Pound climbs as Tories gain Brexit Party boost – live updates

UK dodges recession but momentum seeps out of economy in August and September

Pound nears $1.29 after Brexit Party stands down hundreds of candidates

FTSE 100 sinks more than 1pc on pound's rise

Radisson Hotels boss: 'In the end, our industry will be four or five big groups'

FTSE still in the red after aggressive bounce from the pound

"Sterling’s hero came in an unlikely form on Monday: the Brexit Party. Nigel Farage announced that his single-issue group would not contest the 317 seats the Tories won back in 2017, says Connor Campbell of SpreadEx. He adds:

"Investors have read this move as one that makes it easier for Boris Johnson to secure a majority, the Conservatives now the one proper ‘Brexit’ option in a huge swathe of constituencies.

"Cable rocketed 0.7pc higher after Farage’s reveal, surging towards $1.287 having fallen below $1.28 at the start of the session. Against the euro, meanwhile, sterling rose 0.6pc, leaving it at a 6-month-plus peak of €1.1668. It didn’t hurt that the UK saw growth of 0.3pc in Q3 – below the 0.4pc forecast, but far better than the second quarter’s 0.2pc contraction.

"Ever the currency’s enemy, the FTSE wasn’t pleased with the pound’s burst of confidence. Add onto this a miserable set of commodity stocks, and the UK index was unable to shake a 0.5pc decline, leaving it at 7320."

Greedy bankers are overpaid, says JP Morgan boss awarded $248m since financial crisis

JP Morgan boss Jamie Dimon has hit out at "greedy" and "selfish" bankers who have overpaid themselves since the financial crisis – despite himself being awarded around $248m (£193m) since the crash.

The American chief executive said on Sunday night that he believes after the crisis there were bankers "who were greedy, selfish, did the wrong stuff, overpaid themselves, and couldn't give a damn".

Mr Dimon called out overpaid financiers despite being awarded a $31m pay packet last year and $248m since the financial crisis, a package which includes stock options.

In an interview on the CBS show 60 Minutes, the 63-year-old initially said he took no responsibility for the 2008 crisis, which tipped the West into its worst recession for decades when banks recklessly lent billions of dollars to mortgage borrowers who would never be able to pay it back.

Read Lucy Burton's full report here

Sirius seeks lifeline

Can Sirius Minerals, the company that is building a giant potash mine in Yorkshire, land $600m in rescue funding?

That's the amount it is seeking to progress its huge project. Shares in the company - beloved by retail investors - tumbled in September after it admitted a $2.5bn financing package had fallen through.

Here's my colleague Ed Clowes:

[Sirius] has gone back to the drawing board and now plans to split the work in to two phases.

A giant deposit of fertiliser ingredient polyhalite lies beneath a national park on the North York Moors, which Sirius plans to access via two 1.5km mineshafts drilled in to the ground.

Polyhalite can be used as a fertiliser, although its true value has been questioned by some experts.

Read the full report here.

US markets open lower

It's a sea of red across the pond, following Europe's lead. The Dow Jones is down 0.37pc at 27,583.77 while the S&P 500 has slipped a similar amount to 3,082.57.

'UK is growing faster than Germany, France and the eurozone'

Here's my colleague Ambrose Evans-Pritchard on today's GDP figures:

With the 0.3pc expansion reported on Monday, Britain has now had 13 quarters of economic growth since the Brexit referendum. The evidence is irrefutable: the UK economy has grown faster than Germany, France and the eurozone as a whole for most of the last two years. It is has outgrown several west European states even since the vote.

Totting up the exact numbers, it is no longer excusable for the Remainer establishment, the Liberal Democrats, and allied think tanks, to keep claiming that the UK economy is 3pc smaller than it would have been without Brexit, or that we are “3pc poorer” in Westminster parlance.

Read more of Ambrose's column here.

Steelworks saved

Here's more from Alan Tovey on confirmation that Jingye is buying British Steel:

An internal document sent to staff on Monday from special managers at EY who have been running British Steel since it collapsed into insolvency in May confirmed an initial deal had been struck.

"I am pleased to be able to confirm to you that sales contracts have been agreed with Jingye Steel (UK) Ltd and Jingye Steel (UK) Holding Ltd (Jingye group), to acquire certain [aspects] of the business and assets of British Steel Limited," the document said.

The deal covers the main steelworks at Scunthorpe, along with the Teesside and Skinningrove steel rolling mills, and the subsidiary businesses FN Steel, British Steel France and TSP Engineering. The stake in the Redcar bulk terminal port is also be included in the sale.

Get the full report here.

'A long way to go'

Here's Adrian Lowcock, head of personal investing at Willis Owen, explaining the pound's move:

The announcement by the Brexit party that it will not stand against the Conservatives is being well received by investors, with the pound in particular rallying sharply. This is because it raises the likelihood of a Conservative majority and in turn that would remove the risk of a hung parliament or minority government, and a return to the uncertainty over Brexit.

There is still a long way to go in this election campaign so investors should be prepared for further volatility in markets. There will likely be surprises along the way and many debates which will be keenly watched. It is hard for political experts to predict the result of this general election, let alone for investors, and as such it is best to be prepared, ignore the short term, and have a portfolio capable of protecting (and profiting) from a range of outcomes.

Farage move: a game-changer?

Back to politics and the pound. The Telegraph's correspondents have been chewing over what Nigel Farage's move means for the election. Some differences of opinion here - are currency traders right to be so sanguine that this means stability in government is assured?

Champagne corks will be popping in 10 Downing Street. https://t.co/Kzc6CSwrFO

— Christopher Hope�� (@christopherhope) November 11, 2019

But @brexitparty_uk will still stand in the Tory targets in North/Midlands?

Do I have that right? In which @BorisJohnson might not be getting the champers out quite yet. https://t.co/WJEd4sXrZV— Peter Foster (@pmdfoster) November 11, 2019

YouGov's political research manager Chris Curtis says Farage's big announcement will make "little difference" and is "unlikely to be a game-changing moment" UNLESS Farage's tacit approval of Boris's plans makes hard Leavers feel more comfortable about voting Tory

— Gordon Rayner (@gordonrayner) November 11, 2019

British Steel rescue confirmed

Here's my colleague Alan Tovey confirming what he first reported at the weekend - a rescue deal for British Steel by Chinese firm Jingye.

Deal to save #BritishSteel confirmed. China's Jingye Steel has "agreed sales contracts" subject to regulatory approvals, employee consultation and other conditions pic.twitter.com/7ZXCsQZEpq

— Alan Tovey (@batsub1) November 11, 2019

KKR readying mega-buyout for Walgreens?

That mega take-private for Walgreens Boots Alliance could be on. Bloomberg is reporting that private equity giant KKR is in talks with the owner of Boots over a potential leveraged buyout. The retailer has a market cap of $55bn, so any deal would have to be well north of that, comfortably eclipsing the $45bn takeover of Texas energy giant TXU in 2007 - which was led by a KKR-led consortium.

That didn't end so well for TXU, which later went bankrupt, costing KKR $4bn. Either memories are short, or KKR thinks it's learned enough lessons...

'Rescuing British Steel certainly lacks wisdom'

Here's The Telegraph's chief City commentator Ben Marlowweighing in on British Steel's likely sale to the Chinese:

One wonders how wise it is of the Government to be selling the company to a firm that makes no secret of its admiration for China’s repressive regime.

It may not be as risky as allowing China’s Huawei to build parts of our 5G network but, as Julian Lewis, the Tory chairman of the last Parliament Defence Select Committee, has pointed out, steel is vitally important to the UK’s defence industry, and China’s Government is openly opposed to our free way of life.

Read Ben's full column here. And don't forget to sign up to his daily City Intelligence newsletter for good measure.

FTSE 100 slides

Less good news for the FTSE: as is often the case when the pound climbs, the blue-chip index has fallen. It has extended its decline, down 1.2pc now at 7,270. It's by far the worst performing European stock market today.

Pound gains

The pound has now hit a six-month high versus the euro and strengthened as much as 1pc against the dollar, after the Brexit Party said it would not contest previously Conservative held seats in the UK's upcoming election.

It's seen as a big boost to Boris Johnson's chance of getting a majority and pushing through his Brexit deal.

The pound rallied to as much as $1.2896 on the news, before easing to $1.2880. Versus the euro, the pound strengthened to its highest in six months, at 85.62p.

Once again traders are expressing their dearly held desire for a clear result in this election and no more hung parliaments.

Farage U-turn on Brexit deal

Nigel Farage's speech has certainly surprised plenty of people, not just traders.

Here's The Telegraph's Brexit and Europe correspondent James Rothwell:

This Farage speech is extraordinary. Sounds like a 180 degree turn on Johnson's Brexit deal

— James Rothwell (@JamesERothwell) November 11, 2019

Pound jumps as Brexit Party stands down in Tory seats

The pound has jumped after Nigel Farage promised to stand down hundreds of candidates in Tory seats, delivering a major boost to Boris Johnson's election hopes.

Sterling jumped from just over $1.28 to withing touching distance of $1.29 agaisnts the dollar and from just over €1.16 to almost €1.17 against the single currency as the prospect of

The Brexit Party leader said his party will not contest the 317 seats held by the Conservative Party and will focus on trying to beat Labour and other pro-Remain parties.

Neil Wilson at Markets.com said:

"This is a big boost to the Conservative Party as the Brexit Party had talked about fielding 600 candidates. It changes the electoral map.

Mr Farage seems to have been persuaded by Boris Johnson’s commitment not to extend the transition period beyond December 2020. Mr Farage and everyone else knew it would have been crazy politics for the Brexit Party to take Leave votes away from the Tories and enable a pro-Remain grouping to take seats....

It’s not been so warmly received in equity markets – the FTSE 100 was already being hammered and endured further losses on the news to touch 7,260."

For the latest political developments, head over to our politics live blog.

Board move at Rightmove

Rightmove is parting ways with its finance boss Robyn Perriss, who has told the board she plans to step down after a dozen years at the company.

No date has been set for her departure but the company said it expects she will leave in the second quarter of next year. She will support in the recruitment of he successor, Rightmove said.

Shares slipped in early trading but have recovered and are now down just 0.2pc on the day.

Peter Brooks Johnson, Rightmove's chief executive said:

“Robyn has been a huge asset to Rightmove. In the dozen years she has been with Rightmove, firstly as financial controller and latterly as finance director, Rightmove’s revenue has grown by nearly five times. ”

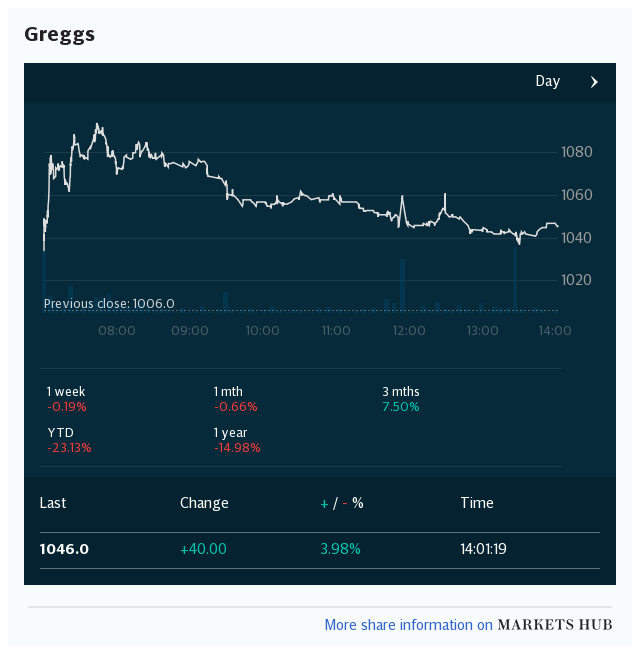

Greggs shares soar as it upgrades profit forecast

Shares in Greggs have jumped 15.3pc to £20.42 today after the chain known for its bacon butties said it expected full-year profits to be higher than previously expected.

Sales in the six weeks to November 9 rose 12.4pc.

Greggs has been on a roll so far this year – no pun intended – rising 61pc since January.

Construction sector grows but outlook uncertain

Construction output grew 0.6pc in the third quarter but shrunk in September.

Construction grew 0.6% in Q3 with new work growing (+1.4%) offset slightly by a fall in repair & maintenance (-0.8%) https://t.co/5WL2YGtKx6pic.twitter.com/9McDWZMFdC

— Office for National Statistics (@ONS) November 11, 2019

Clive Docwra of construction consultancy McBains said:

“These latest figures reflect the uncertainty the sector is currently experiencing.

They show an increase in new work over July to September, and in particular higher than expected increases in housing, commercial and industrial new work, but a slowdown in September itself.

We expect this slowdown to continue over the next few months, especially given last month’s confirmation of a further delay in Brexit."

UK GDP figures: Business reaction

Business groups and economists have been reacting to this morning's GDP figures.

While there is relief that the UK has not slipped into an unexpected recession, there is concern at the overall state of the economy as we head towards a December election.

There is particular focus on the fact that momentum ebbed away in August and September. Only a strong July ensured that growth for the full quarter was positive.

Suren Thiru, head of economics at the British Chambers of Commerce (BCC), said:

“While there was welcome confirmation that the UK avoided recession in the third quarter, the stronger headline figure masks an alarming loss of momentum through the quarter from a relatively strong July outturn and therefore does little to suggest any meaningful improvement in UK’s underlying growth trajectory.

The dominant services sector was the main driver of GDP growth in the quarter with industrial production and construction sectors adding little to overall UK GDP growth.

Against this backdrop, more must be done to boost the UK’s economic growth prospects. With interest rates already close to historical lows, the extent to which further rate cuts are able to significantly stimulate the economy is limited. It is vital that any incoming government drives the UK’s growth trajectory forward by investing in infrastructure and incentivising greater business investment.”

John Hawksworth, chief economist at PwC, said:

"The fact that growth was positive in the third quarter was largely due to a strong July. Output then fell back in August and September, which points to a lack of momentum in the economy going into the fourth quarter.

Household spending remains the main motor of growth, with a 0.4pc rise in the third quarter bolstered by stronger earnings growth. By contrast, business investment was flat, reflecting the continued drag from Brexit-related uncertainty, which looks set to continue into the fourth quarter."

Manufacturing sector remains flat

I said I would break down the manufacturing and construction figures a little more. So here goes...

Manufacturing output was flat in the third quarter after falling 1.8pc between April and June.

Eight of the 13 sub-sectors contracted with the biggest drags being:

machinery and equipment, which fell by 2.6pc – the ONS attributed this mainly to the weakness of larger businesses; and

computer, electronic and optical products, which fell by 1.7pc, where demand from big businesses was especially weak in August.

The struggles of those sectors were offset almost entirely by a robust 6.2pc growth in the transport equipment segment.

That growth was boosted because of the weak performance in the second quarter when many manufacturers implemented shutdowns in April in an effort to avoid disruption the predicted would arise following the UK's intended departure from the EU on March 29.

Within manufacturing (0.0% growth in Q3) notable strength from transport equipment (+6.2%) was offset by falls in eight other subsectors https://t.co/ceSgB2LR3Qpic.twitter.com/3Z4CwSKje1

— Office for National Statistics (@ONS) November 11, 2019

How does 1pc annual growth stack up internationally?

We know the UK economy grew 1pc in the past year and that this is the slowest rate of growth in almost a decade.

But how does it stack up against other economies?

Economist Rupert Seggins has dived into the figures. A quick look shows that the UK is behind the US (2pc), Spain (2pc) and France (1.3pc) but ahead of Italy (0.3pc).

UK GDP up 1%y/y in Q3 2019. Not many OECD countries have reported, but UK %y/y growth currently 3rd out of the four G7 nations that have (US 2%y/y, France 1.3%y/y & Italy 0.3%y/y). pic.twitter.com/FnVp5Nd1Mi

— Rupert Seggins (@Rupert_Seggins) November 11, 2019

Broadcaster Andrew Neil has also been giving his reaction.

NO boom. No recession. A little worse than France. Better than Germany. A lot better than Italy. What else can I help you with? https://t.co/9kDxaq7ArI

— Andrew Neil (@afneil) November 11, 2019

Year on year growth is 1%, the weakest since Q1 2010. That’s a better guide than simply annualising one quarter. Worse than France, better than Germany. UK economy clearly slowing in 2019. But not in much-anticipated recession. https://t.co/0ReixcdHY8

— Andrew Neil (@afneil) November 11, 2019

If you're wondering who Senator Neale Richmond is, he's the Brexit spokesperson for the Fine Gael party of Irish Taoiseach (prime minister) Leo Varadkar.

Services sector drives growth

The UK's services sector grew 0.4pc in the three months to September, making it the biggest driver of overall economic growth.

Within services, the information and communication industries were the biggest contributors, the Office for National Statistics (ONS) said.

The services sector is crucial to the economy's overall wellbeing, accounting for roughly four-fifths of all UK economic activity.

Elsewhere, construction grew 0.6pc while manufacturing was flat. We'll break those figures down a little in a few minutes.

Annual growth rate remains sluggish

So a recession has been averted but it's not all good news as some commentators have been quick to point out.

The economy grew 0.3pc in the third quarter but the annual growth rate was a sluggish 1pc. That's the slowest rate of annual growth since 2009, as Sky's Ed Conway has noted.

Good news: UK recession averted as economy grows 0.3% in Q3. Bad news: as I pointed out on @skynews a moment ago, that ANNUAL growth rate of 1% is the lowest since 2009 https://t.co/Plx86IXEm4

— Ed Conway (@EdConwaySky) November 11, 2019

Our spokesperson continued: https://t.co/0WMykWUTbupic.twitter.com/N9JUoNY2ro

— Office for National Statistics (@ONS) November 11, 2019

More on those UK economic growth figures

Here is the latest from the Office for National Statistics, which compiles the economic data.

0.3% increase in GDP in Q3 2019 with services up 0.4%, manufacturing unchanged and construction up 0.6% https://t.co/f8rVIakt1apic.twitter.com/mTIMpHzdUS

— Office for National Statistics (@ONS) November 11, 2019

Commenting on today’s GDP figures for Q3, an ONS spokesperson said: https://t.co/eDWp8tPUB7pic.twitter.com/gWDlyl9ab3

— Office for National Statistics (@ONS) November 11, 2019

UK avoids recession

The latest economic figures mean that the UK has avoided falling into recession.

The economy contracted by 0.2pc in the second quarter, meaning that the country would have entered recession if the contraction had continued in the three months to September.

BREAK: UK economy returns to growth

The UK economy returned to growth in the third quarter of the year, expanding by 0.3pc. That's marginally lower than analyst consensus of 0.4pc.

Prosus presses on with Just Eat cash bid

Prosus is pressing ahead with its hostile cash bid for food delivery firm Just Eat.

The firm, backed by South African tech company Naspers, has dropped the required level of acceptances for its offer to proceed from 90pc to 75pc.

This is not a major surprise as more than 10pc of shareholders were already opposed to the Prosus offer.

The decision sets up a battle with Takeaway.com, which is offering Just Eat investors shares in the merged Anglo-Dutch entity that its bid would create.

Prosus, which published its bid prospectus this morning, is holding its offer at £4.9bn.

It argued that Takeaway.com's share price has fallen 12.4pc since the star of the offer period – that potentially makes the Takeaway.com offer less valuable because it is offering to pay Just Eat investors using shares in itself.

A reminder what's at stake: Take a look at some of the numbers behind Just Eat

Prosus has warned Just Eat investors that if they opt for the Takeaway.com offer, it will not buy the combined group. Our transport & leisure correspondent Oliver Gill has the details:

Chinese firm Jingye closes in on British Steel rescue deal

Chinese firm Jingye is set to buy British Steel, potentially saving up to 4,000 jobs.

Jingye has emerged as the most likely buyer of the business after talks with Turkish group Ataer collapsed.

Advisers were this weekend putting finishing touches to a draft agreement that would see Jingye pay about £70m for British Steel, The Telegraph reported on Saturday.

Read this morning's report here: Chinese firm Jingye closes in on British Steel rescue deal

Poor timing for Fortnum & Mason's Hong Kong opening

ICYMI Fortnum & Mason is opening it's first overseas standalone store today in Hong Kong as protests continue to rock the region https://t.co/htj2fFpu4K

— Hannah Uttley (@huttleyjourno) November 11, 2019

My colleague Hannah Uttley has noted that today is the first day of trading for Fortnum & Mason's Hong Kong store – not great timing.

Fortnum was due to open the Hong Kong store in early autumn, but this was delayed. The British retailer announced in April that it would open the store, before the protests began in June.

The 7,000 sq ft store overlooks the territory’s harbour and will host a restaurant designed to replicate its site at 45 Jermyn St, London.

Protests spill into Hong Kong's central business district

In Hong Kong, police fired tear gas in the central business district where some protesters, crouching behind umbrellas, blocked streets.

Office workers on their lunch break crowded the pavements and hurled anti-government abuse, Reuters reported.

Protests have been happening almost daily in Hong Kong, sometimes with little or no notice, disrupting business and piling pressure on the government.

But it is rare for tear gas to be fired during working hours in Central, an area lined with bank headquarters and shops with high-end brands.

The rising tensions have put a halt to a strong run for the territory's stock market, which has risen steadily this month on hopes of a US-China trade deal.

Escalation of tensions in Hong Kong sends markets into tailspin

Tensions have escalated in Hong Kong after reports that police had shot a protester at close range. The protester was in critical condition, hospital officials said.

The Chinese-ruled territory spiralled into rare working-hours violence in its 24th straight week of pro-democracy unrest.

The violence usually begins after dusk. Some offices were closing early and workers were heading home.

The escalation caused renewed anxiety among investors in the region, sending markets into a tailspin. The Hang Seng index is trading more than 2.7pc lower today.

Agenda: How did the economy fare in Q3?

Good morning. We'll find out later today whether the UK economy expanded in the three months to the end of September, as third quarter GDP numbers are published.

Economists are anticipating a 0.4pc increase, rebounding from the 0.2pc contraction in the second quarter, with the UK's dominant services sector expected to be the main driver of growth.

5 things to start your day

1) Tech giant Prosus is warning Just Eat investors that it will walk away from its pursuit of the delivery company if they back a rival plan to merge with Takeaway.com: Prosus gatecrashed Just Eat’s marriage with Takeaway.com at the end of last month. Despite being armed with a €20bn (£17bn) war chest, boss Bob van Dijk is telling Just Eat shareholders that Prosus is not interested in buying both and would walk away if they pursue the Takeaway.com deal.

2) Energy sector woes ‘just tip of the iceberg’ as 28 suppliers go under: At least 28 electricity companies have gone bust since the start of 2018, a substantially higher number than previously thought, as rising wholesale costs and renewable power commitments squeeze smaller suppliers. And now, experts say, a "single insolvency can potentially push multiple wholesalers into financial difficulty, or even collapse”.

3) A wintry washout dealt a fresh blow to Britain’s retailers, putting off would-be shoppers from venturing out on to the high street last month: Footfall fell 3.2pc compared with last year – the largest drop in October for seven years, according to figures released today.

4) A lack of new homes is hampering plans to create innovative technology clusters between Cambridge and Oxford, research has found: One million new jobs could be created in industries including cybersecurity and biotechnology across the so-called Oxford-Cambridge arc, Savills said – but first, land for 680,000 homes needed to be found, as well as 9.6m sq feet of office space, and 69m sq feet of warehouse space.

5) More than 200,000 employees at major companies including Ikea, Aviva and Nationwide are in line for a pay rise after campaigners announced a rise in the voluntary UK Living Wage today: The new rate comes as major political parties make low-pay a key battleground in the general election.

What happened overnight

Asian markets turned lower on Monday as another record close on Wall Street was overshadowed by uncertainty over the China-US trade talks, while Hong Kong was also hit by fresh protests in which at least one person was shot.

Expectations Beijing and Washington will agree a mini pact have fuelled an stock market rally for the past few weeks. Hopes were given an added boost Thursday after China said the two sides had agreed to roll back some tariffs as the negotiations progress.

But the US side sent out some confusing signals after that announcement, before Donald Trump denied such an agreement, leaving investors scratching their heads.

Still, White House trade adviser Peter Navarro provided a lift to sentiment, saying Trump could postpone tariffs on Chinese goods scheduled to take effect in December. The S&P 500 and Dow both ended at fresh all-time highs.

However, Asian investors were unable to extend the winning streak.

Tokyo went into the break 0.2pc lower and Singapore shed 0.4pc with Seoul, Taipei and Manila also lower.

Shanghai dropped 0.9pc, with traders keeping tabs on Alibaba's annual "Singles' Day" shopping frenzy, the world's biggest 24-hour shopping event, which acts as a gauge of the country's consumer spending.

Total gross merchandise volume settled through the company's payments platform Alipay hit 100 billion yuan ($14.3 billion) within 63 minutes and 59 seconds, according to Alibaba - 43 minutes ahead of last year's pace. The firm said the first $1bn was spent in just 68 seconds.

Hong Kong sank more than 2pc as the city was gripped by another wave of protests that have jammed up the transport network and led to the closure of several businesses.

At least one person was hurt after a policemen fired several shots are demonstrators, as the five-month-long unrest - which has battered the city's image and dragged on the economy - shows no sign of letting up.

Tensions have soared in recent days following the death on Friday of a 22-year-old student who succumbed to injuries sustained from a fall in the vicinity of a police clearance operation a week earlier.

On currency markets the pound struggled to bounce back after suffering a sell-off Friday in reaction to news that Moody's had downgraded the outlook for Britain's debt, citing mounting policy challenges as the Brexit saga rumbles along.

Coming up today

Full-year results: Carrs Group

Trading statements: Dignity

Economics: Third quarter GDP figures (UK), Industrial production (UK), Manufacturing production (UK)

Yahoo Finance

Yahoo Finance