

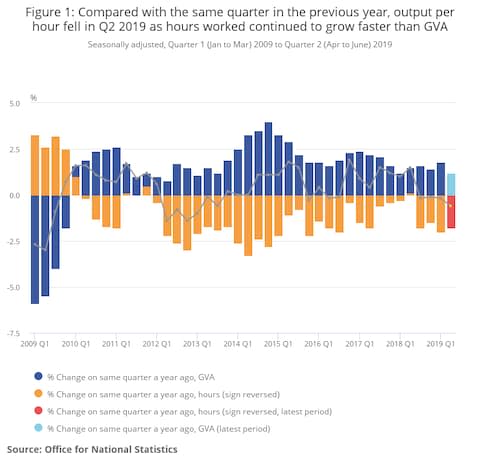

Productivity slips as businesses ‘wait for greater clarity’ on Brexit

Other data released by the Office for National Statistics shows the UK’s productivity dropped by 0.6pc during the second quarter (April to June), compared to the same period last year.

The ONS highlighted the slow recovery UK productivity has seen since the financial crisis a decade ago:

Both employment – which captures the total number of people in work – and total hours – which captures both changes in employment and working patterns – fell in the course of the economic downturn, though total hours fell further reflecting a fall in the average hours of those in employment.

However, GDP fell by a larger proportion in the economic downturn than either hours or employment and has grown slowly by historical standards during the recovery. In consequence, productivity growth has been subdued since the downturn and has recovered more slowly compared with previous downturns.

Reacting to the productivity stats and labour data, PwC Economist John Hawksworth said the figures show Brexit doubt is weighing on investment:

There are increasing signs that the tight labour market is feeding through to higher earnings, with regular weekly pay growth picking up to almost 4pc in the second quarter - the highest growth rate since before the financial crisis. This will continue to support consumer spending, which has been the main thing keeping the UK economy afloat over the past six months in the face of ongoing Brexit-related uncertainty and a slowing global economy.

The flip-side of strong jobs growth, however, is that productivity growth remains very weak. Output per hour was down by 0.6pc in the second quarter of 2019 compared to the same quarter in 2018. Weak productivity growth reflects subdued corporate investment growth over the past three years as businesses wait for greater clarity on Brexit.

Pawel Adrjan, economist at job site Indeed, said:

This is far from a perfect jobs report. Employer caution is limiting the supply of new vacancies, yet stiff competition for recruits is still driving up wages. Given the wider slowdown in the economy, the labour market is holding up surprisingly well for now. But continued falls in vacancies suggest employers are mindful of the broader economic and political risks on the horizon.

German investor confidence plummets to eight-year low

Investor confidence in German’s economy fell for the fourth month in a row, according to data from the ZEW index.

A gauge measuring economic expectations for the next six months dropped to minus 44.1, the wortst reading since 2011.

There are wide expectations that Germany’s may have contracted during the second quarter, with Europe’s largest economy set to report GDP figures tomorrow.

ZEW’s president, Achim Wambach, said:

The most recent escalation in the trade dispute between the US and China, the risk of competitive devaluations, and the increased likelihood of a no-deal Brexit place additional pressure on the already weak economic growth

Ouch! German ZEW survey for Aug was even worse than already low expectations. Current situation index fell to -14.5 vs -6.3 exp, but more worryingly, Expectations index fell to -44.1 vs -28.0 exp, lowest since 2011 when the Eurozone debt crisis dampened the mood of investors. pic.twitter.com/RF6Yg5kyJM

— Holger Zschaepitz (@Schuldensuehner) August 13, 2019

Ugly sentiment number... https://t.co/Ufpq1o5YUz

— Michael Hewson ���� (@mhewson_CMC) August 13, 2019

Reaction: Will tight labour market stay the Bank of England’s hand?

Today’s data presents something of a conundrum for the Bank of England. A tight labour market with rising wages suggests there’s little need for stimulus from Britain’s central bank, but it is increasingly appears at odds with the wider health of the UK economy. Here’s how analysts are reacting this morning.

Monex Europe’s Ranko Berich said:

June’s jobs report features a beat in wage growth combined with job creation that’s almost double expectations - in normal circumstances you’d expect sterling to rally on these figures. But the pound remains hobbled by no deal risk, and you’d practically need a microscope to see sterling’s appreciation this morning. Labour market data is also a lagging indicator, while forward indicators such as surveys indicate the economy is slowing and remains vulnerable to further shocks.

The takeaway from this report should be that there is a very strong case for sterling strength once Brexit is resolved. Rising wages should drive sustained consumption growth, which combined with recovering investment should require the BoE to eventually raise rates.

The 115,000 rise in employment in Q2 suggests the labour market shrugged off the 0.2% fall in GDP and supports our view that the economy will recover in Q3. Granted, the unemployment rate rose from 3.8% to 3.9%, but that was the only blemish on an otherwise solid set of figures.

— Capital Economics UK (@CapEconUK) August 13, 2019

The Institute of Directors’ chief economist Tej Parikh said:

The jobs market remains a source of strength for the UK economy, though it may now be reaching its peak.

High employment has proved a lifeline for the economy in a difficult period. With so many people in work, solid household incomes have kept consumer spending fairly buoyant while the production and construction sectors have waned...

...Impressive jobs market data should not lull policymakers into a false sense of confidence. As it becomes harder to find talent, businesses will need better access to training courses and a flexible immigration system to meet their skill needs.”

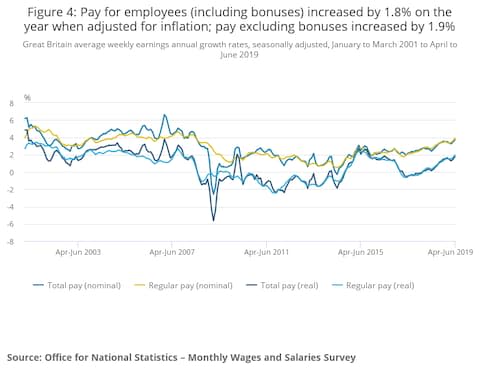

ONS: Average real pay per week is £469

The Office for National Statistics’ earnings estimates put the average pay per week in real terms for British workers at £469. Its full labour market report says:

For June 2019, average regular pay, before tax and other deductions, for employees in Great Britain was estimated at:

The equivalent figures for total pay are £499 per week in June 2019 and £525 in February 2008, a 5.0% difference.

Earnings remains below post-crisis levels once inflation is factored in

The Office for National Statistics tweets...

Employees’ earnings are still lower than before the 2008–2009 downturn, after taking inflation into account https://t.co/SaOrlRozD2pic.twitter.com/eXPrG4uVil

— Office for National Statistics (@ONS) August 13, 2019

Snap take: Employment rate for women hits record high as wages grow at fastest rate for 11 years

The employment rate for women has hit an all-time high, as statistics showed UK employment figures rose and wages grew at their fastest rate in 11 years — even though unemployment also slightly ticked up.

Between April and June this year, 72.1pc of women reported being in employment, the highest figure since comparable records began.

Basic pay (excluding bonuses) climbed by 3.9pc during the quarter, meaning the Brexit uncertainty weighing on Britain’s economy more widely hasn’t had a widespread impact on workers’ wages. Total pay (which includes bonuses) also grew at its quickest rate since 2008., up 3.7pc.

Unemployment hit 3.9pc, bucking expectations it would remain at 3.8pc, but is still near historic lows.

The ONS adds, on the contentious topic of zero-hour contracts:

There were an estimated 896,000 people (not seasonally adjusted) in employment on zero-hour contracts in their main job, 115,000 more than for a year earlier, but 8,000 fewer than the same period in 2016. This represents 2.7% of all people in employment for April to June 2019.

Breaking: Wage growth stronger than expected as unemployment rises

UK labour stats for the second quarter have just been released.

Unemployment rose to 3.9pc from 3.8pc

Wage growth rose to 3.9pc from 3.6pc

Gold returns to pushing six-year high as markets lean away from risk again

Events in Argentina and Hong Kong have been enough to push traders back towards safe havens, pushing gold solidly back over $1,500 an ounce to a six-year high of $1,527.28. The precious metal has been testing price ceilings repeatedly in recent weeks, as investors scramble for ways to shield their money.

As has been the trend for most of this year, that rush for shelter have sent many traders to the bond market, where heightened demand is sending many government debt bundles to offer negative rates of return.

This morning, consumer staples company Nestle’s 10-year bond went negative, becoming the first euro corporate bond to do so.

Meanwhile, European equities are all looking a little off-colour, with falls of 0.3pc to 0.7pc across the continent’s blue-chips, led by Italy’s FTSE MiB

Markets.com’s Neil Wilson said:

Equity indices have taken fright on a mix of factors, but chiefly I would say for the US at least it is the persistent damage being done to the global economy from trade disputes. Overnight Singapore cut its growth estimates for the year drastically because of US-China trade strife and a slowdown in the global electronics cycle, which has traders worried about the read across for other Asian economies.

Path ahead for pound ‘will still be very tricky’ even if wage growth impresses

The pound is trading narrowly stronger against the euro today, and is 0.1pc down against the US dollar, as a broad sterling slide continues.

ING analysts say any one-day gains for the pound are likely to be quickly lost as Brexit uncertainty continues to drag on the currency. They write:

While the June UK wage growth may well hit another post-crisis high, any spill over into the market expectations of the BoE policy stance should be fairly non-existent as the Brexit uncertainty takes precedence over the monetary policy outlook. We view any days of GBP strength as a fade (such as yesterday) and see more sterling weakness ahead as we get closer to potential early elections , a road to which will still be very tricky and characterised by hard Brexit risks.

UK labour data could give pound a lift

It is set — on paper, at least — to be another fairly quiet day today, with political factors remaining the biggest influence on the markets as disruption in Hong Kong, political fear in Argentina, and the usual gruesome twosome of Brexit and trade war worries.

The summer’s lower levels of market liquidity (i.e., how much money is being chucked around) mean movements can tend to be more exaggerated, increasingly the overall impression of sensitivity.

UK unemployment data, released in just under forty minutes, is unusual in that it is expected to be fairly upbeat, following a long period of strong unemployment stats in Britain.

Unemployment is expected to remain at its 40-year low of 3.8pc, despite data on from Friday that showed the UK economy shrunk during the second quarter of the year, its first contraction since 2012.

Basic wage growth is expected to have hit 3.8pc in the second quarter (from April to June) according to a Bloomberg survey of economists and forecasters, up from a 3.6pc rise between January and March.

Economist Craig Erlam, from trading platform Oanda, says:

There may be a rare piece of good news today though as the labour market data is released. This has been a constant source of positive news for the economy and forecasts today suggest there could be more of the same...

...Whether it will be enough to lift a currency that's mired in doom and gloom Brexit headlines is another thing. Of course, a shock weak report could deliver another blow to the pound and knock it below the psychologically-important 1.20 level.

Agenda: UK prepares for unemployment data as political worries move markets

Good morning. Markets will likely be weighed down today amid fears about a drawn out trade war between the US and China, protests in Hong Kong and a crash in Argentina's peso currency.

All eyes will also be on the pound, which rebounded yesterday following a plunge to a 10-year low against the euro on a no-deal Brexit warning. UK employment data released today may push the currency to fresh wobbles.

Five things to start your day

1) Traders have increased short bets against the pound to the highest level in more than two years as the currency continues to decline.

2) The financial watchdog is looking into last week’s “bear attack” on litigation funder Burford Capital by US short seller Muddy Waters.

3) Britons don’t seem to realise they’ve never had it so good. New statistics suggest families are becoming better off as ultra-low unemployment and rising wages boost their finances — but people are growing more pessimistic about the economy.

4) M&C Saatchi, the advertising agency group best known for its work on Conservative campaigns, has been punished by investors after admitting failings in its accounting had triggered a one-off charge of £6.4m.

5) And airline Cathay Pacific has threatened to sack staff who take part in the Hong Kong protests, bowing to demands of China’s aviation regulator. All flights out were suspended on Monday after thousands of protesters chanting “fight with Hong Kong, fight for freedom” descended on the terminal.

What happened overnight

Markets retreated in Asia on Tuesday as uncertainty over the China-US trade talks was compounded by increasing tensions in Hong Kong and the fallout of shock primary election results in Argentina.

Hong Kong fell 1.5pc in the morning session while Shanghai shed 0.7pc by lunch.

In Japan, the benchmark Nikkei-225 index lost 1.11pc, falling 229.38 points to 20,455.44, while the broader Topix index fell 1.15pc or 17.27 points to 1,486.57.

Cathay Pacific, which on Monday tumbled to its lowest levels in a decade after drawing China’s wrath over Hong Kong protests, fell as much as 5.4pc.

Coming up today

UK data on jobless claims, wages and the unemployment rate are the day’s big releases.

If the employment figures follow the pattern of recent releases, they should prompt a fairly typical response: The Government is likely to welcome an apparently-strong jobs market, while critics will (rightly or wrongly) suggest that Britain's unemployment rate, which hit a 45-year low in May, is underpinned by gig economy jobs and zero-hours contracts.

A post-Brexit delay slowdown might results in slightly worse figures.

Interim results: IFG Group, John Menzies, JPJ Group, Mears Group, Polypipe Group

Trading update: Card Factory, Volution Group

Economics: Jobless claims, wages and unemployment rate (UK), Consumer Price Index (US)

Yahoo Finance

Yahoo Finance