Markets cheer US jobs data as manufacturing slowdown continues

GOOD JOBS, FACTORY FEARS: US added 128,000 jobs in October, smashing expectations of a slowdown

Economy shrugged off major drag from 46,000 striking General Motors workers who counted among unemployed

But factory slowdown continues as key activity gauge misses estimates

‘A SCARY END TO THE YEAR’:Manufacturing sector remains in ‘agony’ as production downturn continues

Brexit stockpiling offsets fall in new orders

Factories continue to shed staff amid uncertainty

EYES ON STERLING: Pound hovering under $1.30 after softer dollar gives it a midweek boost

October was sterling’s best month in since the financial crash

Global heavyweights eye ‘massively-undervalued’ pound as the fog clears in Westminster

Russell Lynch: Christine Lagarde is not in Kansas any more as she takes over at the struggling European Central Bank

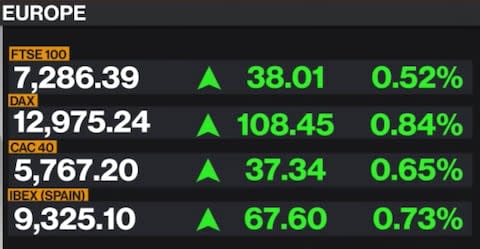

Wrap-up: Europe closes in the green

That’s all, folks! Markets are closed: the pound is steady, the FTSE is up, and the UK is still part of the European Union.

Plenty to chew on as we head into weeks darkness (from a electoral and weather perspective), but if the past few days are any guide, investors seem to have shaken their addiction to the Brexit news cycle.

Next week, the pressure of heavyweight movers will be off the FTSE 100, which might leave the blue-chip index unsure which way to move – so keep an eye on macro events, particular any changes on the trade war front.

Thanks to everyone who followed along today. I’ll be back on Monday, with more news on business, economics, markets, tech and money!

Mike Ashley blocks Labour councillor from board meetings amid Corbyn spat

It’s never too late from some Mike Ashley drama.

The Sports Direct tycoon has blocked a Labour councillor from joining the retailer’s board meetings after a spat with Jeremy Corbyn, my colleague Laura Onita reports. She writes:

The billionaire wrote to John Gray, who is also the vice-chair of the Local Authority Pension Fund Forum (LAPFF), to say that he could no longer attend Sports Direct’s board meeting in December.

It comes after the Labour leader accused Mr Ashley of taking advantage of the UK’s “corrupt system” in a blistering attack on capitalism on Thursday.

Corbyn had labelled Mr Ashley a “bad boss”, accused him of not paying staff properly and said he had an exploited workforce.

Deutsche Bank hires board member to work on ‘holistic’ restructuring

Here’s a Teutonic twist as we approach the closing bell. My colleague Lucy Burton reports:

Embattled Deutsche Bank, which announced plans to cut 18,000 jobs earlier this year, today created a new board role so that someone can run its restructuring “holistically”.

The German lender, which has around 90,000 staff, said this afternoon that it has made its wealth boss Fabrizio Campelli chief transformation officer “given the size of the task” facing the bank as it culls a fifth of its workforce.

Deutsche was once one of the world's most powerful banks but has struggled since the financial crisis, battling heavy fines for past misconduct, sluggish performance, sweeping restructuring costs and competition from Wall Street peers.

One of the 18,000 people affected by the job cuts told The Telegraph earlier this year that waiting to speak to HR was like “being in a hospital waiting room” with people crying and names being called out one by one to find out the details of their redundancy package. Staff were told their passes would stop working at 11am on the day of their departure.

Tech round-up: Huawei, Fitbit and WeWork

Here are the day’s biggest tech stories:

Google to buy Fitbit for $2.1bn in a bid to take on Apple: Google will buy Fitbit in a $2.1bn (£1.6bn) deal that will see it take on Apple in the fast-growing wearables market.

WeWork could cancel deals for new leases in London as it launches sweeping review: WeWork could scrap a swathe of London offices as part of a major review into its operations.

Decision on Huawei 5G access delayed until after election amid ‘hostile state’ security concerns: A government decision on whether to allow the controversial Chinese tech firm Huawei access to the UK’s 5G networks has been delayed until after the December 12 election.

Full report: US jobs numbers defy fears of slump

Here’s an extract from my colleague Tim Wallace’s full report on those non-farm payroll figures:

US employment surged last month as the economy defied fears of a slowdown to add 128,000 jobs.

It comes despite a strike at car maker GM that removed 46,000 factory workers from the data for the month, indicating the American economy is in more robust health that previously realised.

Economists had expected as few as 85,000 jobs would be added, in what would have been the worst monthly performance since May.

The stronger than expected result lit a fire under stock markets, with the tech-heavy Nasdaq breaching its record level for the first time since July. The benchmark S&P 500 notched its fourth record high this week.

How Trump maths works

The Washington Post’s fastidious economics correspondent Heather Long has followed up with the White House over Donald Trump’s weird jobs figures:

I asked the WH about 303,000 figure. Here's what Trump's Council of Economic Advisers said:

October: +128k

Revisions: +95k

Adjusting for GM: +60k

Adjusting for Census: +20k

= +303k https://t.co/2NjPoymNhp— Heather Long (@byHeatherLong) November 1, 2019

That does not make a whole lot of sense. Putting aside the weirdness of adding revisions to August and September to October’s figures and presenting them as a bundle, those General Motors and Census figures are both exaggerated.

Finally, its is odd for census data to be excluded from these numbers, but to not acknowledge they had padded previous months’ stats. Oh well...

Interestingly, Heather adds that Mr Trump broke rules by tweeting about the figures so soon:

Yes. Rule in place since 1985. Good run down of it here: https://t.co/Z9ZpvP0Rqh

This WH has interpreted the rule to apply to executive branch employees but not the president.— Heather Long (@byHeatherLong) November 1, 2019

Spain to host climate conference after Chile backs out

My colleague Edward Clowes reports:

Spain will now host the annual climate conference COP 25 in December, after former host Chile pulled out following major, countrywide protests in recent weeks.

The Executive Secretary of UN Climate Change confirmed that it would now be held in Madrid.

Brazil was originally slated to host the event, which will see tens of thousands of delegates gather to discuss environmental policy, but pulled out due to the cost of holding the huge summit.

Jair Bolsonaro, Brazil’s president, has hired a number of climate change deniers, including a foreign minister who has claimed that concerns about the environment are fuelled by “cultural Marxists.”

Chile also pulled out of hosting the APEC summit, set to be the staging ground for a meeting between US President Donald Trump and his Chinese counterpart Xi Jinping.

WTO approves $3.6bn in Chinese trade sanction on US

The World Trade Organisation has cleared the way for China to hit the US with $3.6bn in sanctions, resolving a dispute that predates the current tariff war between the countries.

The decision, which has awarded the third-highest damages figures in WTO history, relates to the US’s anti-dumping regime, part of the way Washington restricts Chinese exports. Anti-dumping duties are protectionists tariffs on foreign imports.

The WTO says:

China may request authorization from the DSB to suspend concessions or other obligations at a level not exceeding $3.579bn annually.

Reaction: Manufacturing conditions ‘to remain weak’

Responding to those US manufacturing activity figures, Capital Economics’ Andrew Hunter said:

The muted rebound in the ISM manufacturing index to 48.3 in October, which left it only slightly higher that September’s 10-year low of 47.8, may dampen some of the enthusiasm in the markets following the better-than-expected payrolls data released earlier today.

The drags on the economy from weak global growth and lingering trade uncertainty haven’t yet dissipated and we suspect that the Fed still has a little more work to do.

He said there were signs the sector may be “turning a corner”, but added:

With a sustained rebound in global growth still looking unlikely, and the very real prospect that trade negotiations with China once again break down, however, we still expect manufacturing conditions to remain unusually weak over the coming months.

Markets rally on jobs data and hopes of further rate cut

That manufacturing activity reading may be just enough to have kept a further Federal Reserve rate cut in play. Combine that with the strong jobs data, and investors seem pretty cheery.

One man is happy (or, at least, as happy as he can be while facing impeachment proceedings):

Stock Market up BIG! Record highs for S&P 500 and NASDAQ. Enjoy!

— Donald J. Trump (@realDonaldTrump) November 1, 2019

Here are the ISM’s full readings...

Sentiment remains cautious

The Institute for Supply Management, which gathered the figures, has shared some findings for its discussions with purchasing managers (whose figures inform the index). It says:

Comments from the panel reflect an improvement from the prior month, but sentiment remains more cautious than optimistic. October was the third consecutive month of PMI contraction, at a slower rate compared to September. Demand contracted, with the new orders index contracting marginally, the customers’ inventories Index moving into ‘about right’ territory and the backlog of orders index contracting for the sixth straight month (and at a faster rate).

Its chair, Timothy Fiora, said:

Global trade remains the most significant cross-industry issue. Food, beverage and tobacco products remains the strongest industry sector and transportation equipment the weakest sector. Overall, sentiment this month remains cautious regarding near-term growth,

Gauge signal third month of contraction

That is the third month in a row that the ISM manufacturing PMI has indicated a contraction in activity, with production levels hitting their lowest reading since the financial crisis.

Despite coming off a 10-year low, the figures missed estimates, with the production sub-component slipping to 46.2 after four weeks of drops – possibly a reflection of the General Motors strike.

#ISM Manufacturing Index v S&P 500 Index, moving in the same direction but the ISM has some work to do... pic.twitter.com/kG3f2dvtEQ

— jeroen blokland (@jsblokland) November 1, 2019

That reading offsets the sunny jobs report we got earlier, and may cause markets to pare back slightly – though so far they have advanced.

The continued weak figures show the ongoing impact of the US’s trade war with China, which is driving uncertainty and sending shivers through the world’s biggest economy’s manufacturing firms.

Break: US manufacturing slowdown worse than expected

Just in: October data for the Institute for Supply Management’s purchasing managers’ index is in, and it shows a reading of 48.3 (where a score above 50 indicates growth), compared to expectations for 48.9.

That is slightly better than last month’s reading of 47.8, which was the worst since the financial crisis in 2009.

Side note:The final reading for the IHS Markit US manufacturing PMI came in at a slightly more positive 51.3 earlier, but the ISM figure is the more respected and closely-watched.

Bloomberg: London WeWork sites under review

WeWork has reportedly begun a “sweeping review” of its London expansion plans, after the company was bailed out by investor Softbank.

There are 28 potential office deal under review, Bloomberg says, citing sources. The news service reports:

The deals under review are at varying stages, from a preliminary inspection of promising properties to detailed talks, according to people with knowledge of the process. The review raises questions about what proportion of these offices the company will end up leasing, the people said, asking not to be identified because the talks are private.

Even a small pullback by WeWork, which is the biggest private office occupant in London, could ripple across the city’s commercial real estate market. The company accounts for about 7pc of central London leasing this year and now rents about 4m square feet across the city, according to data compiled by CoStar Group Inc. Still, vacancy rates in the capital remain low, and rival flexible office companies continue to acquire space.

Google to buy Fitbit in $2.1bn deal

Just in: Google is set to buy wearable tech-maker Fitbit in a deal worth $2.1bn. My colleague James Cook reports:

Fitbit’s stock jumped more than 30pc on Monday following a report that Google had made an offer to purchase the firm. Trading was briefly suspended due to the leap in its share price.

In recent years, Fitbit has struggled to compete with Apple which entered the wearables market in 2015 with its Apple Watch product.

Fitbit announced earlier this year that it was seeking a buyer following four years of declining sales following a disastrous public listing in 2015. Its share price dwindled from almost $50 at its peak to just $4 a day before reports of Google's potential acquisition.

Google said that it expects the transaction to close in 2020.

James Park, co-founder and chief executive of Fitbit, said:

Google is an ideal partner to advance our mission. With Google’s resources and global platform, Fitbit will be able to accelerate innovation in the wearables category, scale faster, and make health even more accessible to everyone. I could not be more excited for what lies ahead.

The offer was initially reported by Reuters on Monday.

Trump tweets...

The US President has welcomed the jobs report, but appears to have completely made up the number of jobs added.

The total added including adjustments, if we look over both October AND September, was 308,000.

But in terms of jobs added that are new in these figures, the most generously you can phrase it is 218,000 added: 128,000 in October, plus a 44,000 upwards adjustment to September, plus the 46,000 GM workers (corrected to include GM workers).

Wow, a blowout JOBS number just out, adjusted for revisions and the General Motors strike, 303,000. This is far greater than expectations. USA ROCKS!

— Donald J. Trump (@realDonaldTrump) November 1, 2019

Exxon profits plunge

My colleague Ed Clowes reports:

Exxon Mobil became the latest oil giant to feel the sting of weak oil prices and falling margins in the chemicals business this week, reporting a nearly 50pc plunge in profits for the third quarter.

The largest US oil producer – which is currently facing a number of lawsuits for misleading investors over the risks of climate change – saw its quarterly earnings fall to $3.17bn, down from $6.24bn a year earlier.

A bad week turns worse for Exxon...

As it faces two seperate lawsuits for misleading investors over the potential cost of climate change, the oil giant today said its profits plunged by nearly 50%.

It joins the likes of BP and Shell, who also posted dreadful earnings this week. pic.twitter.com/lxqa4TYWt2— Ed Clowes ادوارد كلاوس (@EdClowes) November 1, 2019

Auto sector and census jobs add pressure

Alongside the October expectations beat, the adjustment to September’s figures (from 136,000 jobs added to 180,000) really stands out.

The Bureau of labor Statistics, which gathers the data, noted the impact from the General Motors strike, with the number of employed workers in the auto and parts manufacturing sectors falling by 42,000.

Federal employment also slipped by 17,000, as workers engaged in temporary employment as part of the 2020 Census finished up their work.

Payroll employment rises by 128,000 in October; unemployment rate changes little at 3.6% https://t.co/NsuHovcqn0#JobsReport#BLSdata

— BLS-Labor Statistics (@BLS_gov) November 1, 2019

Premier Asset Management’s Neil Birrell said:

The jobs data was distorted by the General Motors strike, one of the biggest this century, but the number of jobs created was quite a bit higher than expected. This appears to back up the Fed’s comments on Wednesday night about the economy being in decent shape and its shift in policy stance.

����Strong US jobs growth despite soft indicators like PMI employment has indicated otherwise.

The #Fed hawks will use this as an argument for not easing further. One more jobs report ahead of the next #FOMC meeting! pic.twitter.com/RRBLFyWk7L— Danske Bank Research (@Danske_Research) November 1, 2019

‘Golidlocks’ figures suggest Federal Reserve can hold off on further rate cuts

The numbers show a 36,000 jobs drop in the manufacturing sector – that will be largely down to the roughly 46,000 General Motors workers who went on strike (but is, for the sake of the records, the worst drop in a decade).

All things considered...that's a strong #payrolls report

- Headline beat

- +95k net upward revision

- Participation rate up to 63.3%

- Unemp @ 3.6%

Slight miss on the MoM wages only notable downside

A goldilocks report, #Fed will stay on hold, should support risk assets— Michael Brown (@MrMBrown) November 1, 2019

Goldilocks for risk that one you feel. ISM could undo it later

— Neil Wilson (@marketsneil) November 1, 2019

Stock markets cheered by jobs figure beat

US futures trading has pushed upwards on those numbers, suggesting Wall Street will advanced solidly at open. European equities have also extended their gains.

S&P 500 futures rise after payrolls number beats expectations https://t.co/YM4G9q2dzlpic.twitter.com/be395WuZ94

— Bloomberg Markets (@markets) November 1, 2019

Another Goldilock-ish US jobs report. NFP +128k vs 85k exp., AHE +0.2% MoM vs +0.3% MoM expected. UR at 3.6% vs 3.6% exp up from 3.5%. pic.twitter.com/eVGeTv0rtX

— Holger Zschaepitz (@Schuldensuehner) November 1, 2019

Break: US jobs added beats expectations

Just in: US jobs figure for October has smashed expectations, with 128,000 jobs added versus expectations (per Bloomberg) of 85,000, while September’s figures were adjusted upwards by 44,000.

As a reminder, those figures will have included a major hit from striking General Motors workers – who count as unemployed because they are not on the payroll – after a 40-day walkout by the car manufacturer’s staff.

More follows...

Full report: Brexit stockpiling stems manufacturing decline

Deputy Economics Editor Tim Wallace has a full report on this morning’s manufacturing activity reading. He writes:

A surge in stockpiling before the now-cancelled Brexit deadline of October 31 helped stem a slump in manufacturing last month, providing short-lived relief for an industry battling a global slowdown.

Activity edged down month on month, according to the purchasing managers’ index, a closely watched survey of businesses.

The PMI recorded a score of 49.6, the highest score since April, and just below the 50 level that signifies growth.

Read more here: Brexit stockpiling helps stem manufacturing decline in October

This year has been awful for Metro Bank

Here’s a reminder of how much shares have sagged at the challenger bank, which recently dropped out of the FTSE 250, and swung to a loss in the third quarter.

My colleagues Lucy Burton and Simon Foy reported last month:

The troubled lender, which is fighting to rebuild confidence following a major accounting gaffe earlier this year that left investors nursing huge losses, swung £2.2m into the red for the three months to September 30 compared to a £15.1m profit a year earlier.

Metro's chief executive Craig Donaldson also hinted at a wider overhaul by telling investors the bank is now evaluating its future plans to strike a balance between growth and costs.

He did not go into further detail about what options are on the table, but said the board would have a “fiduciary duty” to discuss any approaches by potential buyers.

Money round-up

Here are some of the day’s top pieces from the Telegraph’s Money team:

It has never been better for women at work – here’s what we need to do next

Victim of a scam? Here’s why you might be more likely to get your money back

Metro Bank shares jump after Standard speculates over Lloyds takeover

Shares in Metro Bank are up nearly 13pc currently, following speculation in the Evening Standard that the high-street lender may draw takeover interest from Lloyds.

Citing rumours, the Standard reports:

Is Lloyds lining up a bid for troubled Metro Bank? The City rumour machine reckons it might be, noting that such a deal would be welcomed by the regulator, said to be concerned by Metro Bank’s declining financial position.

The recent departure of chairman and founder Vernon Hill could clear the way for a rescue bid from Lloyds Banking Group, which yesterday reported a 97% plunge in third-quarter profits

It notes that Metro’s depressed share price would make it a bargain grab for the bigger bank. Metro and Lloyds both declined to comment to the Standard.

You can read the Standard’s report here: Is Lloyds pondering a bid for Metro Bank?

Tesco bans Monzo cards at some branches after double-payment issue

Another twist in the UK fintech bank saga: a number of Tesco branches have banned the use of Monzo cards in their stores after months of complaints from customers, my colleague James Cook reports. He writes:

The issues began in July when Monzo customer started complaining of being charged twice for purchases at Tesco self service tills.

A Monzo employee claimed on its forum earlier this month that the issue was with Tesco’s payments systems and had since been resolved.

However, complaints on social media continue and some Tesco branches still display signs asking customers not to use Monzo cards.

Who do you think should be the next Bank of England Governor?

Take our poll:

Poll suggest Tories will hold lion’s share of Leave supporters’ votes

Some interesting voting intention polling (which should, as ever, be taken with a substantial pinch of salt) from YouGov, which has found that the Conservatives command a massive majority of support from people who voted Leave in 2016.

Voting intention among 2016 REMAIN voters

Lib Dem - 34%

Labour - 33%

Con - 16%

Green - 9%

Voting intention among 2016 LEAVE voters

Con - 58%

Brexit Party - 24%

Labour - 10%

(Fieldwork 17-28 Oct)https://t.co/ia8ACO4b8vpic.twitter.com/QBAR5Uq4oi— YouGov (@YouGov) November 1, 2019

That is likely to be encouraging for Boris Johnson if tensions between him and Brexit Party leader Nigel Farage flare up, but also shows how divided things have become. There’s still everything to play for, it would seem.

��The last time the Conservatives won a majority, a Brexit-ier party took 12.6% of the vote��

— Duncan Robinson (@duncanrobinson) November 1, 2019

Mixed signals

The UK’s broadcasters appear split on the topic of Bank of England Governorship. Minouche Shafik was named as the preferred choice by the BBC, but Sky economics editor Ed Conway says there are still several candidates in the running:

Contrary to what some are reporting on @bankofengland governorship, I'm told by sources close to the process that it hasn't yet been narrowed down to one candidate. A final decision has NOT yet been taken. I'd take any stories on who it's going to be with a massive pinch of salt

— Ed Conway (@EdConwaySky) November 1, 2019

Economist: PMI reading shows manufacturing sector is in recession

Ruth Gregory, from Capital Economics, says the PMI figures suggest the UK manufacturing sector is in recession. She writes:

While the manufacturing PMI recovered in October from September’s extremely weak level, it is still consistent with a recession in the manufacturing sector.

Ms Gregory adds that the downturn may spur the Bank of England’s Monetary Policy Committee – which is expected to hold rates when it meets next week – to go for a cut next year:

Overall, it seems likely that the manufacturing sector has remained a drag on GDP growth at the start of the fourth quarter. And with the other sectors showing little growth, we are expecting the economy to expand by no more than 0.2pc-0.3pc q/q in the next few quarters.

Admittedly, the MPC still looks set to stand pat at its meeting next Thursday. But if Brexit is delayed again beyond 31st January, and the economy remains weak as we expect, then we still think that the Bank of England will cut rates – perhaps by 25bp in May 2020.

Manufacturing activity figures show ‘horror show’ continues – KPMG

KPMG’s Stephen Cooper has called those manufacturing PMI figures (see 9:33am update) proof of an ongoing uncertainty “horror show” for Britain’s factories. He said:

UK manufacturers will see today’s PMI figure as more trick than treat, as stockpiling in anticipation of an October Brexit flattered the numbers, which remain in negative territory. Looking East, Chinese manufacturers are seeing a ray of unexpected sunshine in the form of better than expected Chinese PMI data which boosted Asian markets. We could do with a similar uptick in the UK and Europe, as continued job losses and falling investment paints a gloomy picture.

Brexit continues to weigh down on confidence in the sector, as does the global economic backdrop – but perhaps the result of the upcoming UK general election will help alleviate some of this.

Looking ahead, manufacturers need to keep an eye on sterling and exchange rates, and they should also continue to manage their cost base and working capital carefully.

Reuters’ Andy Bruce has taken an interesting look at the crucial stockpiling element:

Worth noting that although the rate of #stockpiling in today's UK manufacturing PMI isn't as strong as early 2019, it's still higher than anything recorded by @IHSMarkitPMI in any other G7 country �� pic.twitter.com/tbFquEGyEX

— Andy Bruce (@BruceReuters) November 1, 2019

Farage gives Johnson two weeks to ditch deal or face battle for Brexit seats

In Westminster, Nigel Farage is launching the Brexit Party’s general election campaign.

He has given Boris Johnson an ultimatum: drop the current Withdrawal Agreement Bill and push for a Brexit based on a free-trade agreement, or face competition for the hardline pro-Leave group in the December vote.

Nigel Farage's is making an impossible ask of Boris Johnson

He's asking him to junk his deal, which is the centrepiece of the Conservative manifesto, and go for an FTA instead

He's given him until Nov 14 to accept his offer— Steven Swinford (@Steven_Swinford) November 1, 2019

Farage gives the Tories two weeks to accept his offer to reject the withdrawal agreement and he will stand down (seems unlikely)

He notes 150 seats in this country are Leave constituencies that aren't going to vote Tory that would suit the Brexit party.— Sebastian Payne (@SebastianEPayne) November 1, 2019

Johnson has two weeks to accept his terms: abandon his deal and go for a simple free trade agreement.

— Tom Newton Dunn (@tnewtondunn) November 1, 2019

Follow live political updates here: General election latest news: Nigel Farage launches Brexit Party campaign as Tories reject electoral pact

The markets seem unmoved by Mr Farage’s statements so far, with the pound holding steady at $1.295.

Who’s still in the running to become the next BoE Governor?

With reports naming Minouche Shafik as Chancellor Sajid Javid’s preferred candidate to become the UK's first post-Brexit – and first woman – Governor, my colleagues Russell Lynch and Michael O’Dwyer have taken a closer look at who’s still in the running to replace Mark Carney. They write:

Ms Shafik’s emergence is the latest fevered speculation on the identity of the appointment, coming days after another former deputy – Harvard academic Paul Tucker – was linked with the role.

If successful, Ms Shafik will have seen off eight other reported candidates in a contest with almost as many runners as a Conservative leadership contest

Their list is:

Dame Minouche Shafik, director, London School of Economics

Sir Paul Tucker, former Bank of England deputy Governor

Gerard Lyons, Boris Johnson’s former economic adviser

Dame Helena Morrissey, City fund manager

Shriti Vadera, chairman, Santander UK

Ben Broadbent, deputy Governor, Bank of England

Ben Broadbent, deputy Governor, Bank of England

Andy Haldane, chief economist, Bank of England

Andrew Bailey, chief executive, Financial Conduct Authority

You can read more about all the candidates here: Who’s still in the saddle for the Bank of England job as race enters final furlong?

Chemring shares rise after contract win

Shares in small-cap defence manufacturer Chemring are up nearly 4pc today, after it announced a contract win. My colleague Jasmine Cameron-Chileshe reports:

Manufacturer Chemring has been awarded a new contract from the US Department of Defense, allowing it to predict that operating profit and earnings per share will be slightly ahead of expectations this year.

The news comes as a much needed boost for the company, which at the beginning of the year reported growing losses. In August last year, a fatal incident at the company’s Salisbury plant killed one worker and critically injured another, forcing work at the site to stop. In January 2018, the company also revealed that it was being investigated for bribery and corruption.

Chemring employs around 2,500 people worldwide and specialises in the manufacture of high technology products to defence, security and aerospace markets. Full end of year results are expected to be announced on Dec 16.

General Motors strike expected to have hit US job growth

Coming up later today, we’ll get the latest figures on US jobs growth, with sharp slowdown expected in October because of the General Motors strike.

Analysts polled by Bloomberg expect 85,000 jobs to have been added over the month, compared to 136,000 in September.

The 40-day strike will have hit non-farm payroll (NFP) figures because striking workers do not receive paychecks, and are counter as unemployed for the sake of the survey.

Job growth has been slowing this year, with the trade war between the US and China weighing on business investment.

OANDA’s Craig Erlam said:

The US NFP report caps off another chaotic week in the markets, one in which the Fed has cut interest rates again, the US and China have moved closer to a phase one agreement and the UK has, kind of, hopefully, maybe moved closer to leaving the EU while not actually leaving as planned.

The report is expected to be unusually weak but will be distorted by the General Motors Strike so we shouldn't read too much into it. Wed have to see a pretty appalling report to worry traders at this point, although it will be interesting to see just how quickly they start pricing in another Fed rate cut.

Former Sainsbury’s boss calls for business rates to be halved

My colleague Simon Foy reports:

The former boss of Sainsbury’s, Justin King, has called for business rates to be halved and VAT to be increased in order to help bricks and mortar retailers against online rivals.

Speaking to the BBC’s Today programme, Mr King said it was unfair that high street retailers are forced to pay the charge when internet competitors are not. He proposed a 2pc increase in VAT to plug the shortfall.

“The services that those business rates pay for are used by online retailers,” said Mr King.

“They drive on the roads that are maintained by them, the brown cardboard boxes they deliver are collected by dustmen or taken to tips paid for by those business rates,” he added.

FTSE pushes higher

The FTSE 100 has slightly extended its gains, as part of widespread bounce-back on European stocks.

The pound is holding small gains, but has fallen back to $1.295.

SpreadEx’s Connor Campbell said:

Sterling is in a pretty good place – despite Goldman Sachs’ suggestion to ignore the currency completely over the new few months.

Manufacturing sector in ‘twilight zone’

Duncan Brooks, director of the Chartered Institute of Procurement & Supply, said of the figures:

A minor uplift in overall purchasing activity did little to ease the agony for manufacturing companies in October as the sector remained submerged in contraction terrain and heading for recession. Business was still restrained by the Brexit leash, as firms were subjected to the struggle against client indecision and also the downpull of a slowing global economy.

This affected new order intakes which fell for a sixth sequential month as the second Brexit deadline loomed into view. Domestic clients packed up and went home without placing orders, leaving the sector to survive on a handful of stockpiling purchases from clients in the EU.

Naturally this had a heavy impact on job creation as manufacturing firms cut jobs for the seventh month in a row and at one of the fastest rates for a decade. Companies have lost faith in their ability to weather the ongoing storms, reining back spending where they can. As the manufacturing sector remains in the twilight zone, wondering whether to stock or de-stock, hire new staff, look for new business or batten the hatches once again, it looks like a scary end to the year.

Best reading in six months at firms stockpilie, but slowdown continues

Researchers at IHS Markit said:

Ongoing uncertainties surrounding Brexit, the economic outlook and the political situation continued to weigh on the UK manufacturing sector during October. Output and new order inflows contracted, leading to further job losses. Firms also ramped up stock-building and purchasing activity in the lead-up to the (postponed) October Brexit departure date.

They note that the data was gathered for the October 11 to October 28 period, meaning it is all from before the Brexit extension was confirmed.

Their analysis continues:

The downturn in manufacturing production continued, although the rate of contraction slowed. Firms reported that weaker inflows of new business, especially from the domestic market, had led to a further scaling back of output. This was partly offset by manufacturers who raised production to build-up stocks in advance of the October Brexit deadline.

New orders decreased, while factories continued to shed workers.

Rob Dobson, director at IHS Markit, said:

The manufacturing downturn continued at the start of the final quarter as uncertainties surrounding Brexit, the economic outlook and domestic politics all took their toll.

However, the underlying picture looks even darker than even these disappointing headline numbers suggest, as output and new orders fell despite short-term boosts from stock-building activity in advance of the October 31 Brexit deadline, which included a rise in exports as clients in the EU sought to mitigate supply risk.

Break: UK manufacturing slows down in October, but beats expectations

Just in: Activity in the UK’s factories continued to slow down in October, but was better than expected.

Purchasing managers’ index activity data for October gave a score of 49.6, where a reading above 50 indicates growth. Analysts had expected 48.2

From Markit: pic.twitter.com/kO4bJvH5sA

— Michael Brown (@MrMBrown) November 1, 2019

Questor: How we’d invest through a Corbyn government

Does a possible Corbyn government represent an existential threat to Questor’s portfolio?

That’s the question the Telegraph’s investment column has set out to answer today. Questor editor Richard Evans writes:

We’ll have to await the party’s manifesto for details of its latest plans for these businesses but previous indications about its intentions can only mean pain for shareholders.

Read his full analysis here: Jeremy Corbyn could be at No 10 in six weeks’ time. This is Questor’s response

Shafik for Governor?

A new frontrunner in the heated field of possible replacements for Bank of England Governor Mark Carney?

The BBC reports Egyptian-born Dame Minouche Shafik, director of the London School of Economics, is the Government’s current favourite to take the hot seat at Threadneedle Street.

Mr Carney’s replacement is likely to be announced after the outcome of December’s election, with the Canadian set to leave on January 31.

NEW: told that Minouche Shafik is THIS govt's preferred candidate for next Bank of England Governor. No announcement this side of election - cos it would be "politically messy" but if (a big if) this government secures majority - Egyptian born Minouche is current favourite.

— Simon Jack (@BBCSimonJack) October 31, 2019

Dame Shafik, a former deputy governor at the bank, once said she would a “wise” owl if she were in charge of rate-setting (as opposed to a hawk or dove).

Evraz steel output falls

Crude steel output at Russian miner Evraz fell during the third quarter, with the group blaming the decline on lower volumes, disruption caused by scheduled repairs, and weaker demand at its North American sites.

The FTSE 100 company’s shares are off about 1pc this morning after releasing the figures in an update to the City. Total steel sales were flat quarter-on-quarter overall.

Lookers shares plummet after profit warning

This morning’s profit warning has put a big dent in Lookers shares, which are down about 16pc currently, having fallen as much as 30pc.

On the FTSE 100, Auto Trader is leading fallers – possibly due to investor nerves about the car-sales sector.

Nervous market movements boost TP ICAP

TP ICAP, the biggest inter-dealer broker in the world, said its revenue jumped over the third quarter as market nerves led to an increase in trading.

It warned, however, that global uncertainties could impact its transaction volumes during the rest of the year, holding its current guidance.

Revenue for the three months to the end of September was 17pc higher than during the same period last year.

Peel Hunt analysts said:

Overall, the business delivered strong growth in Q3, benefitting from more volatile market conditions.

The company’s share price has fallen slightly at open:

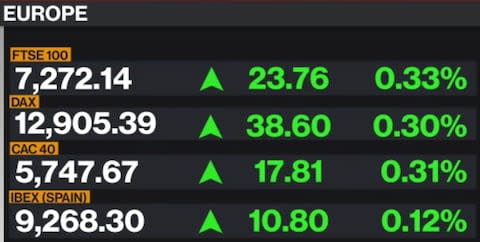

Markets claw back some of yesterday’s slide

European markets have opened slightly upbeat, with the FTSE 100 recovering some of yesterday’s losses.

The pound has continued to push slightly higher, and is just over $1.296.

Profit warning and leadership changes at Lookers

Car dealership Lookers has warned on profits and announced a board clear-out just months after the launch of a probe by the City watchdog sent its shares crashing, my colleague Michael O’Dwyer reports. He writes:

Chief executive Andy Bruce and chief operating officer Nigel McMinn will step down from the board immediately, the company said.

Lookers said that trading since mid-September had been much more challenging than expected. As a result, it warned that underlying pre-tax profits for 2019 could be £20m lower than previously forecast.

Trading in both the new car market and the higher-margin after-sales business had been disappointing, Lookers said.

Agenda: FTSE 100 looks to recover losses after worst day in a month

Good morning. The FTSE 100 is set to open narrowly in the green after better-than-expected Chinese manufacturing data pushed Asian stocks higher overnight.

The UK’s blue-chip index suffered its biggest drop in almost a month yesterday as a series of heavyweight falls and fears that progress in US-China trade talks may be stalling dragged on stocks.

The pound gained overnight to rise above $1.295, closing in on the highest level it reached last month. October ended as the best month for sterling since the financial crisis.

5 things to start your day

1) Plug it in? The drive to ensure Britain can charge millions of electric cars. The final part of our week-long electric vehicle (EV) series examines whether Britain is ready to meet demand for charging points.

2) The economics election scorecard: five charts showing whether Britons have had their pockets picked or lined since 2017. how has the economy performed for the man on the street since voters were last sent to the polls?

3) Italy’s billionaire Agnelli family are in line for a €1.4bn (£1.2bn) payday if the merger of car makers PSA Group and Fiat Chrysler goes through. The Agnellis - already worth almost €10bn - control about a third of Fiat Chrysler through their Exor investment vehicle, of which they own half.

4) Some of Britain’s most prominent business leaders branded Jeremy Corbyn “clueless” and said he has led “a narrow life” after the Labour leader attacked them in an election campaign speech. Financier Crispin Odey and Sports Direct boss Mike Ashley hit back at the Labour leader when he accused them of taking advantage of the UK’s “corrupt system” in a blistering attack on capitalism.

5) Apple faces a potential fine from French authorities for allegedly breaking competition law, the tech company has revealed. France’s Autorité de la Concurrence has hit Apple with claims that its sales and distribution operations in the country are anticompetitive, the company disclosed in its annual report.

What happened overnight

Most Asian stocks rose and European and US futures pushed higher Friday as investors weighed better-than-expected Chinese manufacturing data against uncertainty about an interim US-China trade deal.

Equities in Japan pared losses, while shares in Hong Kong and China rose after a closely-watched manufacturing gauge unexpectedly climbed. Stocks in Seoul shrugged off the latest plunge in South Korean exports.

Sentiment had weakened earlier and the S&P 500 slipped overnight after Bloomberg reported that Chinese officials have warned they won’t budge on the thorniest trade issues. Negotiators are expected to hold a call Friday.

Coming up today

Trading statement: Evraz, TP ICAP

Economics: Manufacturing PMI (UK and US)

Yahoo Finance

Yahoo Finance