Pound rebounds after hitting 10-year low against euro on no-deal warning: as it happened

Sterling drops to post-financial-crisis low against common currency after think tank says MPs may not be able to stop UK leaving EU without a deal

Currency has been declining for months as traders fret over dangers of no-deal

Global economy shows continued warning signs

Brexit means breakfast? Why bacon will be off the menu after no-deal (but thankfully there's a sausage surplus)

The pound dropped to a 10-year low against the euro early this morning, as traders in Asia absorbed a report that said MPs may be unable to prevent a no-deal Brexit outcome.

Sterling reached an intraday low of €1.0724 just after midnight, according to Bloomberg data. The drop landed beneath its previous post-Brexit vote nadir, in August 2017, to hit a 10-year low.

Fortunes reversed later in the day, with the pound mounting a strong comeback against the common currency as UK trading began. Sterling was up against the euro late on Monday morning.

Britain’s Brexit paralysis has dragged on markets in recent months. The pound has repeatedly found fresh 31-month lows over the past fortnight, as ramped up no-deal rhetoric, global market worries and shock data on Friday that showed the UK economy contracted in the second quarter all added to the pressure.

A report by the highly-regarded Institute for Government think tank, released late on Sunday, said “time is running out” for MPs who oppose a no-deal Brexit to prevent the Government from pulling the UK out of the EU without a deal at the end of October.

Markets.com’s Neil Wilson said: “the combination of a slowing economy, global economic weakness, the increasing chance of a cut to interest rates and the risk of a no-deal Brexit will continue to anchor sterling.”

He added: “No-deal talk is the biggest concern — remove that and we get a big bounce even with the economic and monetary risks.”

Wrap-up: Pound problems continue as Hong Kong protests begin to reverberate more loudly

European indices all closed gently in the red, capping off a fairly muted day on the markets so far — but one that looks set to turn more ugly once Hong Kong trading begins again.

The pound actually had one of its better recent days, but an early-morning blip was enough to vault the August 2017 sticking point against the euro it had been threatening to pass for days.

The next big break points are further away, but with no discernible change in tone from Downing Street or the EU, there’s little reason to expect the decline will be arrested.

If there’s one thing markets have shown in the past couple of weeks, it is that the summer’s comparative silence has made things very sensitive. Global equities proved themselves to be a powder keg over the past two weeks, but Donald Trump isn’t the only one hold a match. Protests in Hong Kong, particularly if they draw in China — as looks increasingly likely — might be the spark that blows things wide open again.

That’s all for today. I’ll be back tomorrow with the latest news on business, markets and economics, as we await UK wage growth figures. For the latest news, following Telegraph Business on Twitter.

Full report: Britons are wealthier and happier, but are getting more worried

Deputy economics editor Tim Wallace has put together a full report on those ONS figures on household finances and happiness from earlier. He writes:

Happiness, satisfaction and the feeling that the things done in life are worthwhile are on the rise, according to the Office for National Statistics.

However, even as individuals feel better and more prosperous on average, there is simultaneously a widespread conviction that the wider economy is worsening.

Worries about rising unemployment are at a six-year high. Expectations of the economy’s performance over the next year have not been this gloomy since 2011.

You can read more here: Richer, happier and better paid — but Britons still think the country is getting worse

Wall Street firmly in the red

With markets having been open for just over an hour now, US indices are sticking to their losses, while Europe looks fairly flat. The Dow Jones Industrial Average is off 0.7pc.

At lot of attention is being focused on a Goldman Sachs report that warned the country could be headed for a recession, while traders continue to be worried by the trade war — especially after Donald Trump hinted on Friday that talk with China may not proceed next month.

Mr Trump hasn’t tweeted in the past few hours, so we’re less in sync with his current thoughts on the situation that we often are. What we do know, however, is that President had a phone call with Boris Johnson earlier, during which they discussed Brexit and trade.

Pound ‘will be praying for a strong wage growth figure’ tomorrow

The pound is hovering at around 0.1pc up against the euro and the dollar after this morning’s lows.

Spreadex’s Connor Campbell says strong figure in tomorrow’s wage growth report could help the currency — for a while, at least. He writes:

Desperately searching for a bit of good news, the pound will be praying for a strong wage growth figure on Tuesday, even if any positive headlines not related to Brexit are merely a plaster where emergency surgery is needed.

Movers: Tullow Oil shines as Sirius Minerals heads deeper underground

With most of the day’s stock movements looking pretty settled, let’s look at some of the day’s risers and fallers:

FTSE 100

Up

Reckitt Benckiser: The consumer goods company is up 1.2pc currently, after Liberum analysts praised its joint venture strategy as “driving sustainable, top-line growth”.

SSE: The utility firm said in Saturday it is in discussions to sell its UK domestic energy business, something which Jefferies analysts welcomed. Shares are up 1pc.

Down

NMC Health: The Abu Dhabi-based hospital operator is hurting again after feeling off most of last week. It had initially risen after confirming it would deliver in line with guidance. Shares are down 4pc.

Rolls-Royce: The engineering giant is facing further worries after parts from one of its troubled Trent 1000 engines appeared to drop from a jet taking off in Rome. Shares are down just under 4pc.

Burberry: The luxury good retailer is suffering amid disruption in Hong Kong, which is a key market for its goods. It is down 3.3pc.

FTSE 250

Up

Tullow Oil: Tullow has revealed a “potentially transformational” oil discovery off the coast of Guyana, causing the value of its partner in the country — Aim-listed Eco — to almost double. Tullow itself is up 20.5pc.

Acacia Mining: The Tanzania-focused miner has been given permission to resume exports for its North Mara gold mine. Tanzanian authorities had ordered production to stop while they undertook an investigation into its operation. It is up 2.7pc.

Down

Sirius Minerals: The company is under immense pressure as plans to build a fertiliser mine in North Yorkshire hang in the balance. Shares are 13.6pc down.

Intu Properties: The landlord has slipped further after RBC analysts said they had made “large negative revisions” to their forecast for the company amid a tough retail climate. Shares are 7.4pc down.

Argentine markets rocked by shock election outcome

The Argentine peso shed a quarter of its value against the dollar at the beginning of trade today, as investors reacted to President Mauricio Macro’s thrashing by populist rival Alberto Fernandez in a primary election.

With nearly all votes counted, Mr Fernandez and his running mate, former President Cristina Kirchner, had 48pc of the vote to Mr Macri’s 32pc.

It is now thought likely that Argentina will swing back towards to intervention-heavy style of leadership Ms Kirchner favoured, spooking traders and devastating its bond market.

ARGENTINE PESO OPENS 24.45% WEAKER AT 60 PER US DOLLAR AFTER MACRI'S POOR PERFORMANCE IN SUNDAY PRIMARY ELECTION - TRADERS

— Quantitative Trading (@fiquant) August 12, 2019

And there goes Argentina's bonds... ��https://t.co/8FDlENjjW6 via @businesspic.twitter.com/G07Pcl0Bpd

— JP Spinetto (@JPSpinetto) August 12, 2019

Yuan: having a bit of a month lads

Pound: tell me about it

Peso: Sostenga mi cerveza https://t.co/eP94xHeU4o— Mike Bird (@Birdyword) August 12, 2019

What are the next milestones for the falling pound?

Sterling’s steady decline led it to touch a 31-month low against the dollar, and a 10-year low against the euro earlier today. Here are the next milestone figures it might reach:

Versus the dollar

Today’s low: $1.2015 (12:29am)

Recent low: $1.1984 (16th January 2017 — as Theresa May set out her Brexit strategy)

Post-Brexit low: $1.1752 (7th October 2016 — the ‘flash crash’)

All-time low: $1.05520 (29th March 1985 — a huge dollar climb reaches its zenith)

Versus the euro

Today’s low: €1.0724 (12:45am)

All-time low: €1.0201 (31st December 2008 — end-of-year trading movements at the height of the financial crisis)

Eve Sleep looks to get in bed with rival Simba

From my colleague Harriet Russell:

Mattress maker Eve Sleep has suspended its shares after confirming “very early stage discussions” with rival Simba over a potential merger.

It said any potential deal would see the smaller company, Eve, takeover the larger private company Simba, making it a reverse takeover. Suspension of the shares is necessary as Eve draws up a possible admission document laying out the terms of the deal.

Troubled fund manager Neil Woodford remains the company's largest shareholder with a 31pc holding, as per Bloomberg data, followed by fund manager Ben Whitmore at Jupiter who inherited a 15pc stake via the Omnis Income and Growth fund mandate.

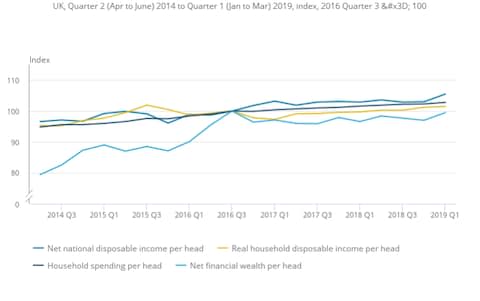

For a reminder of how the pound is looking over the long term...

...here’s sterling charted against the dollar and euro over the past five years.

Virgin Atlantic says it expects to be able to land flight from Heathrow in Hong Kong tonight

The latest advice from Hong Kong’s international airport according to Virgin Airways is that landings will be able to operate from tonight, Bloomberg reported.

The airline believes its 9:50pm service to Hong Kong will not be impacted because the focus of protests is in the airport’s departure lounges.

Virgin told passengers to check its website for the latest information.

Last flight landing in about an hour. Once those passengers are out, I don't imagine the police are planning on leaving the protesters as they have so far pic.twitter.com/itUGZIxrFY

— Mike Bird (@Birdyword) August 12, 2019

Update: City Watchdog confirms it is looking into Burford ‘short attack’

As the saga around short-seller Muddy Waters Research’s brutally effective bear attack on litigation funder Burford Capital continues to unfold, the Financial Conduct Authority has confirmed it has an eye on matters. Harriet Russell and Michael O’Dwyer have updated their report:

Hong Kong unrest: UK spokesperson says international rules ‘must be upheld’ as stocks look set to slump

The UK Government has expressed its concern over the situation in Hong Kong, where protestors have shut down the city’s main airport as part of ongoing pro-democracy action.

A spokesperson said: “We are clear that international rules must be upheld,” including those contained within the Chinese/British declaration that produced Hong Kong’s current constitutional framework.

China has ramped up its criticism of the protesters today, and there are increasing fears that armed forces from the mainland might become involved in efforts to suppress marchers. The Telegraph reports:

China’s Hong Kong and Macau Affairs Office claimed terrorist acts on the part of protesters. A spokesperson said at a press conference that “radical protesters frequently used extremely dangerous arms to attack the police, which were serious criminal acts and also showed traces of terrorism .”

It spells bad news for Hong Kong’s stock markets. The Hang Seng Index, the financial hub’s top bourse, is down 1pc currently on futures trading (which shows bets traders are placing on its future price).

ONS: Economic sentiment falls even as household finances improve

The latest iteration of the Office for National Statistics’s ‘Personal and economic well-being in the UK’ report has been released this morning.

It shows that while most people’s personal finances have improved over the past quarter, most Brits’ sense of well-being has barely altered, and general sentiment about the economy is worsening.

The statistics agency said:

Net financial wealth per head increased by 3.0pc for the quarter ending March 2019 compared to the same quarter a year ago, led by increases in equity and investment fund shares...

Expectations for higher unemployment for the year ahead have been climbing and are now higher than at any point for the past five and a half years.

You can read the ONS’s full report, complete with interactive charts, here.

Gold back above $1,500 spot

One of the big winners from recent turbulence on the markets has been gold, which has seen its value soar as traders flock to safe-haven assets that appear sheltered from global trade headwinds.

Gold has been dancing either side of $1,500 an ounce in recent days, and is currently on the sunny side despite a dip this morning. The price is 6.5pc up since mid-July.

Trade turmoil washes off Clarkson

Shipbroker Clarkson revealed increases sales and profits in its first-half results this morning, despite nerves prompted by global trade tensions. Mason Boycott-Owen writes:

Clarkson chief executive Andi Case said that the company’s financial services division had a “particularly challenging first six months” as capital markets were hit with low investor confidence. He also noted the freight market for dry cargo was “a huge disappointment” during the period due to disruptions in the supply of iron ore, used to make steel.

You can read Mason’s full report here: Clarkson weathers global trade trouble to post rising profits

Marks & Spencer leads FTSE 100 risers

That European stocks rally had turned into a retreat, with the continent’s top indices now just clinging on to the day’s gains. The FTSE is down 0.2pc, with banks and industrial companies weighting most heavily.

The blue-chip index’s second-biggest riser currently is Marks & Spencer, with the food and fashion retailer up about 1pc. In a research note this morning, Barclays analyst James Anstead said a new trial store with a greater emphasis on food was a “promising start”. Narrowly ahead of M&S is consumer goods giant Reckitt Benckiser,

Burford Capital denounces ‘market manipulation’ after short seller attack

Litigation funder Burford Capital, which was savaged last week after a US-based hedge fund criticised it in a report and bet against its share price, has hit back against its attacker.

The AIM-listed company, long a darling of investors, said in an announcement this morning it believes it has found evidence of trading “consistent with illegal market manipulation” related to the incident, which sent its shares down as much as 65pc during Wednesday’s trading.

My colleague Michael O’Dwyer reports:

In a detailed stock exchange filing, Burford set out details of trading activity in its shares following a “forensic examination” of data released by the London Stock Exchange, led by a professor at Columbia University.

It honed in on specific minutes on Tuesday and Wednesday of last week during which a high number of trading orders were cancelled, which it said demonstrated practices known as “layering” and “spoofing” - hallmarks of attempts to artificially drive down a share price.

Muddy Waters immediately hit back, saying that “the only manipulation is that of Burford’s return metrics, accounts, and disclosures”.

You can read Michael’s full report here: Burford alleges ‘market manipulation’ after share price collapse

And you can read our interview with Muddy Waters founder Carson Block here: Muddy Waters boss says dismisses Burford response to short-selling attack is ‘exactly by the playbook’

FTSE left behind as European markets rise

The major eurozone indices are mostly up today after Friday’s slump, with the FTSE staying flat as a heightened pound pressures exporters. As of about 15 minutes ago:

The FTSE 100 was 0.06pc down at 7,250.05

France’s CAC 40 was 0.14pc up at 5,335.86

Germany’s DAX was up 0.28pc at 11,727.65

Spain’s IBEX was down 0.12pc at 8,747.90

Italy’s FTSE MiB was up 0.18pc at 20,363.33

Hong Kong cancels all flights as protesters overrun terminal building

Airport authorities in Hong Kong has suspended all flights for the rest of the day, as thousands of black-clad protesters occupy its arrival area today.

Shares in the territory’s main airline, Cathay Pacific Airways, have hit a 10-year low today following reports that some of its staff joined the protests, sparking a backlash in China.

Protesters have been rallying for months against a controversial new extradition bill, using flash mobs as a disruptive tactic in recent days as violence between police and demonstrators escalates.

China has become increasingly critical of the protests in recent weeks.

Breaking: Hong Kong airport cancelling all flights for the rest of the day, and advising public to stay clear of the airport. Meanwhile China says HK has come to "critical juncture" and says HK shows sign of terrorism

— Lulu Yilun Chen (@luluyilun) August 12, 2019

Sterling makes gains against the euro

Following the fresh low reached this morning, the pound has sharply risen against the euro since London trading began. It’s now up 0.3pc on the day, about halfway back to where it stood at the start of last week.

The long-term trend, however, is still one of a pretty sharp decline:

Are US/China trade relations at a breaking point?

Markets capped off a volatile week with a drop on Friday, with fresh political problems in Italy and a economic contraction in the UK feeding bad sentiment across the continent.

This week had begun with a sharp shock after a rapid devaluation of the yuan on Monday morning, which prompted Donald Trump — and, later, the US Treasury — to accuse China of currency manipulation.

Things had cooled down by the weekend, but the wobble indicated trade tensions between the US and China are potentially entering a new phase: a currency war.

Economics correspondent Tom Rees has taken a closer look at the clash. He writes:

This week, Beijing allowed the Chinese yuan to slump past the symbolically important seven per dollar mark. It was interpreted as a warning shot that signalled Beijing’s willingness to use the dark arts of currency manipulation to gain the upper hand in the trade war. Devaluing its currency helps to offset the impact of Trump’s fast-growing list of US tariffs on Chinese goods.

You can read his full report here: As the global currency war heats up, have US-China tensions reached the point of no return?

Round-up: The business stories you should read to start your week

If you’ve just returned from an August getaway, or have been hiding from headlines, here are some of the top business stories from over the weekend:

Investors divided over HSBC board after Flint exit: HSBC’S biggest shareholders are divided over the bank’s next steps after its board stunned the City last week by ousting chief executive John Flint.

Thomas Cook seeks cash injection of £900m as it calls in bondholders: Thomas Cook is in discussions with its bondholders to inject £150m into the company on top of previously revealed plans for its banks and largest shareholder, Fosun, to pump in £750m as part of a rescue plan.

Slide in bond yields deepens fears of worldwide recession: Debt markets are flashing recession warning signs as sovereign bond yields slide at their fastest pace in years and the value of those in negative territory climbs to record highs.

And here’s something you might want to know more about: Biotech is big business in Cambridge, where a “perfect storm” of academic integration and corporate interest has created a booming, cutting-edge scientific scene. Hannah Boland has visited the Silicon Fen, and reports:

Cambridge is now home to around 430 life sciences companies – businesses, which according to Pitchbook, attracted $72m (£60m) in venture capital funding last year.

Sites such as the Babraham Research Campus, a Government-backed bioscience hub, and the Cambridge Biomedical Campus, where companies work alongside the university teaching hospitals, are almost at bursting point.

You can read her full report here: How biotech became part of Cambridge’s DNA

Agenda: Pound hits post-referendum low against euro on Brexit warning

Good morning. The pound reached a post-referendum low against the euro in Asian trading this morning, following a think-tank report that said MPs seeking to stop a no-deal Brexit have few options to do so.

Sterling hit €1.0724 at 12:45am this morning, according to Bloomberg data — undercutting its recent lowpoint, reached in August 2017, to hit a 10-year low.

It was the weakest the pound has been against the common currency since its historic lows during the financial crisis. It also hit a fresh 31-month low against the dollar.

The currency has recovered since, and is now standing solidly up on the day.

The latest fall came after the highly-respected Institute for Government released a report that poured cold water over several suggestions of how disorderly Brexit could be prevented.

Read more: Remainer MPs are fast running out of time and options to block a no-deal Brexit, says think tank

High streets feeling low

New figures from the British Retail Consortium say the number of empty shops on Britain’s high streets reached a four-year high last month.

Vacancy rates in town centres hit 10.3pc, following a series of high-profile collapses and problems for British retailers.

You can read retail correspondent Laura Onita’s full report here:

In the diary today...

Interim results: Clarkson

Trading update: Syncona

Economics: US mortgage delinquencies

Yahoo Finance

Yahoo Finance