UK shares slide ahead of election vote to break Brexit deadlock

Pound stays fairly flat as Commons appears set to back General Election vote, but UK stocks pull back

Boeing boss Dennis Muilenburg faces grilling from senators on first of two days of hearings

The S&P 500 hit a new all-time high yesterday amid US-China trade optimism

The number that shows Google’s search engine slowing down at a worrying rate

Blog wrap

Thanks for following along a bit later than usual today. Louis Ashworth will be back in the morning as usual!

At the time of writing, the pound is flat against the dollar at $1.2861 and 0.10pc lower against the euro at €1.1577.

The dollar has slightly weighed down today by weaker than forecast US consumer confidence figures.

City leaders criticised as bosses return to 'Davos in the Desert' a year after boycott

Bank bosses and political figures, including former prime minister David Cameron, have been criticised for returning to Saudi Arabia's 'Davos in the Desert' conference just a year after the event was boycotted.

Business leaders last year scrambled to distance themselves from the annual investor event following journalist Jamal Khashoggi's disappearance at the Kingdom's consulate in Istanbul.

Despite boycotting the event last year, bosses at HSBC, Standard Chartered, Credit Suisse, BlackRock, Blackstone and the London Stock Exchange are due to attend the summit this week, according to the Future Investment Initiative's programme. Former UK prime minister David Cameron is also listed as a panelist.

Read Lucy Burton's full report here

Advent ready to offer Cobham guarantees as deadline looms

The US firm seeking to buy defence business Cobham is preparing to offer concessions to protect British national security, as a deadline looms for a probe into the £4bn deal.

Private equity fund Advent's takeover of Cobham is being examined by the Competition and Markets Authority (CMA), which is due to hand over a report to Business Secretary Andrea Leadsom by midnight on Tuesday.

If the CMA finds the sale raises national security issues then it could spark a formal investigation, with Mrs Leadsom able to demand concessions from Advent - or even block the deal.

Meanwhile across the pond...

Stocks on Wall Street are slightly mixed at the moment. Yesterday President Trump said that he hopes to sign phase one of the trade agreement with China next month however Reuters reported that the two economies may not succeed in signing a preliminary trade deal next month.

The Dow Jones is now 0.06pc higher and the S&P is 0.14pc up. The tech-heavy Nasdaq is 0.38pc lower.

* EXCLUSIVE - US-CHINA 'PHASE ONE' TRADE AGREEMENT MAY NOT BE SIGNED AT CHILE APEC MEETING IN NOVEMBER, BUT PROGRESS IS BEING MADE -U.S. ADMINISTRATION OFFICIAL

(via @reuters)— Carl Quintanilla (@carlquintanilla) October 29, 2019

Boris gets election boost as low-paid jobs hit record low

Boris Johnson’s general electoral hopes were bolstered on Tuesday as figures showed the share of UK workers stuck in low-paid jobs at the smallest level since records began, my colleague Russell Lynch writes. He adds:

"Low pay emerged as a key battleground between Labour and the Conservatives during the party conference season as Chancellor Sajid Javid pledged to raise the National Minimum Wage to £10.50 an hour over five years, trumping Labour’s vow to increase the figure to £10 for all over-18s.

"As MPs prepared to dissolve Parliament for a December election, the latest review from the Office for National Statistics (ONS) showed the share of workers in low-paid jobs – defined as no more than two-thirds of the UK median hourly rate of £13.27 – had fallen to 16.2pc."

Juul cuts jobs and appoints new finance chief

E-Cigarette maker Juul has announced it will slash about 500 jobs by the end of the year amid a management shake up.

Several top executives have left the firm, including Tim Danaher, the company's finance chief and chief administrative officer Ashley Gould. Mr Danaher will be replaced by Guy Cartwright.

Juul is battling a backlash from lawmakers and regulators against vaping.

KC Crosthwaite, who took the helm last month, said the vaping industry was undergoing a “necessary reset”.

“To right-size the business, the workforce will be reduced between now and the end of the year,” Juul said.

The jobs cut represents 15pc of staff.

Good afternoon

I'll be taking you through the next few hours, bringing all the latest news. Let's see how European markets closed today...

Stocks closed largely in the red with the FTSE 100 falling 0.34pc to 7,306.26 points. BP dragged the blue-chip index down 3.8pc after posting a 40pc fall in profits this morning. The domestic FTSE 250 closed 0.21pc lower at 20,168.33.

David Madden of CMC Markets says:

"The feelgood factor from the Brexit delay has been replaced by the caution of a possible general election in the UK.

"Elections can be risky as Mrs May found out in 2017. The Conservatives are polling well ahead of the Labour Party but traders have learned not to rely on opinion polls given the events of the past three years, hence why equities are down."

Handover

With markets closing up, but plenty of fun left to occur this evening, I’m handing over to my colleague LaToya Harding, who will take things from here. I’ll be back tomorrow!

Round-up: Consumer credit boom deflates, Amazon offers US grocery delivery, Saudi Aramco set to begin float

Here are some of the afternoon’s biggest stories:

Jittery shoppers help deflate consumer credit boom: Growing political chaos over Brexit took further heat out of the consumer credit boom in September, as lending to jittery households slowed to its weakest pace for five years.

Amazon to offer free grocery delivery for US Prime customers: Amazon is dropping its grocery delivery fees for US Prime customers in a move that is likely to tighten its grip on online shopping and steal more market share from supermarkets.

Saudi Aramco finally set to launch first stage of its mega-float: Saudi Arabia will launch the float of its huge state oil company next month after dramatically scaling back plans for a listing.

Snap wrap: Five key points from the Boeing hearing

These are the points that jumped out to me:

Boeing boss Dennis Muilenburg says he is hugely sorry for the deaths caused by two crashes involving its 737 Max planes...

...but won’t commit to or suggest any specific regulatory overhauls that could prevent a repeat of such incidents in the future.

The CEO said he had not seen explosive texts between Boeing employees about the safety of the 737 Max until around the time they appeared in the media.

Mr Muilenburg attempted to shift blame for the failure to disclose the texts onto Boeing’s legal team.

A timeline for the 737 Max’s return to service is still unclear.

Here’s Industry Editor Alan Tovey’s take:

Every Senator wants to get their hits in on Mr Muilenburg. However, they are walking a tight line between expressing anger at what’s gone wrong at Boeing and within the regulatory system that contributed to the loss of 346 lives, and trashing a company that’s substantial part of the US economy.

Mr Muilenberg has probably performed as well as he could have - he’s not given up anything hugely damning but just can’t give answers. He’s taken some heavy blows - particularly on questions about emails from senior pilots seemingly discovering problems with the MCAS system two years before the first crash.

He’s repeated that he’s “sorry, deeply and truly sorry”, and accepted the way aircraft are certified needs to be reformed. But with the 737 Max still grounded, this hearing is just one of many steps he will be taking out the door at Boeing.

Theseus’s plane?

Ms Rosen points out that the 737 first entered service in 1967, and has changed significantly since then (14 iterations, accord to Mr Hamilton).

Q: Is it functionally the same plane?

Again, a kind of dodge – and it’s beginning to look a bit like we might have all the major information we are going to get from the Boeing representatives today. I’ll round up some of the key points we’ve heard so far shortly.

Inconsistencies

Democrat Jacky Rosen is pointing out that some safety manuals had information about the MCAS system that were lacking from the US safety manual. She points out the details were in the Brazilian manual.

Q: Why were manuals inconsistent?

Mr Muilenburg says he cannot comment on the specifics of the Brazilian manual, but says the decision made on the US manual’s contents were agreed with the FAA. He says:

It is not always the case that extra information adds to safety

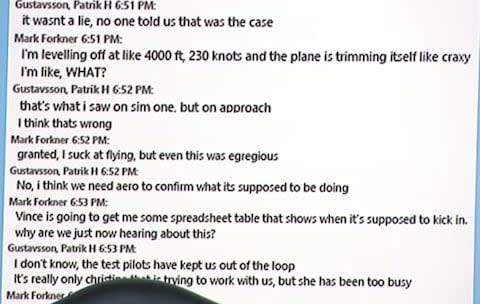

The conversation between Boeing employees

Here’s a sample from the conversation between Mr Forkner and Mr Gustavsson shared in the Senate today:

‘Cozy’

Democrat Jon Tester has also spoken of a “cozy relationship” between the FAA and Boeing:

Q: What needs to change in terms of regulation?

Mr Muilenburg dodges, Mr Tester accuses him of “pivoting” to avoid answering the question. The Boeing CEO says that FAA is ultimately responsible.

Mr Tester is focusing on the role of the Organization Designation Authorization (ODA), essentially a subset of Boeing that the FAA uses to act as proxy on certification oversight. He suggests that the role of the ODA means that Boeing holds blame for safety failures, and cannot pass the buck to the FAA.

‘A la carte‘ safety

From Alan:

Senator Ed Markey accused Boeing of being allowed to treat safety equipment that’s non-critical as an ‘a la carte item’, charging extra for technology which is not essential for safety but improves it. He admits it’s permissible under current law but says “safety must never be for sale”. Muilenberg says “we don't sell safety, that’s not our business”.

MCAS questions

Democrat Tammy Duckworth says Boeing has “not told the whoel truth”, detailing the differences between the MCAS systems on the 737 Max and older 737s, saying “you set those pilots up for failure”. She says Boeing took five months to reply to her questions.

She says the angle-of-attack sensor meant that a pilot’s commands could be continuously overridden by MCAS, meaning the nose of the plane was continuously pushed downwards.

There’s not a clear question at the end of her comments.

‘Stunning’

Republican Ted Cruz is now speaking, saying the testimony has been “dismaying”. He focuses on the text exchange between Mr Forkner and another employee, Patrik Gustavsson.

In the conversation (from 2016), the two employees discussed problems with the MCAS system. At one point, Mr Forkner says “so I basically lied to the regulators [accidentally]”.

Mr Cruz is drawing comparisons between the problems described by the employees, and the issues that later brought down the Lion Air plane.

He says he finds it “stunning” that Mr Muilenburg can claim not to have seen the conversation before.

Mr Muilenburg says he was reliant upon his legal representatives to “handle it appropriately”.

Mr Cruz says: “The buck stops with you,” and asks how it came to pass that Mr Muilenburg did not see the document sooner (i.e., when Boeing first brought up the document as part of investigations).

Mr Muilenburg says he supports “diving deep” into the details. He confirms he has spoken to Mr Gustavsson.

A price on safety?

From Democrat Ed Markey (who says he is introducing legislation banning extra charges for safety features) is focusing on the absence of angle-of-attack tech and ‘disagree light’ technology in the Lion Air craft.

Q: Boeing charged extra for certain safety features, which were missing on the Lion Air plane that crashed. Why was that the case, and will you support legislation banning charges for safety tech?

Mr Muilenburg says “we don’t sell safety and that’s not our business model”, but will not commit to what Mr Markey is asking for.

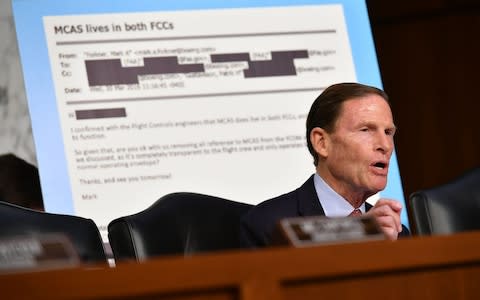

Muilenburg ‘left looking weak’

More from Industry Editor Alan Tovey:

Probably the most devastating questions so far from Senator Richard Blumenthal.

“Pilots and passengers on those planes never had a chance – they were flying coffins because Boeing decided to conceal MCAS. You were saying we are going to delete MCAS from training”.

It may be political showboating but all Mr Muilenburg could stammer was that such actions were “not consistent with Boeing’s values”.

He also lands some heavy blows about the level of certification work that was delegated to Boeing, saying the company lobbied for more responsibility to be handed to manufacturers, and got it.

“Now we’re going to have to reverse that,” the Connecticut senator said and challenges the Boeing chief to support such a policy change.

Mr Muilenburg’s faltering reply that he’d back a “hard look” at it is crushed by Mr Blumenthal, saying that he’s “not looking for support for a hard look, I want your commitment”.

Boeing asked for more control of the regulatory process and received it, the senator adds.

Muilenburg’s left looking weak by it.

Lobbying

Questions now from Republican Shelley Moore and Democrat Tom Udall.

Q: After the second crash, did Boeing lobby the FAA to keep planes in the air in the US?

Dodged question by Mr Muilenburg. Disappointingly, Ms Moore appears to have let him give an answer that was really only context to the crash.

Q: What changes will you commit to in terms of reform to prevent problems linked to regulation?

Mr Muilenburg rejects claims of “cosiness” with the FAA, and says Boeing is “committed to strong oversight” but stops short of any specifics. Mr Hamilton says there could be updates to regulation, including assumptions about pilot performance levels.

Boeing execs reject characterization of a "too cozy" relationship w the FAA, which *legally* allowed Boeing to sign off on safety aspects of the 737 Max. Hearing is as much about federal oversight as it is about Boeing's design of the plane.

— Leslie Josephs (@lesliejosephs) October 29, 2019

Pilots of the future

Democrat Gary Peters asking questions now.

Q: Has your view of regulation changed?

Mr Muilenburg says his thoughts have changed, calling back to his initial comments about the victims of the crashes. Asked whether the industry has been allowed to “police itself”, Mr Muilenburg says “we could look at the balance”.

Mr Peters says there could be a lack of “impartial eyes”, suggesting indsutry has been allowed to mark its own homework.

Mr Muilenburg says “strong oversight” from Government is key to the industry, saying regulators and industry have a “mutual interest” in greater safety.

Q: Does Boeing test its planes on less-experienced pilots?

Mr Muilenburg says Boeing tests its aircraft with a range of pilots, though he acknowledges its own test pilot are typically experts. He says the company is doing more to prepare “future” pilots (by which he seemed to mean less-skilled pilots).

‘We are still learning’

Bit of back-and-forth, in which Mr Muilenburg says Boeing is “still learning” about safety processes (which possibly sounded better on paper).

Q: When will the 737 Max be in the air again?

“When everyone is convinced it is safe” is Mr Muilenburg’s answer. He says Boeing will work with all concerned parties.

Republican Senator Jerry Moran says that makes him worried that the problems are bigger than previously though.

The Boeing chief says they found other safety enhancements they could make while inspecting the planes over recent months, to introduce other “software redundancies”. He pins the extra delay on those changes, adding:

When our teams find opportunities to improve safety, that goes to the top of the list.

Alanalysis: heads must roll

More snap analysis by Industry Editor Alan Tovey:

Having Senators asking about email conversations between Boeing staff referring to the “Jedi mind tricks” they used on regulators getting the 737 Max certified is a heavy blow to Boeing chief Mr Muilenburg. For a company that’s talking about safety being its first priority, it's a direct contradiction.

Terrible follow up by Mr Muilenburg to questions about Jedi mind tricks used by Boeing. Saying that Mark Forkner that chief technical pilot Mark Forkner who was involved in the emails referring to “Jedi mind tricks” could not be contacted makes him look powerless. No matter whether Mr Muilenburg performs well or badly in this hearing, he’s done as CEO once – if – ever Boeing gets the 737 Max back in the air. Heads have to roll and he’s the prime target.

‘Flying coffins’

Democrat Richard Blumenthal has started his questioning by asking family members to lift their photos of loved ones above.

He says: “My anger has only grown. These loved ones lost lives, because of an accident that was not only preventable...but was the result of a pattern of deliberate concealment.”

He says Boeing came to his office after the incident and blamed the crashes on “pilot error”. He adds the victims were in “flying coffins”.

Q: When did you become aware of efforts to take MCAS out of training materials?

Lots of dodging here, and the Senator (who has limited time for questions) is having a fairly heated back-and-forth with the chief executive. The question goes unanswered, but Mr Muilenburg says Boeing will work with the FAA over reform plans. Mr Blumenthal says he is unhappy with the FAA as well, pointing to redacting documents sent to the committee.

Wow. @SenBlumenthal slams Boeing for coming to his office and blaming the pilots for the crashes, says: "Those pilots never had a chance."

— Natalie Kitroeff (@Nataliekitro) October 29, 2019

Changes

Republican Deb Fischer is focusing on changes made to the 737 Max (in comparison to earlier Boeing models).

Q: Were changes reviewed?

Mr Hamilton says of 99 changes that could have been reviewed, the FAA looked at eight.

Q: Were there communication problems between Boeing and the FAA?

Yes, says Mr Muilenburg. He says he cannot comment on the regulator, but says Boeing will “own” their role in communication problems.

Muilenburg: "More information in the training manuals is not necessarily safer."

However, the question at the center of the #737MAX crisis is whether Boeing left MCAS info out of training manuals that it should have known (or did know) should be given to pilots.— Dan Catchpole (@dcatchpole) October 29, 2019

Regulation

We’re now entering the slightly longer grass on regulation, with questions being raised over whether Boeing and the FAA were too close.

Let’s quickly swing back to those questions about “Jedi mind tricks”. Industry Editor Alan Tovey writes:

Having Senators asking about email conversations between Boeing staff referring to the “Jedi mind tricks” they used on regulators getting the 737 Max certified is a heavy blow to Mr Muilenberg. For a company that’s talking about safety being its first priority, it’s a direct contradiction.

Senate Amy Klobuchar, another Democrat,

Q: Was it acceptable for pilots to be flying without information about MCAS?

In short, no, says Mr Muilenburg. He says Boeing tries to train pilot to deal with the impact of the failure, rather than diagnosing it – which Ms Klobuchar isn’t accepting as an clear answer. The chief executive says Boeing bows to the decisions made by global regulators.

He says “we got the implementation wrong” on the angle-of-attack sensor built linked to the MCAS system. Repeating comments from his opening statement, he says Boeing engineers have addressed those issues.

This means that even after Forkner had trouble with MCAS in the simulator, he pushed to remove mention of the system from the pilot's manual.

— Natalie Kitroeff (@Nataliekitro) October 29, 2019

MCAS questions

From Senator Cantrill:

Q: Was Boeing aware of problems with the MCAS system and were they disclosed to the regulator?

Mr Muilenburg is being cagey, as Ms Cantrill asks whether he is confident that Boeing shared all information it had about problems with MCAS. Mr Muilenburg is repeating (as Boeing has previously said) that the aircraft maker has been unable to contact Mr Forkner.

Q: Was adequate testing carried out on the MCAS system?

Mr Hamilton says they “did test” the MCAS system, with regards in particular to the AOA (angle of attack) sensitivities of the plane’s nose-cone sensor. He admits, under pressure from Ms Cantrill, that the test proved inadequate.

Muilenberg closes opening statement

The chief executive cleaved pretty closely to what was in his pre-published statements.

We’re now onto a discussion about the instant messages about the 737 Max sent by Mr Forkner.

Q: When were you made aware of the messages?

Earlier this year, Mr Muilenburg said, but before the second crash. He says the document containing the messages was overlooked during the provision of documents by Boeing. He says he is sorry, put has placed blame on the team responsible. He has refused to rule out that other, further documents may yet be provided.

Mr Wicker has pressed the chief executive more over emails sent by Mr Forkner, in which the former technical pilot said he could “Jedi mind trick” regulators into excluding information about MCAS from its 737 Max safety report.

Mr Muilenburg says he only became aware of the specific details of the documents being discussed over the last few week – his testimony suggests he only became aware of the specific wording after details were reported by the New York Times.

Photos from the hearing

Mr Muilenburg is now beginning to speak, and is summarising his opening statement (which can be read here). He says he is “deeply and truly sorry”.

Here are some photos from inside the hearing:

Cantwell: ‘Safety always has to be job one’

Ranking Democrat Maria Cantwell is now speaking. She says: “we cannot have a race for commercial airplanes become a race to the bottom when it comes to safety,” adding “safety always has to be job one” for aircraft makers.

She says senators wish to know about the “safety culture” at the firm.

Wicker: ‘Disappointed’ to learn of messages between employees

Mr Wicker is speaking of his “frustration” with the FAA, and also criticising both the regulator and Boeing over comments made by the 737 Max’s chief technical pilot, Mark Forkner, who told a colleague in messages sent in 2016 that the craft was “running rampant” during tests.

Boeing says it has not been able to speak to Mr Forkner about the messages.

The New York Times reported on October 18:

For months, Boeing has said it had no idea that a new automated system in the 737 Max jet, which played a role in two fatal crashes, was unsafe.

But on Friday, the company gave lawmakers a transcript revealing that a top pilot working on the plane had raised concerns about the system in messages to a colleague in 2016, more than two years before the Max was grounded because of the accidents, which left 346 people dead.

In the messages, the pilot, Mark Forkner, who played a central role in the development of the plane, complained that the system, known as MCAS, was acting unpredictably in a flight simulator: “It’s running rampant.”

The messages are from November 2016, months before the Max was certified by the Federal Aviation Administration. “Granted, I suck at flying, but even this was egregious,” he said sardonically to a colleague, according to a transcript of the exchange reviewed on Friday by The New York Times.

Read the NYT’s full report here: Boeing pilot complained of ‘egregious’ issue with 737 Max in 2016 (£)

Wicker: Crashes ‘entirely preventable’

Republican Roger Wicker, the Commerce Committee’s chair, is giving his opening statement.

Describing the two crashes as “entirely preventable”, Mr Wicker said “many questions remain about Boeing’s actions” and those of the Federal Aviation Administration, the air regulator.

He says the hearing will aim to find out whether the development of MCAS was rushed.

Worth noting Mr Muilenburg is here alongside John Hamilton, vice president and chief engineer of Boeing. who Mr Wicker says will answer questions of a technical nature.

Here are the key promises Mr Muilenburg will make

From Boeing’s statements, these are the changes that Mr Muilenburg will promise following the crashes:

Watch live

You can follow proceedings live via the US Senate website here: Aviation Safety and the Future of Boeing’s 737 Max

Or via CNBC:

Boeing promises software improvements

From that letter: Mr Muilenburgsaid Boeing made adjustments to address problems with its MCAS system, which were highlighted by Indonesian investigators last week.

While the Ethiopian Airlines accident is still under investigation by authorities in Ethiopia, we know that both accidents involved the repeated activation of a flight control software function called MCAS, which responded to erroneous signals from a sensor that measures the airplane’s angle of attack.

Based on that information, we have developed robust software improvements that will, among other things, ensure MCAS cannot be activated based on signals from a single sensor, 2 and cannot be activated repeatedly. We are also making additional changes to the 737 MAX’s flight control software to eliminate the possibility of even extremely unlikely risks that are unrelated to the accidents.

The company says:

The Maneuvering Characteristics Augmentation System (MCAS) flight control software function has been updated to provide additional layers of protection, including:

Read Mr Muilenburg’s prepared statements in full

The Boeing chief executive’s full opening statements can be read here: Opening statement of Dennis Muilenberg

Failure to disclose messages likely to come under scrutiny

A key point for today’s hearing is likely to be Boeing’s apparent failure to disclose messages sent between its employees related to the investigation into the crashes. My colleague LaToya Harding reported earlier this month:

Boeing has been criticised by US aviation regulators for withholding “concerning” communication between two employees with information on the 737 MAX investigation.

The Federal Aviation Administration said the troubled aircraft manufacturer discovered instant messages “some months ago” but failed to disclose them until this week.

The 737 Max has been grounded worldwide since March after two fatal crashes killed 356 people.

In a letter to Boeing chief Dennis Muilenburg, FAA Administrator Steve Dickson said: “Last night, I reviewed a concerning document that Boeing provided late yesterday to the Department of Transportation.

“I understand that Boeing discovered the document in its files months ago. I expect your explanation immediately regarding the content of this document and Boeing's delay in disclosing the document to its safety regulator.”

Grounded

The commercial impact of the crashes has already been big: with no airline expecting flights to continue sooner than next year at the earliest, carriers have had to absorb big losses from leaving their aircraft grounded.

During the second quarter, Boeing took a $4.9bn charge to fund compensation for airlines impacted.

Speaking to CNBC earlier today, Republican Senator Roger Wicker said the planes receiving new regulatory approval soon was “within the realms of possibility”. Boeing hopes they can be re-approved by the end of the year.

Even if the planes do get clearance to take to the skies again, airline will face big costs to get the planes operational again, including retraining pilots.

Muilenburg declines to say whether he will resign

Speaking to reporters ahead of the hearing, which will kick off in just under 20 minutes’ time, Mr Muilenburg declined to say whether he will resign following the two fatal crashes.

Saying he was focused on safety, and offering to condolences to the victims of the 346 people killed during the crashes, he said:

I’m focused on the job at hand.

Coming up: Boeing chief executive to face hearing over mistakes that led to two fatal crashes

At 2pm, Boeing chief executive Dennis Muilenburgwill appear in front of the US Senate Commerce Committee, who will grill him on the missteps that led two fatal crashes involving the firm’s 737 Max aircraft that killed nearly 350 people.

Mr Muilenburg, who was stripped of his title as Boeing chairman earlier this month, released his opening testimony ahead of his first appearance today. In it, he said:

We have learned and are still learning from these accidents, Mr Chairman. We know we made mistakes and got some things wrong.

The chief executive has will testify further tomorrow, in front of a Congressional panel whose chair has phrased the subject of the hearings as:

How the hell did this happen?

So, how did it?

Two successive crashes involving the 737 Max – one a year ago today, the second less than five months later, on March 10 2019 – have triggered a major scandal for the company, which is one of America’s corporate poster children.

As details of the accidents have slowly trickled out since, it has become increasingly clear that the planes’ Maneuvering Control Augmentation System (MCAS) lay at the heart of issues.

In simple terms, MCAS was being repeatedly activated when it was not needed by an overly-highly-attuned nose-cone sensor. Once the system kicked in, it forced the plane into a downwards trajectory. Investigators in Indonesia blamed the system, alongside maintenance errors and a lack of pilot training, for the fatal crash on October 29 last year.

Reuters reports:

Boeing has admitted few mistakes since the two fatal crashes. Earlier this month, the FAA questioned why Boeing withheld instant messages from a former pilot for months that raised questions about MCAS.

In May, Boeing acknowledged it did not tell the FAA for 13 months that it inadvertently made an alarm alerting pilots to a mismatch of flight data optional on the 737 Max, instead of standard as on earlier 737s. The company insisted the missing display represented no safety risk.

The company’s shares have been impacted by the crashes, but in the longer-term they are still near record high levels.

Today, however, may be less about the future of the company itself, but rather about who knew what, and when.

Office for Budget Responsibility plans new UK economic forecasts next week

The Office for Budget Responsibility, the UK’s fiscal watchdog, has said it will publish a new forecast for the UK economy next Thursday, despite the Government cancelling plans for a November Budget.

In a letter to Sir Tom Scholar, permanent secretary at the Treasury, OBR chair Robert Chote said recent changes in the economy, as well as the new Brexit deal, meant a re-assessment of the road ahead is required. The OBR said:

Given the importance of these changes for public understanding of the baseline against which the Government will wish to judge its fiscal policy options, we believe that it would be useful to explain publicly the impact that these changes would have had on our March forecast.

You can read Mr Chote’s full letter here

The watchdog’s most recent assessment said the UK would enter a recession if a no-deal Brexit occurs.

General Motors takes near-$3bn hit from strikes

From Industry Editor Alan Tovey:

General Motors has put a $2.9bn price-tag on the six-week week strike it recently endured, the US carmaker said as it posted a quarterly update.

Staff walked out on September 16 in a row over pay and hiring conditions, which ended last week after 49,000 agreed to a new four-year deal. Only two weeks of the strike – the longest suffered by a major US carmaker in 50 years – ran into GM’s third quarter but it still knocked $1bn off the company’s profit for the period.

The company said the full cost of the strike was likely to be almost three times that amount as it said it made $2.35bn, or $1.60 per share, during the quarter, with the industrial action knocking off 52 cents from per share of earnings. Revenue fell 0.9pc to $35.5bn, ahead of analyst forecasts of $35bn.

African bank pulls London float

The African Export-Import Bank blamed “unfavourable market conditions” as it postponed its planned flotation on the London Stock Exchange, my colleague Michael O’Dwyer reports. He writes:

The float by the pan-African trade finance group – more commonly known as Afreximbank – could have served as a confidence boost for a market that has struggled to generate fresh company listings this year.

Afreximbank had not publicly set a target valuation for its listing but its assets have a current book value in the region of $2.7bn (£2.1bn).

“Despite significant interest in the bank from investors, in light of unfavourable market conditions, it has decided to postpone the proposed initial public offering at this time,” the bank said.

Heavyweights drag on FTSE 100

On a pretty bleak-looking FTSE 100, several heavyweights are providing a substantial amount of drag.

It’s a poor day for lenders, with HSBC dropping for a second session after announcing its profits had slumped yesterday. Barclays and Lloyds are also doing poorly – their drops aren’t massive, but because of the size of both firms the impact is fairly large.

It’s a similar story for the UK’s biggest listed company, oil giant Royal Dutch Shell – both its share types (it is listed twice because of its structure) are down today. Investors may be growing more nervous about Shell’s third-quarter results, due on Thursday, following BP’s fall today.

There’s no pain relief coming from the pharma sector, either: AstraZeneca and GlaxoSmithKline have both fallen today.

There aren’t any standouts among risers on the blue-chip index, although British Airways-owner IAG is up about 1.4pc ahead of results on Thursday.

FTSE 100 extends losses

The FTSE 100 is now down about 0.9pc, as the pound sheds its losses on the back of news from Westminster.

The blue-chip index, which contains many internationally-focused companies that benefit from a weak pound, is underperforming the FTSE 250 currently.

The mid-cap index, which contains more domestic firms, has outperformed its blue-chip sibling in recent months as hopes of a Brexit breakthrough have grown, also lifting the pound.

Copper price rises amid protests in Chile

The price of copper has been steadily rising over the past few days, amid demonstrations against against President Sebastian Pinera, a centre-right billionaire, whose popularity is at an all-time low amid inequality protests and allegations of human rights abuse.

The country is the top producer of copper, which is highly demanded by manufacturers around the globe. Its price has been a a two-year low recently, however, as a result of worries about a trade war and a global economic slowdown.

Here are some photos from the recent protests:

Pound whipsaws back to flat after election announcement

After reeling back the day’s losses following Labour’s confirmation that it will support a December General Election, the pound is now hold slightly down on the day.

In the bigger scheme of things, it has looked very flat for the past three sessions.

Hunting leads FTSE 250 fallers

Energy services firm Hunting is the biggest faller on the FTSE 250 currently, after warning its full-year earnings would land at the “lower end” of its expectations due to pressure from trading conditions and a US slowdown.

In a update, the group said:

...challenging markets continue to be a feature of our industry, negatively impacting trading conditions and results in September. In particular, a slow down within US onshore completions has continued which has been partially countered by ongoing improvements within our offshore and international operations, resulting in a net overall decline for the Group profit in the quarter compared to Q1 and Q2 2019.

It added profit for the third quarter would also be weaker than the first and second quarters.

As Labour says it will support an early General Election...

...you can follow the latest political updates here:

Brexit latest news: Labour will back December election as Jeremy Corbyn says condition for taking no-deal off the table has been met

Why did Labour change its mind overnight about backing a pre-Christmas pre-Brexit election? All down to the Scottish nats.

"There was a worry is SNP will go for any date and we can’t be seen to resist," said one official close to the shadow cabinet.— Sebastian Payne (@SebastianEPayne) October 29, 2019

As predicted yesterday when shadow cabinet ministers admitted Labour was “snookered”, Corbyn U-turns spectacularly to back a December election. This afternoon’s Commons dust up will now all be about amendments to decide the date and terms. pic.twitter.com/uiz4P65Mj0

— Tom Newton Dunn (@tnewtondunn) October 29, 2019

Question remains - what day in December?

Depends if SNP/Lib Dems table amendment, but Labour appears comfortable with December 11th or 12th.— Daniel Hewitt (@DanielHewittITV) October 29, 2019

Sterling holds above $1.28 as election looks almost certain

With the latest reporting...

CONFIRMED - Labour IS backing an election - story coming

— Dan Bloom (@danbloom1) October 29, 2019

BREAK: DEC ELECTION is on.

Corbyn says his conditions for taking No Deal off the table has now been met. And Labour is backing election. Labour: “We will now launch the most ambitious and radical campaign for real change our country has ever seen”— Beth Rigby (@BethRigby) October 29, 2019

...suggesting a General Election will be confirmed this afternoon, December 11 seems to be the date consensus is pooling around:

Govt Bill says 12 Dec as polling date, but will probably vote in favour of amendment moving that to 11th

Then govt seen to compromise, and LDs/SNP can claim a win & haven't done GE on govt's terms

All about optics...— Michael Brown (@MrMBrown) October 29, 2019

Sterling has slipped slightly today as a new vote – and the uncertainty that entails – grows ever-more likely, but has held above $1.28 despite downwards pressure.

Deloitte partner hit with £120,000 fine over Serco audit failures

Another sordid tales from the world of bean-counting, via my colleague Harriet Russell:

The accounting watchdog has slapped a Deloitte partner with a £120,000 fine for misconduct in the audit of outsourcer Serco’s UK business seven years ago.

The Financial Reporting Council (FRC) said Ross Howard failed to exercise “professional scepticism” when combing through the financial accounts in 2012, which resulted in Serco understating profits from its electronic monitoring contracts with the Ministry of Justice (MoJ).

In 2013 Serco paid a £70m settlement to the MoJ over allegations that it charged for tagging people who were either dead, in jail, or had left the country, and later went on to make a further £23m settlement with the Serious Fraud Office (SFO).

Read more on audit: Every FTSE 100 company is audited by a Big Four firm, research shows

BP shares extend losses

Shares in oil giant BP have fallen as much as 3.3pc following this morning’s results, with investors growing more negative as detail of the oil giant’s plans emerge.

The group’s chief financial officer Brian Gilvery has been speaking to investors this morning, providing further information on the company’s plans. Some key points:

BP is unlikely raise its dividend in 2019

The company will continue to make asset disposals in the fourth quarter and 2020 as part of restructuring efforts

The company’s Raven drill project in Egypt is expected to begin by the end of the year

BP is the UK’s fourth-largest listed firm, so even a few percentage points off its share price is putting a big drag on the FTSE 100 overall, which is currently down about 0.5pc.

A fall may look bad for the blue-chip index overall, but investors may focus on other details instead, said eToro’s Adam Vettese:

...when it comes to BP, which is at the mercy of the price of oil to a certain degree, the value to its shares are almost of secondary importance. Instead, most people are attracted to the generous 6.5pc dividend it pays. In fact, its shares are barely 14pc higher than they were five years ago.

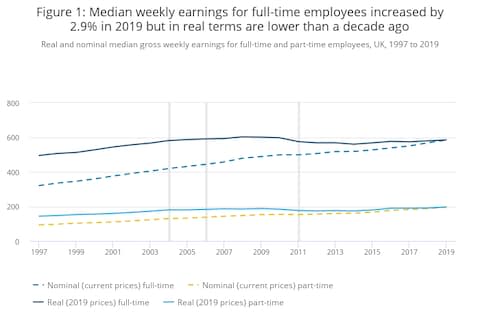

Women’s peak age for earnings increase for first time

Data released by the Office for National Statistics this morning shows that weekly earnings for women during the year to April peaked among those aged 40 to 49, the first time on record that 30 to 39 has not been the top-earning bracket.

The gender pay gap for full-time employees was 8.9% in 2019 https://t.co/UxpDCgS54Npic.twitter.com/naVx2dWQM1

— Office for National Statistics (@ONS) October 29, 2019

However, the figures also show the full-time gender pay gap widened slightly, from 8.6pc in favour of men in 2018 to 8.9pc.

Among other findings in its annual employee earnings report, the ONS highlighted:

You can explore the pay gaps within certain professions using the tool below (from the ONS):

The ONS notes on the data above:

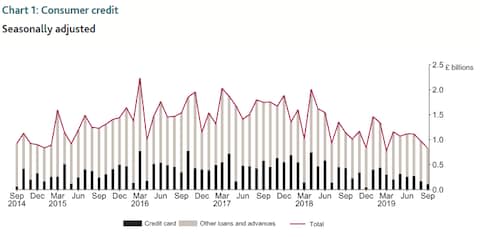

Consumer credit muted

Credit card borrowing fell to its lowest level this year, and overall consumer credit growth was the lowest in five years, as the demand for debt in the UK remained lukewarm.

The latest figures from the Bank of England, which cover a variety of areas (including the mortgage figures I highlighted in my 9:36am post), suggest a muted mood among consumers.

Here are the key points Bloomberg has highlighted from a slew of data released by the Bank this morning:

Round-up: Gupta slams critics, the battle over rare earth materials, price comparison site warning

Here are three things to read this morning:

Steel billionaire Sanjeev Gupta hits back at ‘ridiculous’ critics as he unveils radical shake-up: Entrepreneur Sanjeev Gupta has branded critics “ridiculous” for questioning the finances of his Liberty steel empire, as he unveiled a radical bid to unite it as a single global business.

Rare earths: How Teeside and a mine in Vegas hold the key to ending China's grip on electric vehicles: Part 2 of our week-long series on electric vehicles looks at the battle to find rare earth elements required to power mass adoption.

Why buying insurance on price comparison websites could invalidate your claim: Customers buying home insurance through price comparison websites may have their claims rejected by insurers through no fault of their own.

Mortgage approvals steady in September

Approvals for mortgages were steady in September, slightly beating predictions, according to new data released by the Bank of England.

That’s a sign that people kept borrowing despite severe uncertainty over the global economy and – probably more pressing – Brexit.

Market gloom hits mid-caps

With the FTSE 100 slips behind its continental peers and the pound also weakening, anyone hoping for some mercy for the mid-caps will be disappointed.

The FTSE 250, which is on track to fall over five of the seven sessions since last Monday, is down about 0.3pc currently, as UK-exposed stocks start to wane again.

A Brexit deal, which seemed tantalisingly close last week, now seems like a far-off dream once more as Parliament appears increasingly set to endorse a new General Election.

For companies, that will mean months more of struggling to plan as they wait for a clearer picture of what the UK’s future relationship with the EU.

Plus500 shares jump after earnings grow

Shares in spread-betting firm Plus500 have jumped this morning.

In an update to the City, the company said it has experienced a “strong improvement” in quarterly performance, with new customer numbers driven by “macro and geopolitical events”.

Its chief executive Asaf Elimelach said:

Like all operators in the sector, Plus500's performance for the remainder of the year is dependent, among other things, on financial market conditions providing sufficient trading opportunities for customers. However, we are encouraged by the continued improvement reported in Q3 and we remain on track to meet expectations for the year as a whole.

Plus500 said trading would be in line with expectations for the year.

The firm’s shares are still off around 40pc for the year to date.

Lam: Hong Kong likely to have entered recession amid protests

Hong Kong chief executive Carrie Lam has issued a fresh warning that the territory is likely to record negative growth for the third quarter when its reports GDP figures on Thursday.

Ms Lam said the Hong Kong government would deliver more relief measures to offset pressure from months of major pro-democracy protests in the country against a controversial Chinese extradition law.

A technical recession, defined as two consecutive quarters of negative growth, would arrive as the the Asian financial hub’s tourism and retail sectors slump.

Ms Chan said the protests has dealt a “comprehensive” blow to the Hong Kong economy. Her words came after a similar sentiment was shared by the territory’s finance secretary.

Hong Kong leader Carrie Lam says the city is likely to record negative growth in 2019. More here: https://t.co/IR5AWOhQB0pic.twitter.com/zTrAczytz8

— Reuters (@Reuters) October 29, 2019

House price growth stays tepid

While the Brexit imbroglio continues, the British housing market has remained fairly stagnant, with the latest figures from the Nationwide Building Society showing tepid price changes in October.

For the 11th month in a row, house price growth was below consumer price inflation – which is prompting many would-be sellers to sit on their hands.

#Nationwide report #UK#house prices up 0.2% month-on-month in October (fell 0.2% in September); year-on-year increase in house prices edged up to 0.4% in October from 8-month low of 0.2% in September; it was still only slightly above the near six-year low of 0.1% seen in January

— Howard Archer (@HowardArcherUK) October 29, 2019

Robert Gardner, Nationwide's Chief Economist, said:

Annual house price growth remained below 1pc for the 11th month in a row in October, at 0.4pc. Average prices rose by around £800 over the last 12 months, a significant slowing compared with recent years – for example, in the same period to October 2016, prices increased by £9,100.

Indicators of UK economic activity have been fairly volatile in recent quarters, but the underlying pace of growth appears to have slowed as a result of weaker global growth and an intensifying of Brexit uncertainty. To date, the slowdown has centred on business investment, while household spending has been more resilient.

You can read Nationwide’s full report here

Mixed open for Europe

Another mixed open across the continent , which the FTSE 100 – which narrowly grabbed gains at the end of yesterday’s session – underperforming.

The pound is slightly weaker this morning;

Tokyo shares hit highest close in a year

In Japan, the benchmark Nikkei index closed at its highest mark in a year, after seven successive sessions of gains.

The index added 0.47pc to reach its best close since October 10 last year.

Japanese stocks have been lifted by rising optimism about US-China trade talks, and aided further by a stable yen.

Tokyo’s Topix index, which is broader, closed up 0.86pc.

BP slides to a loss amid low oil prices and storms

Low oil prices and storms in the Gulf of Mexico combined to push BP to a third-quarter loss, my colleague Michael O’Dwyer reports. He writes:

The oil major reported a pre-tax loss of $25m (£19.4m) against a profit of $5.4bn in the same period last year. Revenues fell 14pc to $68.3bn from $78.5bn a year earlier.

The company has been seeking to reshape its business by jettisoning some of its assets and preparing for a lower carbon future.

BP boss Bob Dudley, who will be replaced by Bernard Looney early next year, said:

BP delivered strong operating cash flow and underlying earnings in a quarter that saw lower oil and gas prices and significant hurricane impacts.

Read more here: Storms and low oil prices push BP to a loss

Despite the fall, that result appears to be ahead of analysts’ estimates.

The loss sets the stage for a week of reports from oil majors, which are all expected to have come under pressure over the past quarter due to the falling oil price – but look for potential pressure on Royal Dutch Shell shares when markets open if investors were caught by surprise.

Agenda: For stock markets, the only way appears to be up

Good morning. Asian stocks hit a three-month high overnight following a record-breaking day on Wall Street amid raised hopes of an imminent trade deal and the expectation of a further rate cut from the Federal Reserve this week.

Elsewhere, Boris Johnson's government will make another attempt this evening to secure a December general election after it failed to win the necessary number of votes in Parliament yesterday to go to the polls.

5 things to start your day

1) The number that shows Google's search engine slowing down at a worrying rate: Financial results released by Google's parent company Alphabet showed that paid clicks on its search engine - a crucial measure of growth - had grown by just 18pc year-on-year in the third quarter of the year. A year ago, growth in paid clicks was 62pc.

2) Britain has millions more graduates – so why has the economy got so little to show for it? “Education, education, education” ran Tony Blair’s slogan, and 22 years on from his first election victory his major target for university entrants has finally been hit. Was it worth it?

3) The accounting scandal surrounding Goals Soccer Centres has deepened after the five-a-side operator called in fraud investigators. Evidence has been handed over to the Serious Fraud Office (SFO) just days after the company’s stock was delisted from the London Stock Exchange amid problems with its accounts.

4) Which car makers will survive the electric revolution? The car industry is bracing for more over the next few years than it has experienced in the past century as the electric revolution combines with the advent of self-driving technology and other innovations such as vehicle sharing systems.

5) Former Skyscanner and Just Eat backer Vitruvian Partners has won the race to buy Sykes Cottages in a deal worth £375m. The sale seals a healthy return for City investment firm Livingbridge, which bought Sykes in 2015 for £54m. Sykes’ portfolio of holiday homes has grown from around 5,000 to 17,500 in the last five years.

What happened overnight

Asian shares rose to a three-month peak on Tuesday after Wall Street hit all-time highs amid hopes of progress in US-China trade talks and the expectation that the Federal Reserve will cut interest rates later this week.

Japan's Nikkei led the way with a rise of 0.5pc to reach ground last trod a full year ago, while Shanghai blue chips dithered either side of flat.

US President Donald Trump said on Monday he expected to sign a significant part of the trade deal with China ahead of schedule but did not elaborate on the timing.

In Hong Kong, the Hang Seng index dropped 0.4pc percent, or 106.68 points, to 26,784.58.

Coming up today

Don’t count on “anything revolutionary” from BP’s third quarter results today, says Nicholas Hyett, of Hargreaves Lansdown. With chief executive Bob Dudley preparing to hand over the reins of the firm in February, the results should be free of surprises, so investors will be focusing on the company’s fundamentals instead.

With oil prices a little lukewarm, the company’s write-downs and asset divestments have been forcing it to accumulate more debt that it had planned. Production and cash generation will be in focus, with the former likely to have been affected by hurricanes in the Gulf of Mexico.

Barclays analysts say the energy giant is on track to meet its 2021 targets, but has a continued fight on its hands over its role in the face of climate change activism.

Interim results: Bloomsbury Publishing, BP, Coca-Cola European Partners

Trading statement: Hunting, Riverstone Energy, Standard Chartered Economics BoE consumer credit and mortgage approvals (UK)

Yahoo Finance

Yahoo Finance