Glencore shares plunge over 10pc after receiving subpoena from US DoJ relating to money laundering

Glencore shares plunge as much as 11pc after receiving US Department of Justice subpoena

Documents requested from US relate to possible corruption in Nigeria, the Democratic Republic of Congo and Venezuela

Merkel strikes deal to save German government; boosts European markets

Germany’s economy is dangerously unbalanced and may topple Merkel

Five ways the high street can save itself (and one way the Government can)

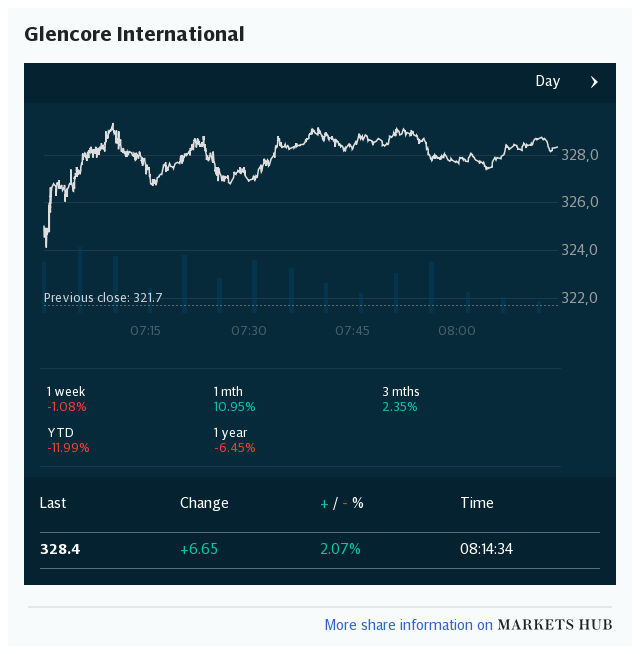

Shares in Glencore suffered their sharpest fall in over two years after the mining giant received a subpoena from the US Department of Justice demanding documents relating to possible corruption and money laundering.

The FTSE 100 company admitted that the documents requested by US authorities are regarding the company's activities in Nigeria, the Democratic Republic of Congo and Venezuela from 2007 to the present day. The subpoena sent the global miner's shares sliding 12pc to a one-year low.

City analysts warned that Glencore could face a lengthy probe and a huge fine. Department of Justice investigations typically take over fours years to complete and the largest fine handed to a company under a Foreign Corrupt Practices Act probe was $965m to Telia in 2017, Barclays noted.

The world's largest commodity trader could reportedly also face a UK probe over its business deals in the Congo. Bloomberg reported in May that the Serious Fraud Office was gearing up to investigate the mining mammoth's dealings with Israeli businessman Dan Gertler in the African country.

City analysts warn Glencore could face lengthy probe and huge fine

Glencore received notice from USA dept of justice regarding foreign corrupt practices in its Nigerian and DRC and Venezuela business. This is serious. Share down 13%

— Wayne McCurrie (@WayneMcCurrie) July 3, 2018

A probe by the Department of Justice could hang heavily over Glencore for years to come and cost the mining giant hundreds of millions of pounds, City analysts have warned.

Barclays highlighted that investigations typically take over four years to complete and the maximum fine issued to any company under a Foreign Corrupt Practices Act investigation was $965m to Telia in 2017.

The FCPA penalty guidelines state that for every violation of anti-bribery rules a company will face a fine of up to $2m while individuals could be hit with a $250,000 fine and up to five years in prison.

Pound flirts with $1.32 after construction sector growth hits joint one-year high

1. UK construction PMI up to 53.1 in June from May's 52.5. As per usual, residential construction was the best performing area. Markit reporting more new work in June and also builders getting their input purchases in the face of sharply rising prices. pic.twitter.com/TP4dzqSOsO

— Rupert Seggins (@Rupert_Seggins) July 3, 2018

The pound is flirting with the $1.32 mark against the dollar after the UK's construction sector in June enjoyed its best growth in a year.

IHS Markit's closely-watched PMI survey indicated that the sector continued to recover from its weather-battered first quarter with growth climbing to 53.1 (any reading over 50 indicates growth), a joint one year high.

The fastest rise in new orders since May 2017 underpinned the sector's acceleration but civil engineering projects continued to hold back growth.

Already on the rise this morning, the reading has lifted the pound to a 0.5pc gain against the dollar at $1.3190.

Glencore plunge halves FTSE 100's gains

New CDU/SPD deal on migration means much tougher regime on Austrian-German border. But Brussels insists there must be no regime whatsoever — not even cameras — on the Irish border.

— Andrew Neil (@afneil) July 2, 2018

Glencore shares are weighing heavily on the climbing FTSE 100 this morning.

The index's gains have been halved by the huge miner's 11pc tumble while the rest of European markets are buoyant after German chancellor Angel Merkel struck a deal over the migrant crisis to save her government.

The DAX in Frankfurt has jumped 0.8pc on hopes of Mrs Merkel's 13 years in power continuing while Europe's laggard, the FTSE 100, has gained just 0.3pc.

Glencore was reportedly also facing UK probe over Congo business deals

Oh wow. DoJ probe into @Glencore's dealings in Congo, Nigeria and Venezuela since 2007. Things just got serious pic.twitter.com/p19007keNO

— Tom Wilson (@thomas_m_wilson) July 3, 2018

Bloomberg claimed in May that the Serious Fraud Office is gearing up to investigate the mining mammoth's business in the Congo relating to its dealings with Israeli businessman Dan Gertler.

Mr Gertler held stakes in two of its copper miners until early last year, when he was bought out by Glencore. Mr Gertler has since launched a $3bn lawsuit in the Congo to recover money from royalties he claims he is owed.

The SFO at the time would not confirm or deny its interest, while Glencore and Mr Gertler’s representatives declined to comment on the claims.

Multiple countries included in Glencore subpoena indicates that 'a relatively thorough investigation' is under way

Glencore shares fall as much as 9% to lowest in a year after subsidiary receives subpoena from U.S. Justice Department "with respect to compliance with the Foreign Corrupt Practices Act and United States money laundering statutes." pic.twitter.com/YFp6Bp7dAo

— Jamie McGeever (@ReutersJamie) July 3, 2018

Glencore shares suffered their sharpest fall in two years after admitting that it has received a subpoena from US authorities.

The mining heavyweight's update to investors this morning is very light on detail but just the threat of a US probe into corruption in Nigeria, the Democratic Republic of Congo and Venezuela has been enough to send Glencore shares sliding 11pc.

RBC Capital Markets analyst Tyler Broda warned that the subpoena covering multiple countries suggests that "a relatively thorough investigation" is under way.

He added:

"The Foreign Corrupt Practices Act appears at first investigation to provide subject to sanctions, fines and penalties up to $25m or twice the gain or loss caused by the violation and imprisonment for up to 5 years per occurrence.

"We would expect that Glencore will use all legal means to defend itself and would highlight that there are no formal charges at this stage."

KPMG faces probe over collapsed Conviviality's accounts

KPMG faces an investigation by the accounting watchdog over its audit of accounts belonging to Conviviality, the alcohol retailer that spectacularly collapsed earlier this year.

The Financial Reporting Council said it was looking into the “big four” auditor’s work on Conviviality’s financial statements for the year to April 2017.

It is also investigating an individual member of the accountancy body ICAEW in relation to their preparation and approval of the company’s financial statements.

Read Jack Torrance's full report here

Glencore shares plunge 11pc after receiving subpoena from US DoJ

Shares in mining giant Glencore have plunged as much as 11pc in early trade after admitting that it has received a subpoena from the US Department Justice to hand over documents relating to corruption and money laundering.

The documents requested by US authorities relate to the company's activities in Nigeria, the Democratic Republic of Congo and Venezuela from 2007 to the present day.

In a short statement to the market this morning the company said it "is reviewing the subpoena and will provide further in due course as appropriate".

Agenda: Markets stabilise as Chinese stocks slide end and Germany swerves political crisis

Global markets have stabilised after German chancellor Angela Merkel stopped her government from breaking apart by striking a compromise deal over the migrant crisis and Chinese assets started to reverse their recent freefall.

Rebel interior minister Horst Seehofer withdrew his threat to resign from Mrs Merkel's government over the migrant crisis after the Germany chancellor agreed to tighten controls on the Austrian border by setting up transit centres for refugees already registered in other EU countries.

Meanwhile, the Chinese yuan and stocks in Shanghai have started to climb higher after suffering a two-week slump on trade war worries. Easing fears over political instability in Germany and the sell-off in China spreading helped European markets rally in early trade with the FTSE 100 climbing 0.3pc.

Interim results: St. Modwen Properties

Economics: Construction PMI index (UK), Factory orders (US), Durable goods orders (US), Retail sales (EU)

#China turbulence knocks Asian mkts to 9mth low as trade war fears grow. Shanghai Comp lowest in 28mths. Yuan slumped once again amid debate surrounding impact of escalating trade war & fear of contagion. US Treasury yields dipped. Euro steady after Merkel resolved migration cris pic.twitter.com/P5c5bcWpo9

— Holger Zschaepitz (@Schuldensuehner) July 3, 2018

Yahoo Finance

Yahoo Finance