What to watch: Over 5m new US jobless claims expected, Barratt CEO's pay cut, stocks rise

Here are the top business, market, and economic stories you should be watching today in the UK, Europe, and abroad:

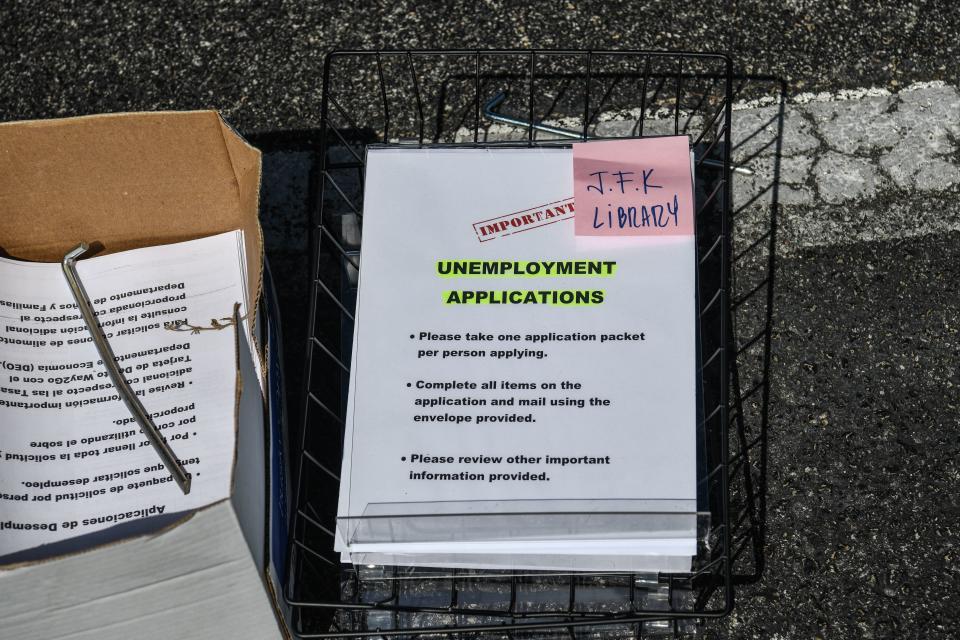

5.5 million extra US jobless claims expected

US jobless claims are expected to show millions more Americans out of work due to the lockdown aimed at curbing the coronavirus pandemic.

Initial jobless claims are due at 12.30pm and economists expect over 5 million more people to have signed on for support. Deutsche Bank and Barclays said they expect 5.5m additional claims, on top of the 16.8 million people who have already claimed for support over the last three weeks. Bank of America said weekly claims to be as high as 6.5 million.

“The overall labor market continues to deteriorate considerably in April,” Barclays economists wrote earlier this week.

Despite pessimistic expectations, US futures were pointing to a higher open for stock markets later today. S&P 500 futures (ES=F) and Dow Jones futures (YM=F) were 0.7% higher, while Nasdaq futures (NQ=F) were up 1%.

Barratt Development CEO takes pay cut

Bosses at major UK housebuilder Barratt Developments (BDEV.L) are taking a 20% pay cut and giving up next year’s pay rises in order to help sustain the business during the coronavirus pandemic.

The group confirmed in a statement that it was in the process of furloughing 85% of its employees, and protecting the salaries of those furloughed for at least another two months. In March, Barratt closed the last of its construction sites, offices and sales centres.

Shares climbed 5.5%.

UK lockdown set to be extended

The pound slipped against the US dollar (GBPUSD=X) in early trading on Thursday 16 April as Britain braces for potentially, at least, another three weeks of lockdown.

UK ministers are later expected to announce at the daily government press conference a three-week extension to help prevent the spread of COVID-19.

While the UK government has yet to officially announce a lockdown extension, the minister of Scotland, Nicola Sturgeon, said at a press conference three days ago that Whitehall is likely to announce continuing lockdown measures on Thursday.

The pound against the US dollar is currently down 0.2% from the previous day.

European stocks rise as Germany plots exit from lockdown

European stock markets opened higher on Thursday 16 April, as investors were buoyed by news of Germany’s plans to relax COVID-19 restrictions on daily life.

Germany’s DAX (^GDAXI) jumped 0.8% and the CAC 40 (^FCHI) in France rose by 0.3%. The FTSE 100 (^FTSE) was trading 0.8% higher in London shortly after the open.

Analysts said European markets were buoyed by signs that lockdowns across part of the continent would begin to be eased in the coming weeks. Germany announced it is extending its lockdown to 3 May but said some parts of the country could gradually begin to open up again after that date.

The announcement boosted financials and car makers. Deutsche Bank (DBK.DE) stock rose 3.6% in Frankfurt, while stock exchange operator Deutsche Borse (DB1.DE) gained 3.1%. Mercedes Benz owner Daimler (DAI.DE) rose 2.5%, Volkswagen (VOW3.DE) climbed 1.5%, and BMW (BMW.DE) rose 2%.

Watch the latest videos from Yahoo UK

Yahoo Finance

Yahoo Finance